Social Security

If you rely on Social Security benefits, knowing exactly when your payments will arrive each month is essential for budgeting and peace of mind. While most people receive payments on a predictable schedule, your exact deposit date depends on several factors — including your birthday and whether you receive Supplemental Security Income (SSI).

R. Tyler End, CFP®

•

Published January 1st, 2025

•

Updated March 5th, 2025

Table of Contents

Key Takeaways

Your payment date is tied to your birthdate.

SSI payments are issued on the 1st of each month (or earlier if the 1st falls on a weekend or holiday).

You’ll receive your benefit via direct deposit or a Direct Express® debit card.

If you rely on Social Security benefits, knowing exactly when your payments will arrive each month is essential for budgeting and peace of mind. While most people receive payments on a predictable schedule, your exact deposit date depends on several factors — including your birthday and whether you receive Supplemental Security Income (SSI).

Retirees trying to stick to a budget will want to know when to expect their Social Security benefits checks each month. However, not everyone gets their checks on the same day – it depends on what day of the month you were born.

Social Security Payment Schedule: How Dates Are Determined

The Social Security Administration (SSA) issues payments on a staggered schedule each month based on the type of benefit you receive and, in many cases, your date of birth. Understanding this schedule is important for budgeting and avoiding surprises, especially if you rely on these payments as a primary income source.

1. Supplemental Security Income (SSI) Payments

SSI benefits are typically paid on the 1st day of each month. However, if the 1st falls on a weekend or federal holiday, the payment is issued on the last business day before the 1st. For example, if the 1st is a Sunday, your payment will arrive on the preceding Friday.

2. Fixed Social Security Payment Date (3rd of the Month)

If you fall into one of the categories below, you’ll receive your Social Security payment on the 3rd of every month—regardless of your birthday:

- You began receiving Social Security before May 1997

- You receive both SSI and Social Security

- You live outside the United States

- Your Medicare premiums are paid by your state

- If the 3rd of the month is a weekend or holiday, you’ll receive your payment on the last business day prior.

3. Birthdate-Based Payment Schedule

If you began receiving Social Security after May 1997, your monthly payment date depends on your birthdate. Payments are made on a Wednesday according to the following schedule:

| Birthday Range | 2025 Payment Day (Each Month) |

|---|---|

| 1st – 10th | Second Wednesday |

| 11th – 20th | Third Wednesday |

| 21st – 31st | Fourth Wednesday |

Example: If you were born on the 7th of the month, expect your payment on the second Wednesday. If your birthday is the 15th, you’ll be paid on the third Wednesday.

Summary of Monthly Payment Schedule

| Type of Recipient | 2025 Payment Timing |

|---|---|

| SSI-only beneficiaries | 1st of each month (or prior business day) |

| Recipients on Social Security before May 1997 | 3rd of each month (or prior business day) |

| SSI + Social Security recipients | 3rd of each month |

| Social Security recipients (after May 1997) | Based on birthday (see schedule above) |

| Living abroad or state pays Medicare premiums | 3rd of each month |

Understanding this schedule helps ensure you know when to expect your benefits, plan bills accordingly, and spot any delays quickly. If your payment is ever late, the SSA advises waiting three business days before contacting them, as most delays are resolved within that window.

2024 Social Security Payment Exceptions

If you're receiving Social Security based on someone else’s work record — such as spousal or survivor benefits — your payment will follow the primary beneficiary’s schedule, not your own.

Some individuals will always receive their benefits on the 3rd of each month, regardless of birth date. This group includes:

- People who filed for Social Security before May 1, 1997

- People who receive both Social Security and SSI

- Individuals whose Medicare premiums are paid by the state (typically through Medicaid)

- People who live outside the United States

The Social Security Administration typically increases benefits annually, based on inflation. These increases are called cost-of-living adjustments, or COLAs.

When do SSI recipients get their Social Security payments?

If you receive Supplemental Security Income (SSI) only — and not in combination with Social Security retirement or disability benefits — your payment is generally issued on the 1st of each month.

However, if the 1st falls on a weekend or federal holiday, the payment is deposited on the last business day of the prior month. For example, since January 1, 2024, was a holiday, SSI payments were deposited on December 29, 2023.

This early payment rule applies to all months when the 1st does not fall on a standard banking day, helping ensure recipients have access to their funds without delay.

Quick Reference:

- Standard SSI payment date: 1st of each month

- Holiday/weekend adjustment: Paid on the preceding business day

How will I receive my payments?

The Social Security Administration (SSA) no longer sends paper checks. To improve speed and security, all benefits are now delivered electronically, either by direct deposit into a bank account or through a Direct Express® debit card.

Electronic payments ensure you receive your benefits on time, every month. They also reduce the risk of lost or stolen checks and eliminate delays caused by mail delivery.

Setting up direct deposit

If you have a bank account, setting up direct deposit is quick and easy. You'll need the following:

- Your Social Security number

- Your bank’s routing number

- Your account number

- Your account type (checking or savings)

Direct deposits are processed on your scheduled payment date, so your funds are available right away.

Using a Direct Express® card

If you don’t have a bank account or prefer not to use one, the SSA offers the Direct Express® debit card. This is a prepaid debit card that automatically receives your benefit payments.

You can use the Direct Express® card just like any other debit card to:

- Make purchases in stores or online

- Withdraw cash from ATMs

- Pay bills

Most transactions are free, and there’s no need to open a bank account to use the card.

For more information or to enroll, visit ssa.gov.

