Spend confidently throughout retirement.

With a regular monthly income and a clear idea of where you stand, staying in control is easy.

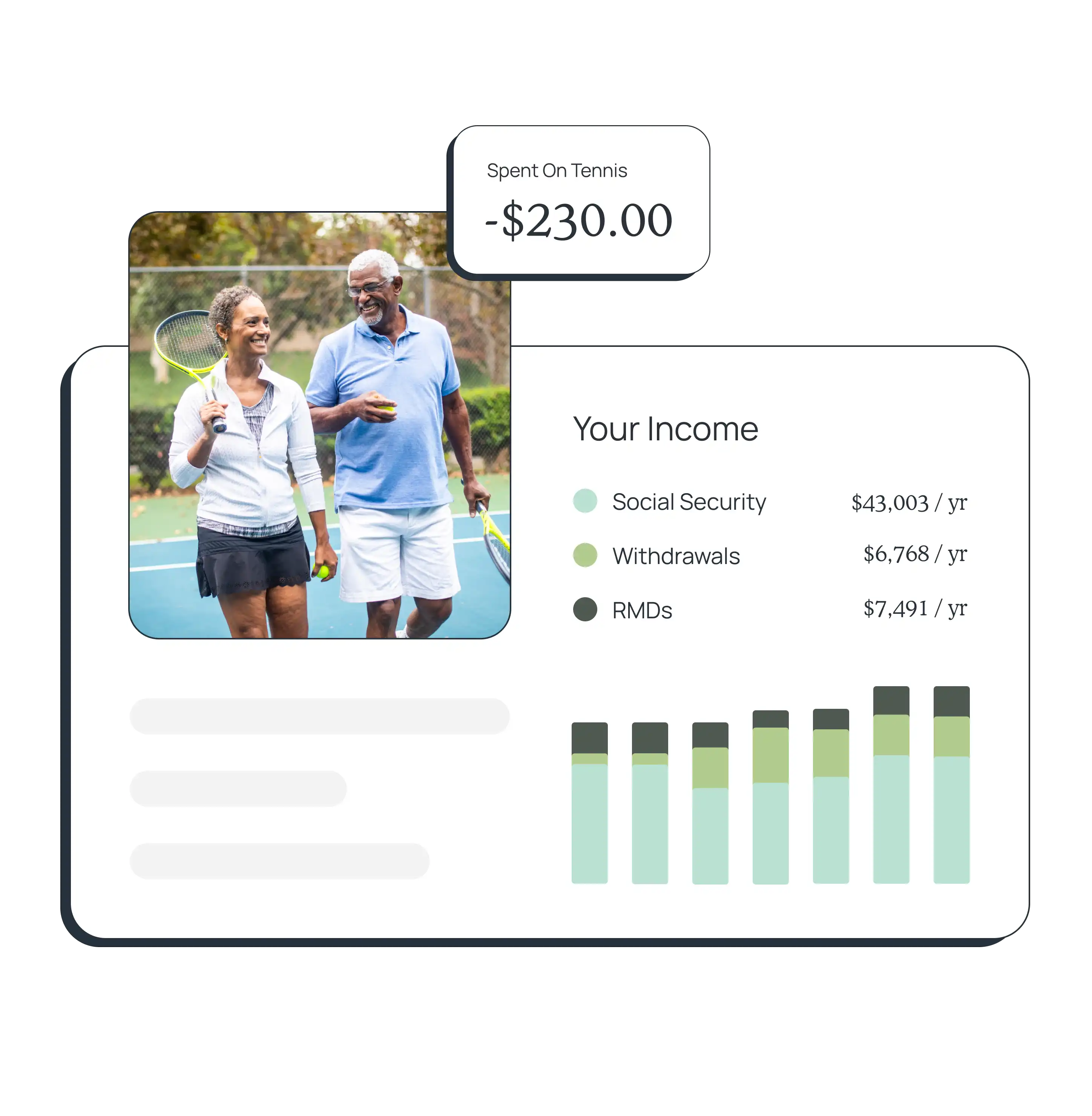

Income to fit your lifestyle.

