An expert by your side throughout retirement.

Your dedicated advisor will help you grow your savings, spend smarter, and navigate key decisions.

Let's build your best retirement.

Your dedicated Retirable advisor is a U.S-based licensed fiduciary, specializing in holistic retirement planning. They're committed to always presenting your best solutions across retirement planning, enrollments, and other big decisions.

Let's build your best retirement.

Your dedicated Retirable advisor is a U.S-based licensed fiduciary, specializing in holistic retirement planning. They're committed to always presenting your best solutions across retirement planning, enrollments, and other big decisions.

Cover all your bases.

We specialize across all areas of retirement — including income, healthcare, housing, and quality of life. This enables us to better manage a holistic plan to serve your unique needs.

Cover all your bases.

We specialize across all areas of retirement — including income, healthcare, housing, and quality of life. This enables us to better manage a holistic plan to serve your unique needs.

See a better path forward.

There's a big difference between retiring and retiring comfortably. As you need to make key decisions, your advisor will help you understand what options are best for you.

See a better path forward.

There's a big difference between retiring and retiring comfortably. As you need to make key decisions, your advisor will help you understand what options are best for you.

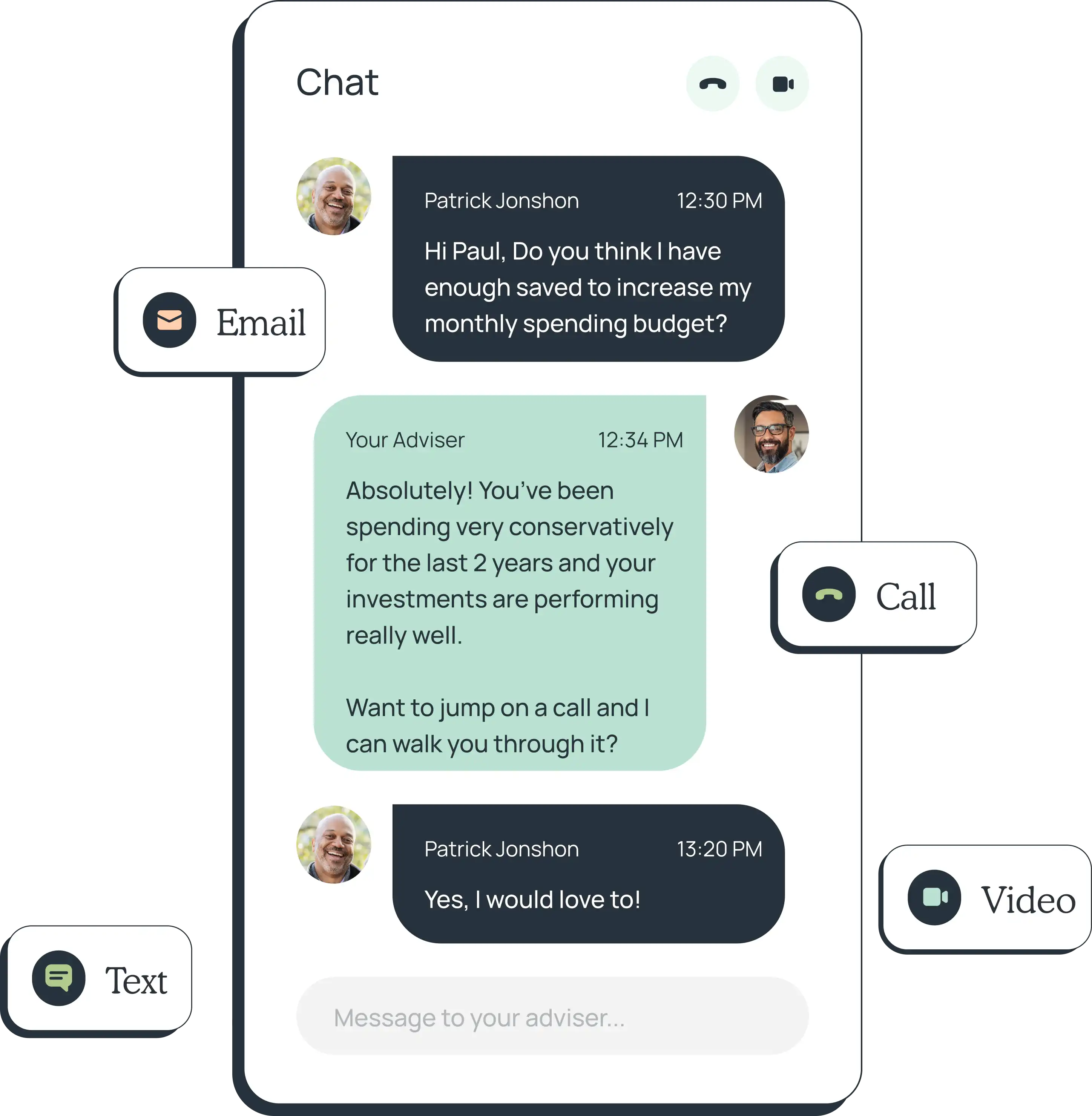

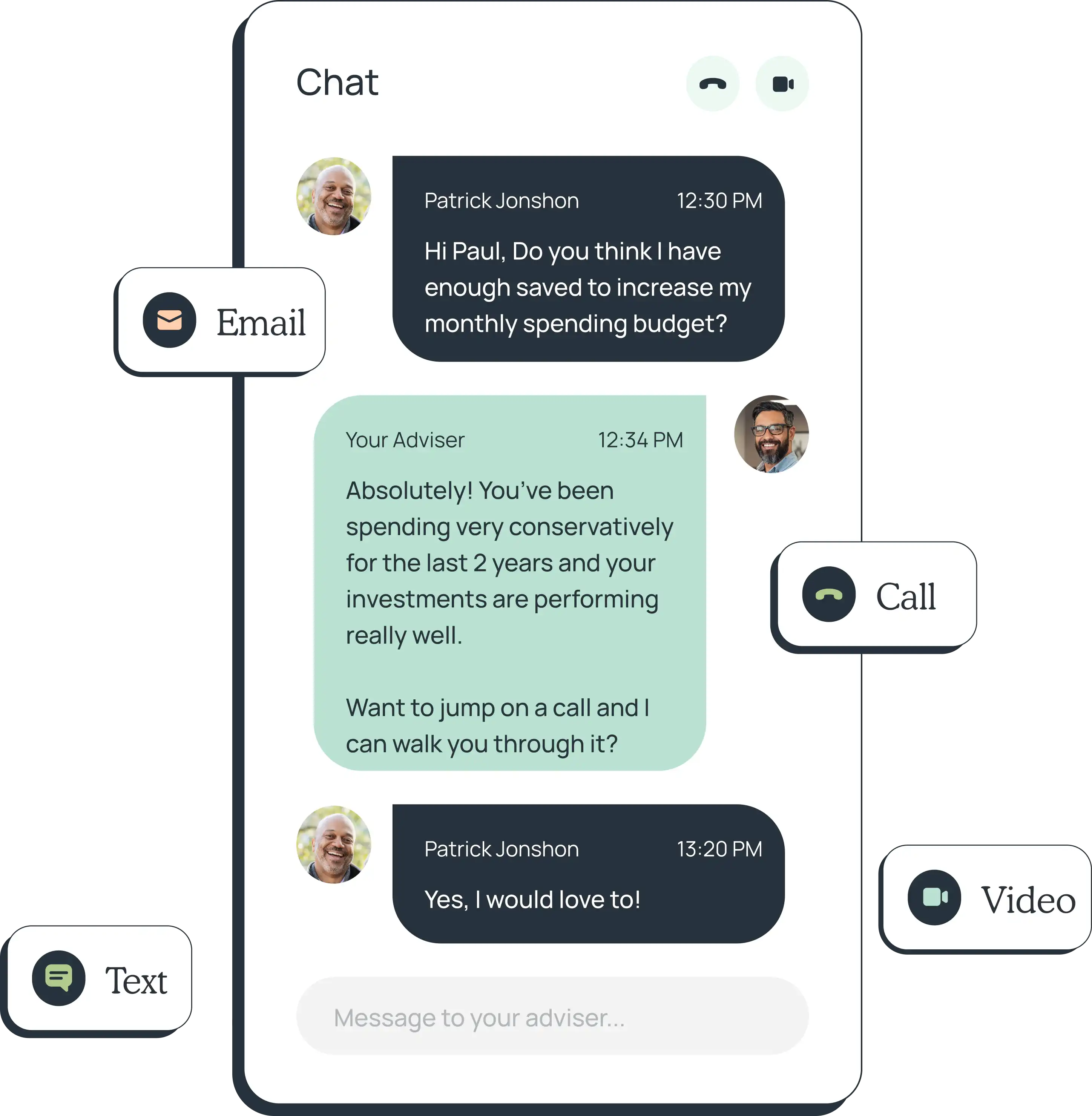

Navigate the unexpected.

Changes like market volatility, inflation and personal circumstances are inevitable. As these arise, your advisor is available by phone, text message, video, or email to help you confidently adjust.

Navigate the unexpected.

Changes like market volatility, inflation and personal circumstances are inevitable. As these arise, your advisor is available by phone, text message, video, or email to help you confidently adjust.

We know more than just investments.

Health Care, housing, Social Security, and beyond — we can provide help with everything impacting your retirement.

See when to elect and how much to expect.

Anticipate your changing needs and costs.

Use our expert strategies to help avoid unexpected bills.

Create a plan around your decision to move or stay.

Set financial goals to gift to your loved ones.

Incorporate plans for travel, projects, and more.

We know more than just investments.

Health Care, housing, Social Security, and beyond — we can provide help with everything impacting your retirement.

See when to elect and how much to expect.

Anticipate your changing needs and costs.

Use our expert strategies to help avoid unexpected bills.

Create a plan around your decision to move or stay.

Set financial goals to gift to your loved ones.

Incorporate plans for travel, projects, and more.