Lifestyle

Planning for retirement can be daunting, and knowing where you stand financially is crucial. In 2025, understanding the average retirement income is more important than ever. This article explores the latest data on retirement income, helping you gauge your financial readiness and make informed decisions for a comfortable retirement.

C.E Larusso

•

Published January 12th, 2024

•

Updated January 8th, 2025

Table of Contents

Key Takeaways

Population averages are typically made up of two major calculations: mean and median data.

Although you can calculate averages, every person’s individual circumstance affects the income needed to retire comfortably.

Factors like the average pension amount are also important to consider when you’re weighing averages.

Understanding where you stand financially can help you better prepare for retirement—whether you’re already retired or planning ahead. By looking at what typical retirement income looks like, you can start to determine how your finances stack up.

But it’s essential to remember, as you research the average retirement income, that everyone’s circumstances are unique. You may be able to live well on Social Security alone. At the same time, your neighbor or friend may find that retirement savings or a part-time job is necessary to pay the bills. Consider these statistics, but set your budget based on your financial needs.

What is Considered a Good Retirement Income in 2025?

There’s no universal “right amount” for retirement, but experts often use the 70–80% rule—meaning retirees should aim to replace 70-80% of their pre-retirement income.

Retirement Income Benchmarks (2024-2025 Estimates)

- Low-income retirees: Less than $30,000 per year (primarily Social Security, varies by state)

- Middle-income retirees: $30,000–$70,000 per year (mix of Social Security, savings, and pensions, sufficient in lower-cost states)

- High-income retirees: $70,000+ per year (strong 401(k), investments, and multiple income streams, ideal for high-cost cities like NYC, SF, or Miami)

For a comfortable retirement in 2025, financial planners suggest a minimum income of $50,000–$70,000 per year for individuals and $80,000+ for couples, depending on location and lifestyle.

Average & Median Retirement Income

Even during non-Census years, the Census Bureau keeps population tables up to the most recent full year.

Retirement Income Data (Latest Available - 2022 Census & 2024 Projections)

- Median household income for 65+ retirees: $50,290 (2022 Census)

- Mean household income for 65+ retirees: $82,000+ (inflated by top earners)

Understanding Mean and Median

When you’re looking at income averages for any population, you’ll see the number expressed in two terms: mean and median. A mean number is the result of adding a group of values (usually numbers) together and dividing the total by the number of values. Median values come if you group a list of numbers. The one in the middle is the “median.” So, the answer to a good monthly retirement income isn’t as cut and dried as it seems.

Why This Matters:

- The median is a better indicator of what most retirees earn, as the mean is skewed by high-income individuals.

- Future retirees (Gen X, Millennials) may have higher average incomes due to longer careers, increased female workforce participation, and 401(k) growth.

One example of that is how the numbers change when additional filters are added to it. If you look at the average retirement income by ZIP code, you may find that your income falls in line with your area's lower or high-income levels. Compare that to the typical income for your age bracket, and you’ll get a more accurate picture of where you stand.

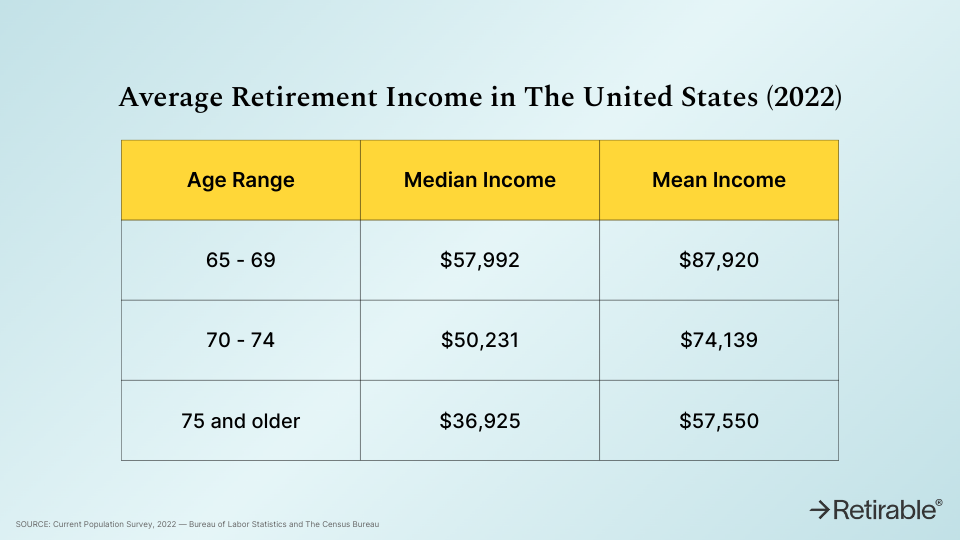

Average Retirement Income by Household Age

When you look at the U.S. Census's population tables, one thing that stands out is how much retirement income drops as a household's population changes. The most recent provided numbers are for 2022. Still, you'll recall the overall median income for senior citizens is $46,360, with a mean income of $71,446.