Your investments are designed to provide reliable monthly income based on your plan. Since your funds stay in your name, the ability to make changes stays in your hands.

Income to fit your lifestyle.

Your investments are designed to provide reliable monthly income based on your plan. Since your funds stay in your name, the ability to make changes stays in your hands.

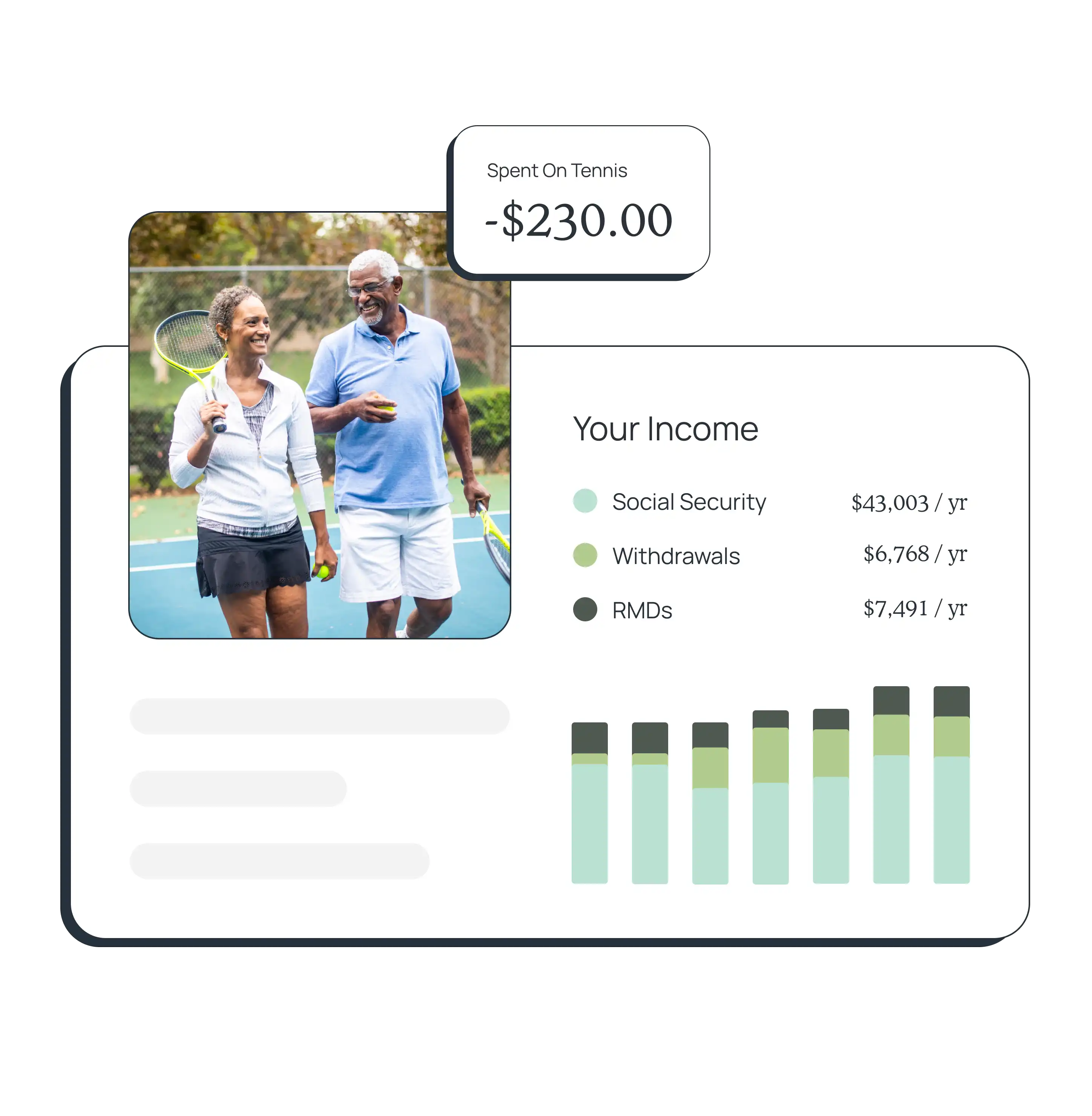

Always know what's safe to spend.

