Social Security

The Bipartisan Budget Act of 2015 permanently changed the way spouses claim their benefits.

Stephanie Faris

•

Published August 8th, 2020

•

Updated December 16th, 2020

Table of Contents

Key Takeaways

At one time, you could claim your Social Security benefits on your retiring spouse’s account even if you weren’t retiring yourself.

The Bipartisan Budget Act of 2015 made some changes to the requirements that affect spouses requesting payments.

You can still claim spousal benefits if you’re 62 or older, but the IRS will deem you as having filed for all your benefits when you do, and will issue the benefits available under your own Social Security number first.

At one time, couples could use a practice called “file and suspend” to maximize their Social Security earnings. In this scenario, one spouse would file with the other spouse making a claim on that spouse’s benefits. So, for instance, a husband might file, then his wife would claim spousal benefits off of his record. The husband would then suspend benefits, delaying his benefit and accruing delayed retirement credits to maximize his long-term payout, while the wife continued to collect while delaying her own retirement.

As clever as that bit of maneuvering may seem, it’s a thing of the past. The Bipartisan Budget Act of 2015 permanently changed the way spouses claim their benefits. If you turned 62 on or after January 2, 2016, something called “deemed filing” applies to you. Here’s what you need to know about today’s restricted application for spousal benefits.

Claiming a Spousal Benefit Under the New Rules

If you’re still working when your spouse retires, your age will determine whether you qualify to file a Social Security restricted application. Those born before Jan. 2, 1954 can still claim half their spouse’s benefits. If you were born on or after that date, though, filing for your benefits serves as an application for your own benefits.

Under the Social Security deemed filing rules, you’re filing for all benefits when you file along with your spouse. Once your spouse is eligible for benefits, you can apply but only if you’ve already turned 62. The Social Security Administration will look at your own eligibility for benefits and pay any benefits you’re entitled to before issuing spousal benefits.

Questions about Social Security? We're here to help.

Schedule your FREE Retirable consultation today.Taking a Spousal Benefit When Working

What if you’re still working when your spouse retires? The same rules that apply to your own Social Security benefits will apply when you’re requesting restricted spousal benefits. You can earn up to a certain amount each year, and once you’ve reached that threshold, your Social Security payments will be reduced based on a calculation.

The maximum you can earn can vary from one year to the next, so you’ll need to keep an eye on it. This varies depending on whether you’ve reached retirement age or not. In 2021:

- If you’re younger than full retirement age, you can earn up to $18,960 before your benefits see a reduction. Beyond that threshold, the IRS will deduct $1 from your benefits for every $2 you earn above the limit.

- In the year that you reach full retirement age, you can earn up to $50,520 before you reach the threshold. The IRS will deduct $1 in benefits for every $3 you earn above that.

Timing of Multiple Benefits: “Deemed Filing”

So what is “deemed filing?” When you file for your spouse’s Social Security benefits, you’ll have been deemed to have filed for any Social Security benefits available to you. This includes the benefits you’re entitled to based on your own work history.

At one time, you could enjoy part of your spouse’s benefits, then claim your own when it was time. But due to the Social Security spousal benefits loophole that created, the Bipartisan Budget Act of 2015 changed some things. When you file for your spouse’s benefits, you fall under the “deemed filing” classification, which means you’ve opted to take your own benefits, as well.

Here’s the problem with that. When you request your benefits before reaching the official retirement age, which is 67 unless you were born before 1960, you get a reduced amount for the lifetime of your benefits. If you can, instead, delay until you reach the age of 70, you’ll get a higher amount than if you’d filed earlier. By requesting restricted spouse benefits, Social Security benefits will be based on your current age, which means you’ll receive less.

Exceptions to Deemed Filing

There are instances where you can file a Social Security restricted application for spousal benefits and not have it affect your own benefits. One of those is if you are receiving disability payments through the Social Security Administration. You’ll also qualify if you’re caring for the retired worker’s child.

If your spouse was eligible for Social Security benefits and died, you may be eligible for survivor’s benefits. Any children your spouse had may also be able to receive payments. The funeral home will report the death on your behalf as long as you provide the Social Security number of your spouse. From there, you’ll have to file an application. You can get directions on how to file a restricted application for spousal benefits as a survivor on the SSA website.

Voluntary Suspension of Benefits: “File and Suspend”

At this point, you may wonder about a Social Security restricted application vs file and suspend. At one time, file and suspend provided a loophole where the recipient could delay benefits while the spouse continued to collect on them.

But file and suspend off of your own career earnings history iis definitely still a viable option in itself. As long as you haven’t reached the age of 70 yet, you can put your benefits on hold. Why would you do that? When you take your retirement early, you reduce your payout. By suspending your payments, you can continue to receive credits, which means when you do start receiving them again, they’ll be higher.

To suspend your benefits, contact the SSA either in writing, by phone, or by visiting a location and ask to suspend them. At that point, you’ll see restricted Social Security spousal benefits in that your spouse cannot receive payments on that account until you’ve reinstated it.

