Partner with

Partner with

Featured In

Featured In

Designed to support growth across a range of industries

Differentiate your Medicare offer while improving health and wealth outcomes.

Complement your offerings with financial planning and investing solutions

Empower employees to transition into retirement with expert guidance

Succession planning for your aging clients with fiduciary support

Transition client portfolios into retirement to navigate financial complexities

Trusted By

Trusted By

Helping everyday retirees stress less, and live more

We've earned the trust of 50,000+ Americans

Don't just take it from us. Discover why our clients choose us to instill confidence in their retirement.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.

Our Platform is purpose-built to help retirees.

Plan

Personalized retirement investment and income plan designed to maintain lifestyle

Invest

Expert investment management built for cash flow, stability and growth

Advice

Fiduciary advisors provide guidance to help grow savings and spend smarter

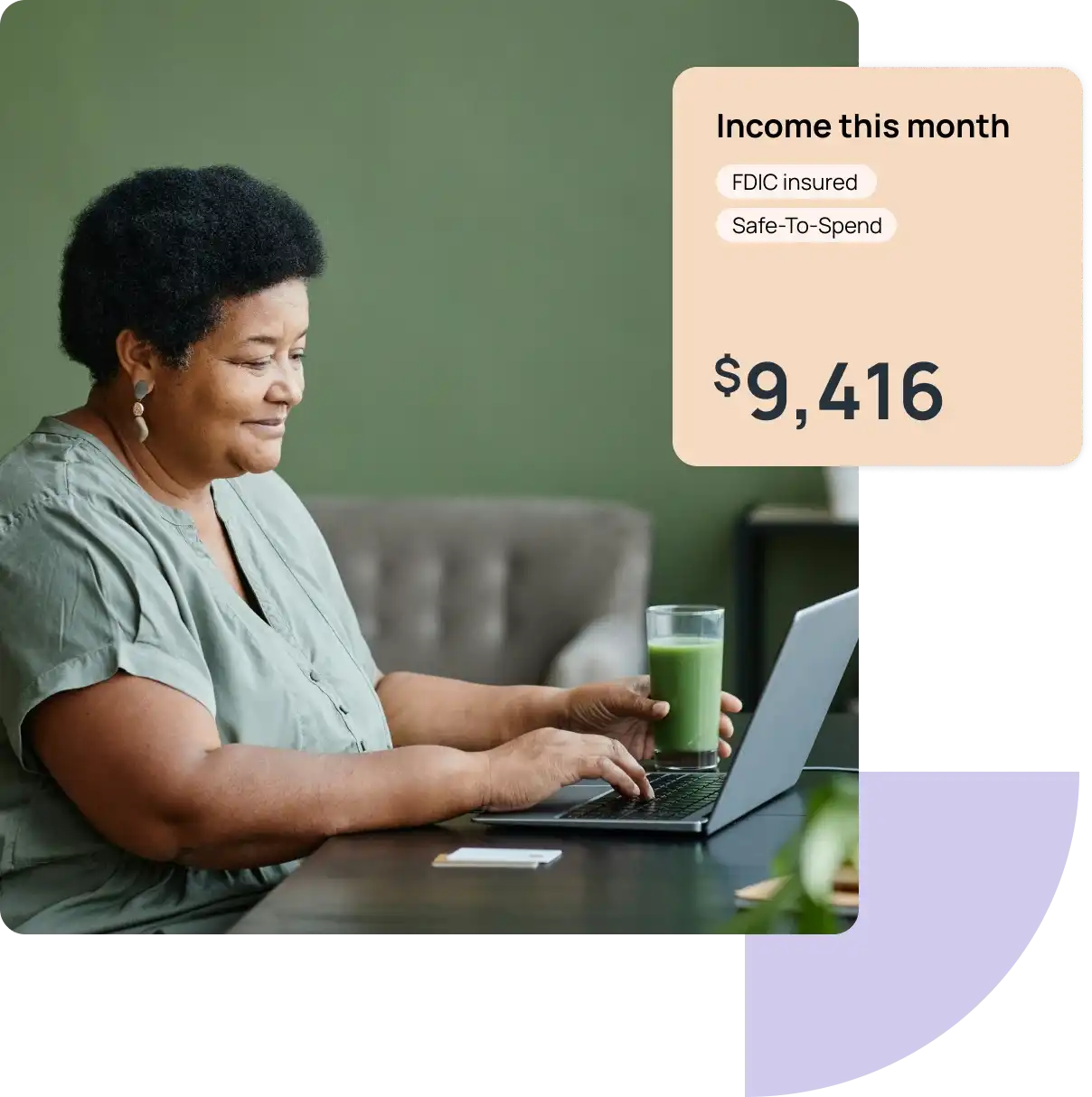

Spend

Reliable retirement income with one easy, safe-to-spend paycheck

Save

Earn interest on cash savings and emergency fund with our high-yield cash account