Your spending plan paints a clear picture of what you can withdraw next and updates automatically based on your actual spending.

Always know what's safe to spend.

Your spending plan paints a clear picture of what you can withdraw next and updates automatically based on your actual spending.

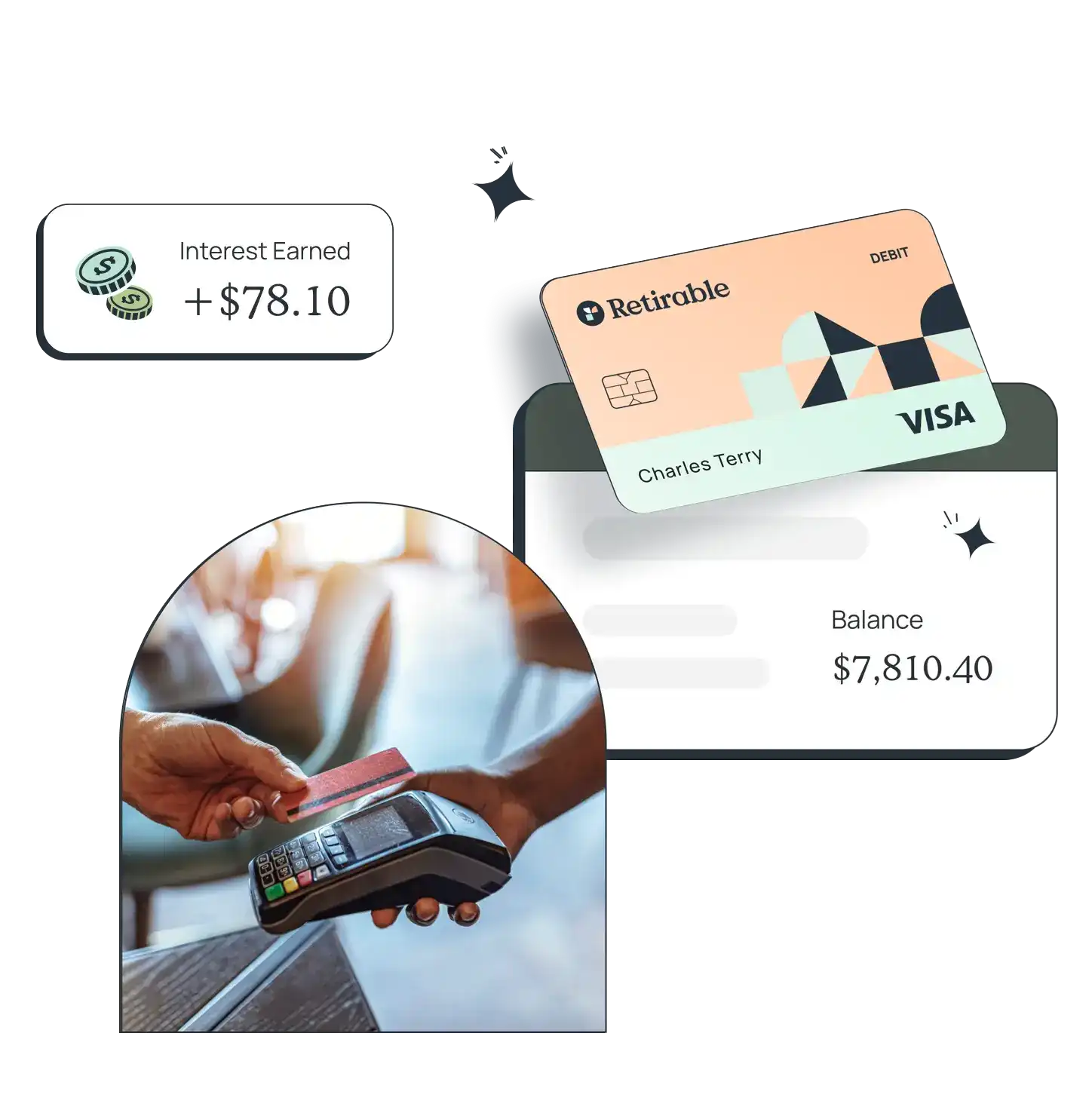

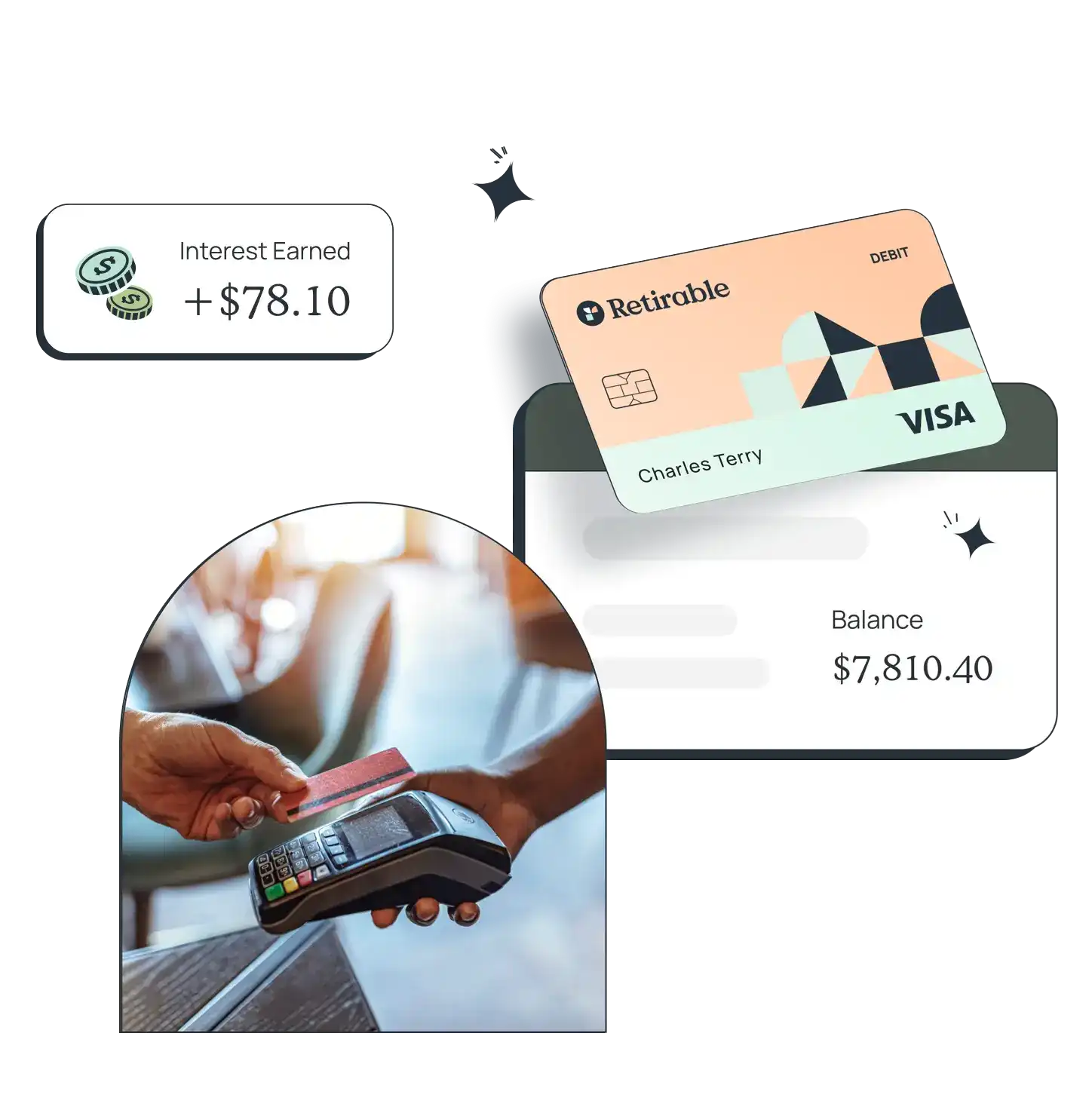

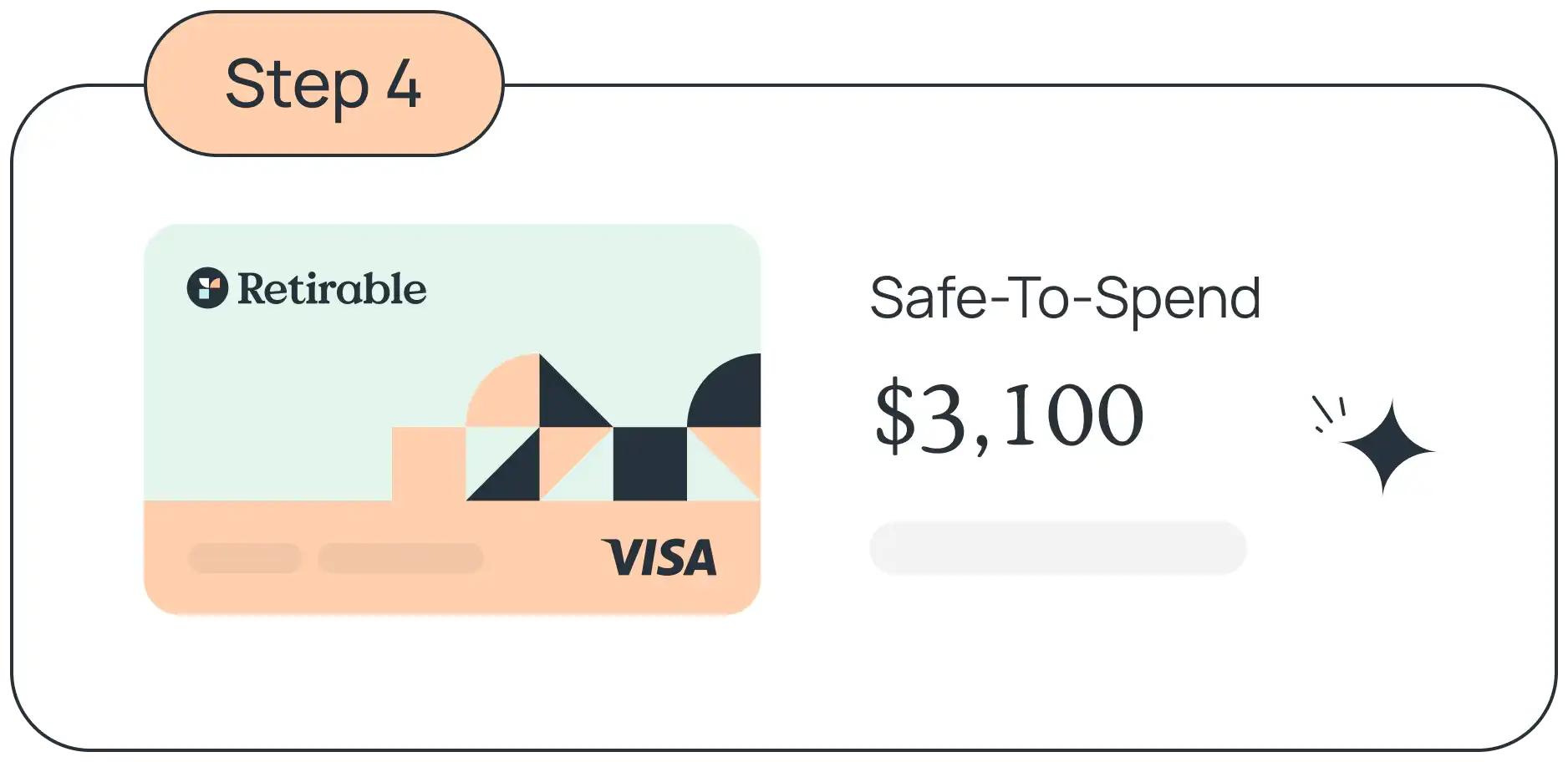

Simplify the way you pay.

Use our debit card to tap directly into your savings while optimizing for tax efficiency.

Simplify the way you pay.

Use our debit card to tap directly into your savings while optimizing for tax efficiency.

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.