Income

When you leave the workforce for retirement, it’s only natural to worry about your finances. There are ways to generate some extra retirement income after you’ve left the workforce, which we've outlined in this article.

Stephanie Faris

•

Published July 19th, 2021

Key Takeaways

When you retire, you’ll rely on your retirement savings to supplement the Social Security payments and pensions you receive.

If you want to maximize your retirement income, planning how you’ll spend it and withdrawing it strategically can make a big difference.

There are some retirement income options, but annuities can be a way to bring in steady pay. You can also rely on your HSAs and sell off some of the assets you’re no longer using.

When you leave the workforce for retirement, it’s only natural to worry about your finances. You’ll be going from a steady paycheck to a combination of your Social Security check and whatever retirement savings you have.

But there are ways to generate some extra retirement income after you’ve left the workforce. Here are a few retirement income strategies that can help give you peace of mind as you settle into the good life.

Ways to Increase Your Retirement Income

Money can be a big source of stress, whether you’re retired or not. But finding financial security is the same after retirement as it was before. After you’ve cut your expenses, it’s time to take a look at your retirement income sources. Here are some ways to get a little more money into the “income” column of your budget worksheet.

Questions about your retirement income? We're here to help.

Schedule your FREE Retirable consultation today.Bucket Strategy

One income strategy embraced by many retirees is the “bucket strategy.” This strategy separates your finances into three buckets, ensuring you have enough money to see you through at least a couple of decades.

- Bucket 1: This bucket contains enough money to get you through the next couple of years, along with an emergency fund.

- Bucket 2: This bucket has funds to take care of you in years three through 10.

- Bucket 3: This bucket contains money you don’t touch until at least year 10.

Systematic Withdrawals

Among the many alternative retirement strategies you’ll hear about is the 4 percent rule. This rule has you spending less than 4 percent of your savings each year. But consider instead taking out less the first year, then increasing gradually each year thereafter to account for inflation.

Annuities

If you like the security of a guaranteed income, retirement income investments like annuities can help. An annuity is an insurance contract where an institution holds your money, issuing it to you over a pre-agreed timeframe.

Although annuities can give you peace of mind, look at the cons of these agreements, as well. To participate in an annuity, you’ll have to agree to be without your funds until the annuity period begins, and annuities often come with high fees.

Maximizing Social Security

One of the best retirement income streams you’ll have is your Social Security payment, assuming you’ve earned enough over your working years. You can retire as early as age 62, but this will reduce your monthly payment for the duration of your retirement.

For best results, wait until full retirement age to start claiming Social Security (or the maximum at age 70). If you were born after 1959, that will be age 67. Otherwise, it’s age 66. Consider speaking with a Retirable advisor about a Social Security bridge, this strategy uses more of your retirement accounts early so you can make the most of your Social Security.

Tax Efficiency

When you were looking into the best investments for retirement income, you likely noticed the biggest difference in the way they’re taxed. After retirement, it’s important to pay attention to those differences and keep them in mind as you’re taking distributions.

- Roth IRA and Roth 401(k) – No taxes due once the money has been in the account at least five years. Must be at least 59½ to begin taking tax-free distributions.

- Traditional 401(k) and Traditional IRA – Taxed as regular income.

You’ll also need to start taking distributions once you reach the age of 72 to avoid paying penalties.

Work with a Retirable advisor to get the most out of your retirement accounts with distributions that minimizes the taxes you pay.

Health Savings Account

When you’re looking at how to generate income in retirement, it’s important to consider whether you have a health savings account (HSA). As soon as you sign up for Medicare, you will no longer be eligible to contribute pre-tax dollars to your HSA. However, once you turn 65, you can use your HSA for non-medical expenses. After age 65, you also get some tax breaks when you use your HSA card for expenses like insurance premiums, so be sure to check into that to make the most of the money.

Downsizing & Decumulation

As you’re looking into creating income for retirement, consider the benefits of downsizing. You’ll likely enter the decumulation phase, which means you’ll stop accumulating assets. But you can also begin selling off assets and even move into a smaller house to reduce your monthly expenses. For many people, home equity is their biggest asset and there are several strategies available to use your home for retirement income.

