Investment strategies built to last

We'll help you improve tax efficiency, prepare for the future, and plan to sustain your lifestyle no matter what happens in the market.

We strategically bucket your investments based on your short and long-term goals.

Cash

Your most risk-averse investments designed to meet your immediate spending needs, and help protect you from short-term market downturns.

Cash

Your most risk-averse investments designed to meet your immediate spending needs, and help protect you from short-term market downturns.

Stability

Your medium-risk investments focus on steady year-over-year growth and stability during market changes to counter inflation.

Stability

Your medium-risk investments focus on steady year-over-year growth and stability during market changes to counter inflation.

Growth

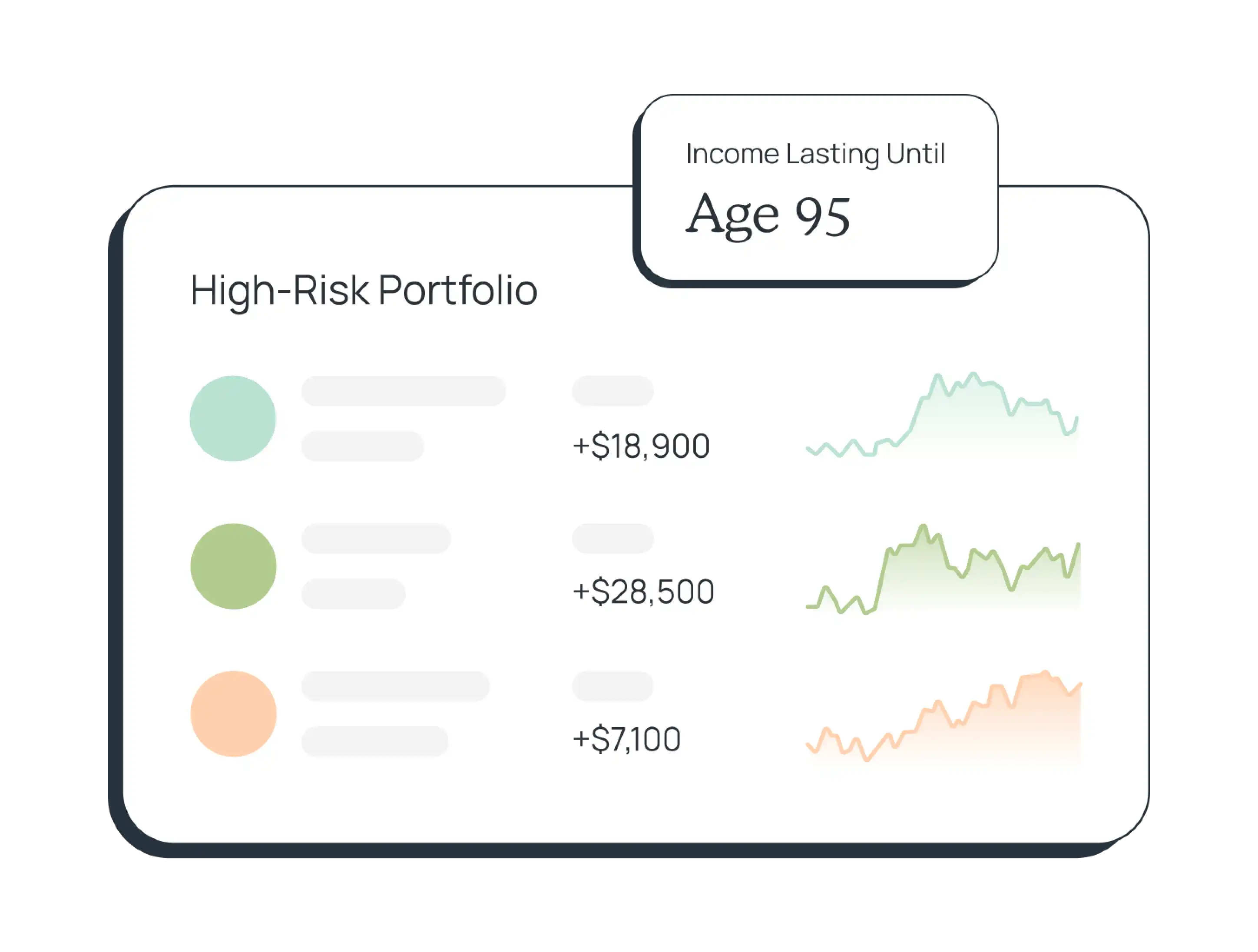

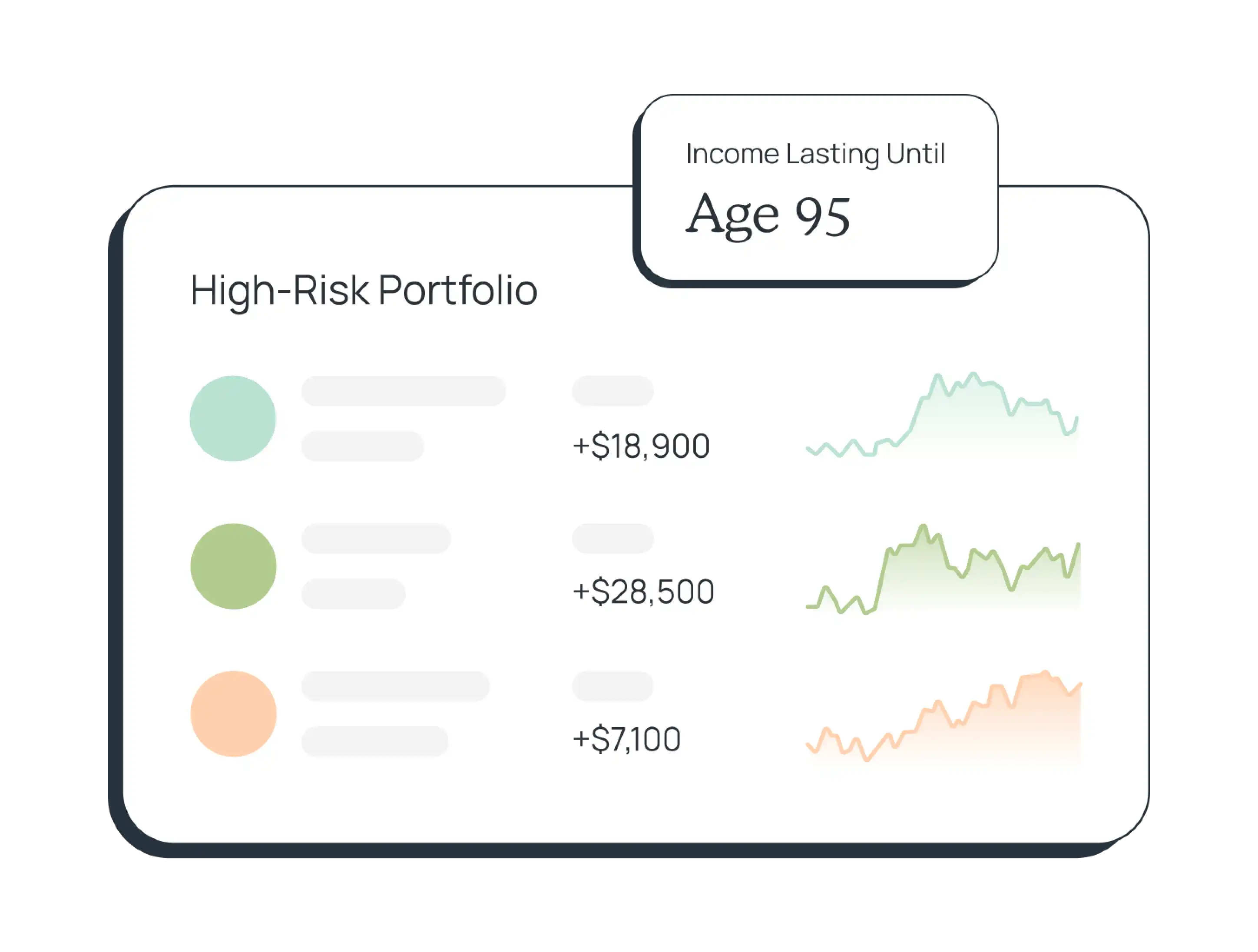

Your high-growth, long-term investments designed for higher risk and reward to make your money last through the entirety of retirement.

Growth

Your high-growth, long-term investments designed for higher risk and reward to make your money last through the entirety of retirement.

Investment Features

Our investment strategy is designed to meet your needs in retirement, while protecting what you've earned.

Your portfolio is designed for your goals, needs, and risk tolerance.

We help minimize taxes through trading, reinvesting dividends, and RMDs.

We plan for inflation and ensure you're drawing from the bucket at the right time.

Our portfolios work alongside Social Security and your other income streams.

We have industry-low expense ratios with no hidden fees or trading fees.

We invest in ETFs from firms you know, with no kickbacks from fund providers.

Your portfolio is designed for your goals, needs, and risk tolerance.

We help minimize taxes through trading, reinvesting dividends, and RMDs.

We plan for inflation and ensure you're drawing from the bucket at the right time.

Our portfolios work alongside Social Security and your other income streams.

We have industry-low expense ratios with no hidden fees or trading fees.

We invest in ETFs from firms you know, with no kickbacks from fund providers.