Unfortunately for older retirees, the table shows that the high end of those averages is set by those between the ages of 65 and 74. Here's how the average retirement income in U.S. breaks down:

Primary Sources of Retirement Income

You've probably heard for years that you should set aside a percentage of income for retirement, but how much does that come into play? Social Security income is a relatively small percentage of the average retiree's income. That means most senior citizens are getting their income from other sources.

What is retirement income, including for many of these retirees? We have the breakdown for you.

Average Social Security Income 2025

Social Security makes up, on average, only 30 percent of the income for elderly recipients. For single recipients in 2024, the average monthly Social Security payout is $1,907, which amounts to approximately $3,200–$3,400 for a married couple. Only 12 percent of men and 15 percent of single people rely on Social Security for 90 percent of their income.

Average Retirement Income from Assets

With Social Security providing less than half of retiree income, many will need to rely on assets like savings. According to the Pension Rights Center, though, only 68 percent of retirees receive income from financial assets. Of that 68 percent, half receive less than $1,754 each year.

Average Retirement Income from Pensions

On average, retirees with monthly pensions are financially better off than those without. With an average monthly payout of $1,500, someone relying on Social Security alone would be looking at an annual income of $18,660. The average pension in the U.S. can significantly add to that. The average pension is $10,788 per year, which could bring a retiree up to almost $30,000 before even touching retirement savings. Those monthly pension dollars go a long way to fund the basic expenses of retirement.

Average Retirement Income from Work

According to the Pension Rights Center, in 2022, the median income from all sources for individuals aged 65 and older was $29,740. For those with earned income, the median income increased to $39,690. Approximately 23% of older adults had earnings from work in 2022.

Average Public Assistance Income

The percentage of older adults relying on public assistance is 3 percent, according to the Pension Rights Center. Another 4 percent rely on Veterans’ benefits, while 1 percent have no income whatsoever.

2025 Financial Trends for Retirement Income

The biggest trend of 2025 is actually something that’s been in progress for a while. The average pension per person may not have changed much, but the number of private-sector employees earning a pension has steadily declined over the past few decades. This trend is only expected to continue as private employers shift to defined contribution plans like 401(k)s, which require the employer to contribute to their future retirement savings.

While there are concerns about the future of retirement due to population increases and longer life expectancies, the Urban Institute has better news. The social and economic policy research institute released a report on the future of retirement and, despite reports of lower average retirement savings by income, the study made some interesting conclusions, including:

- The average retirement income by age will increase as those born between 1966 and 1975 reach the age of 70. The report predicts this group of retirees will have a 17 percent higher average household income than pre-Baby Boomers.

- The news is even better for the generation born between 1976 to 1985, who the Urban Institute predicts will have a 24 percent higher household income at age 70 than pre-Boomers.

- Women earners will increase average annual income. There’s no denying more women are earning full-time salaries than those who were born 40 years earlier. The Urban Institute predicts that their retirement savings and Social Security income will put them in much better standing after retirement.

One ongoing concern mentioned in the report is Social Security. As younger generations ask what is a good retirement income, it’s important to consider what might happen if lawmakers someday cut Social Security benefits. Many of the Urban Institute’s projects rely on those funds still being available to retirees 10, 20, and 30 years from now.

Final Thoughts

Funding your retirement doesn’t have to be complicated. You simply look at your finances and determine how much you’ll need. But it can help to take a look at what the norm is when it comes to retirement, just as long as you consider factors like the average retirement income by state, age, and marital status. For best results, we recommend getting to know the numbers and working with a Certified Financial Planner® to make sure you’re adequately prepared.

Share this advice

A professional content writer, C.E. Larusso has written about all things home, finance, family, and wellness for a variety of publications, including Angi, HomeLight, Noodle, and Mimi. She is based in Los Angeles.

Decumulation

Paycheck

Lifestyle Planning

Income Sources

Strategies

Taxes

Risks

Share this advice

A professional content writer, C.E. Larusso has written about all things home, finance, family, and wellness for a variety of publications, including Angi, HomeLight, Noodle, and Mimi. She is based in Los Angeles.