Spousal Benefits and Divorce

If you were married more than 10 years, your ex-spouse may also be able to claim a portion of your Social Security benefits. Their payment won’t affect how much you receive, and they’ll face the same restricted Social Security rules that your current spouse does.

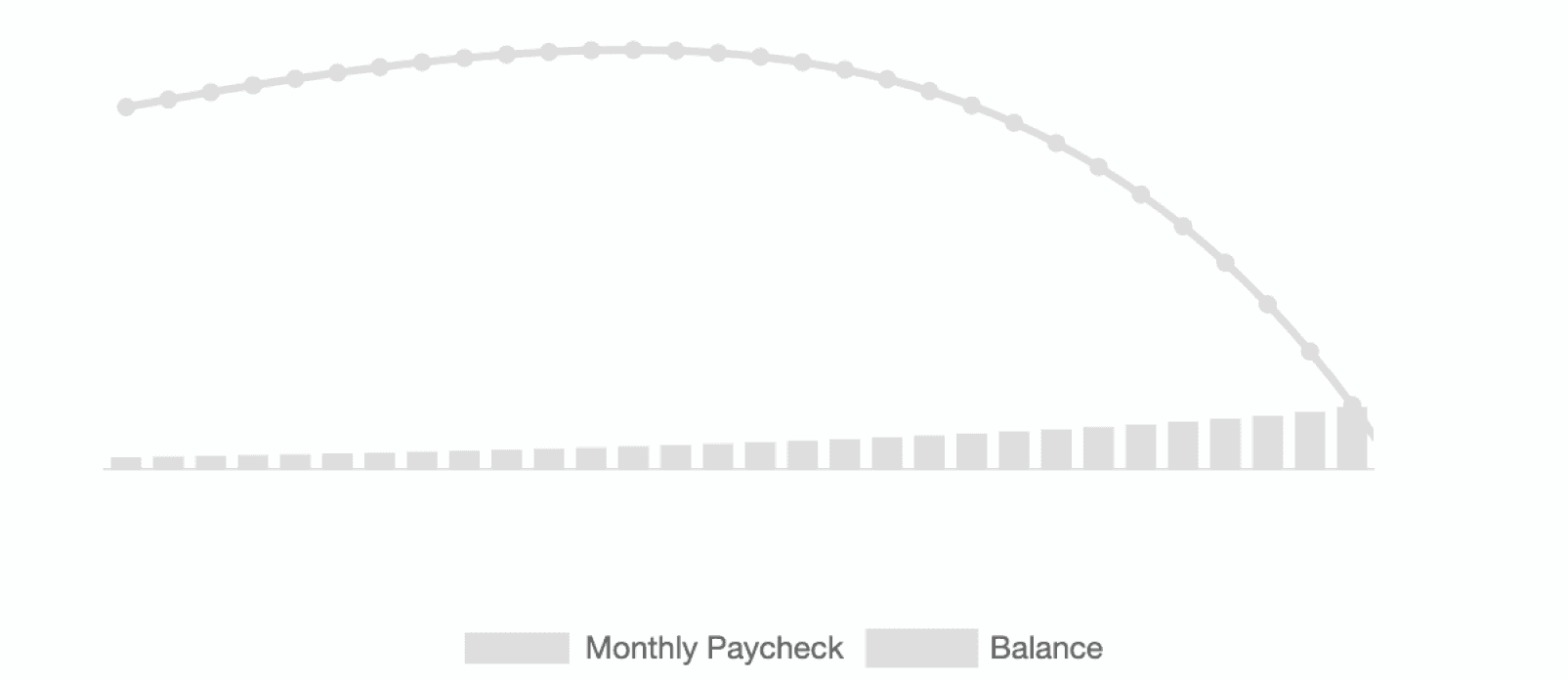

Retirable’s retirement calculator helps to project how much monthly retirement income your retirement nest egg can produce while ensuring your savings last as long as you need.

Birthday

Retirement savings

Retirement age

Bottom Line

If you’re considering completing a Social Security restricted application form for spousal benefits, make sure you’ve done a complete study of the benefits available to you. A Certified Financial Planner® can help you determine the best time for you to apply for your Social Security benefits, whether you’re retiring soon or decades from now. You may find that by waiting just a few extra years, your benefits will increase enough to make it worth it.

Share this advice

Stephanie Faris has written about finance for entrepreneurs and marketing firms since 2013. She spent nearly a year as a writer for a credit card processing service and has written about finance for numerous marketing firms and entrepreneurs. Her work has appeared on Money Under 30, The Motley Fool, MoneyGeek, E-commerce Insiders, and GoBankingRates.

Introduction

Benefits

Taxes

Considerations

Social Security in 2022

Local

Spouse

Applying for Social Security

Share this advice

Stephanie Faris has written about finance for entrepreneurs and marketing firms since 2013. She spent nearly a year as a writer for a credit card processing service and has written about finance for numerous marketing firms and entrepreneurs. Her work has appeared on Money Under 30, The Motley Fool, MoneyGeek, E-commerce Insiders, and GoBankingRates.