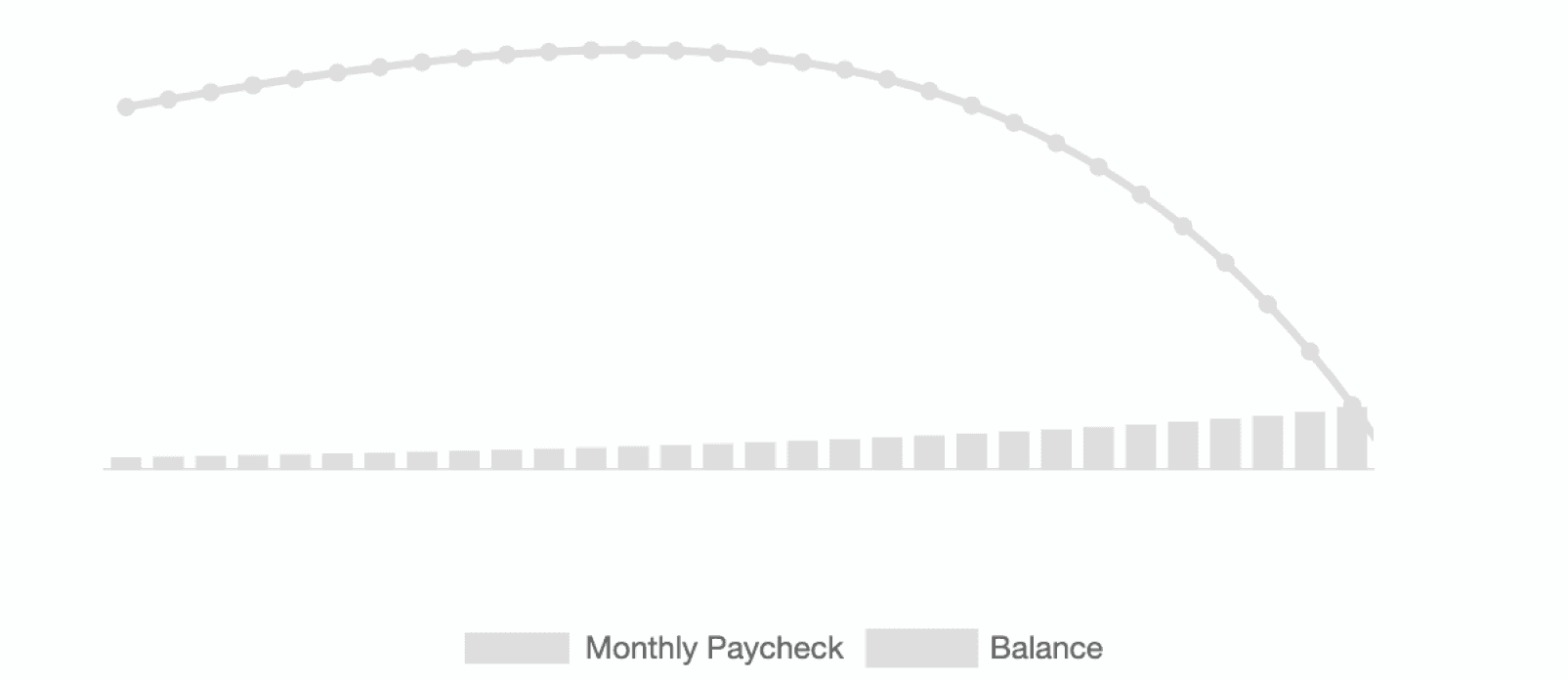

Retirable’s retirement calculator helps to project how much monthly retirement income your retirement nest egg can produce while ensuring your savings last as long as you need.

Birthday

Retirement savings

Retirement age

Next Steps

Planning for retirement can feel overwhelming. If you need help budgeting your Social Security money, or you have other questions concerning your retirement, talk to a Certified Financial Planner® at Retirable. We can help you get a head start on retirement planning by evaluating your financial profile and your goals. A comfortable, secure retirement is waiting for you!

Share this advice

Tyler is a Certified Financial Planner® and CEO & Co-Founder at Retirable, the retirement peace of mind platform. Tyler has nearly 15 years of experience at leading companies in the wealth management and insurance industries. Before Retirable, Tyler worked as Head of Operations Expansion at PolicyGenius, expanding the company’s reach into new products — turning PolicyGenius into an industry-leading disability and P&C insurance distributor. Before working at PolicyGenius, Tyler worked as Wealth Management Advisor at prominent financial services organizations.

As an advisor, Tyler played an integral role in helping clients define goals, achieve financial independence and retire with peace of mind. Through this work, Tyler has helped hundreds of thousands of people get the financial planning and insurance advice they need to succeed. Since founding Retirable, Tyler’s innovative approach to retirement planning has been featured in publications such as Forbes, Fortune, U.S. News & World Report, and more.

Introduction

Benefits

Taxes

Considerations

Social Security in 2022

Local

Spouse

Applying for Social Security

Share this advice

Tyler is a Certified Financial Planner® and CEO & Co-Founder at Retirable, the retirement peace of mind platform. Tyler has nearly 15 years of experience at leading companies in the wealth management and insurance industries. Before Retirable, Tyler worked as Head of Operations Expansion at PolicyGenius, expanding the company’s reach into new products — turning PolicyGenius into an industry-leading disability and P&C insurance distributor. Before working at PolicyGenius, Tyler worked as Wealth Management Advisor at prominent financial services organizations.

As an advisor, Tyler played an integral role in helping clients define goals, achieve financial independence and retire with peace of mind. Through this work, Tyler has helped hundreds of thousands of people get the financial planning and insurance advice they need to succeed. Since founding Retirable, Tyler’s innovative approach to retirement planning has been featured in publications such as Forbes, Fortune, U.S. News & World Report, and more.