Protect

$1M in identity theft insurance with a suite of identity and credit monitoring tools

Plan

Personalized retirement investment and income plan designed to maintain lifestyle

Invest

Expert investment management built for cash flow, stability and growth

Advice

Fiduciary advisors provide guidance to help grow savings and spend smarter

Spend

Reliable retirement income with one easy, safe-to-spend paycheck

Save

Earn interest on cash savings and emergency fund with our high-yield cash account

Protect

$1M in identity theft insurance with a suite of identity and credit monitoring tools

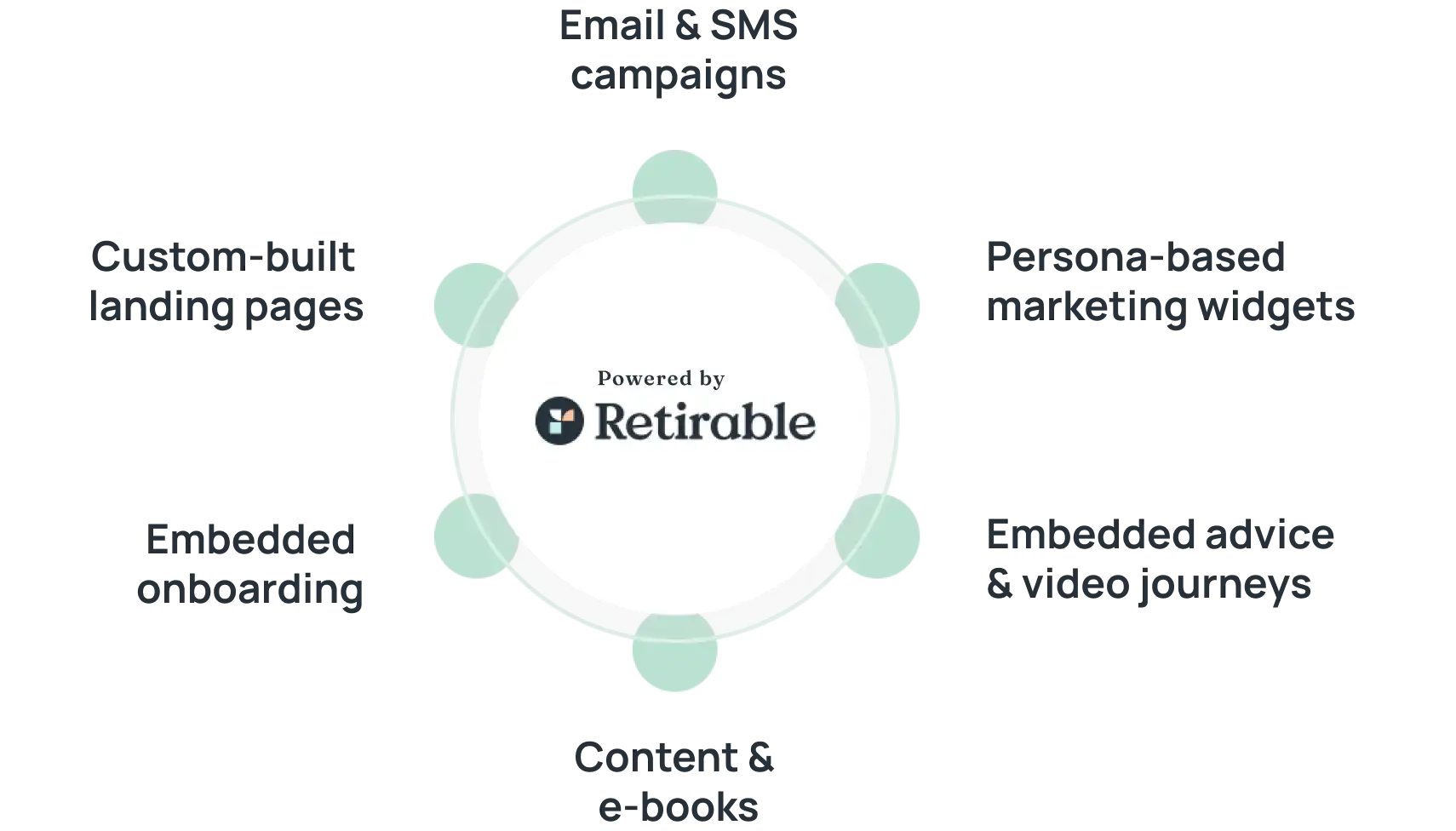

Support for your business at every step

A full eco-system including:

Turnkey marketing materials

Co-branded or white label platform

Consistent reporting

Data-driven client insights