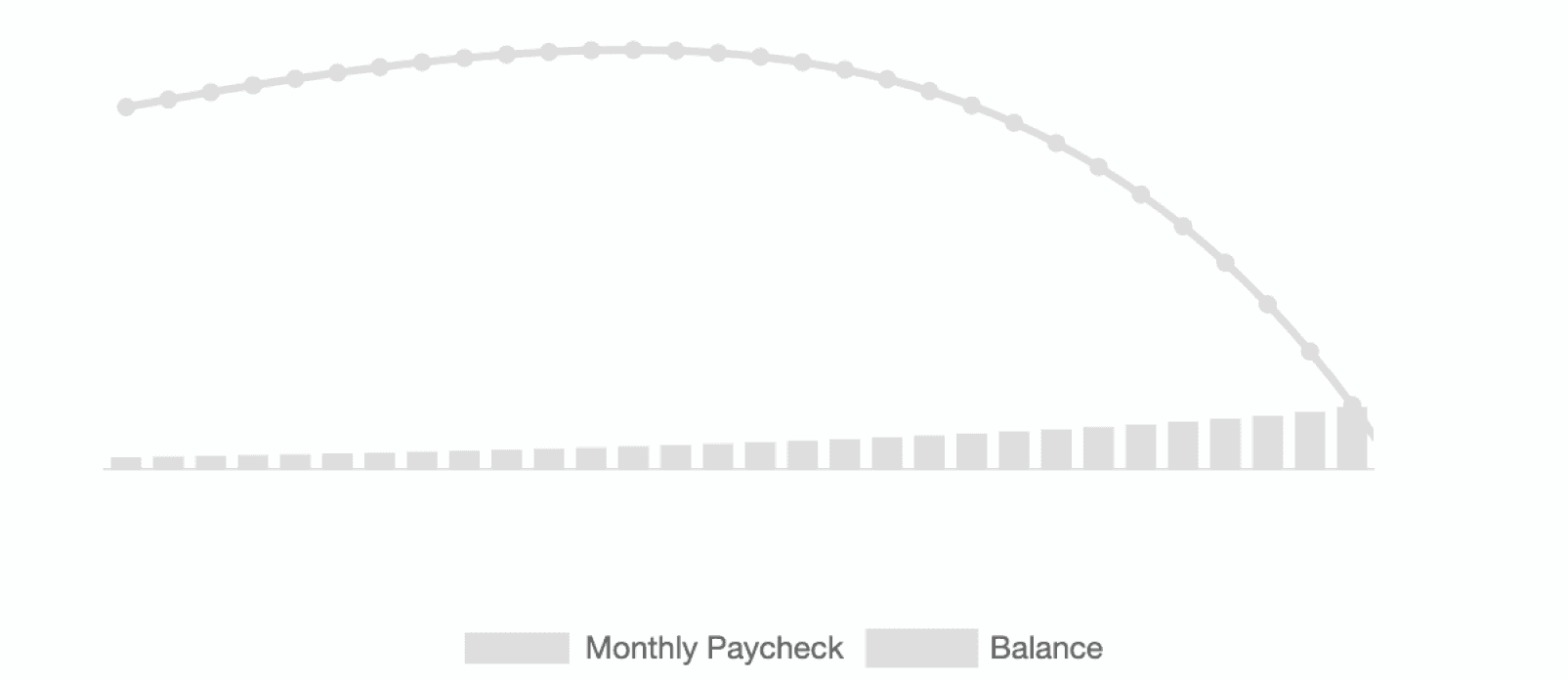

Retirable’s retirement calculator helps to project how much monthly retirement income your retirement nest egg can produce while ensuring your savings last as long as you need.

Birthday

Retirement savings

Retirement age

Final Thoughts

Obviously, the best time to ensure you have plenty of retirement income is while you’re still in the workforce. Once you’ve reached retirement, the key to how to maximize retirement income is to simply reduce expenses and find ways to make your savings last. We recommend working with a certified financial planner who can help you devise a strategy that will make the most of the funds you’re saving.

Share this advice

Stephanie Faris has written about finance for entrepreneurs and marketing firms since 2013. She spent nearly a year as a writer for a credit card processing service and has written about finance for numerous marketing firms and entrepreneurs. Her work has appeared on Money Under 30, The Motley Fool, MoneyGeek, E-commerce Insiders, and GoBankingRates.

Decumulation

Paycheck

Lifestyle Planning

Income Sources

Strategies

Taxes

Risks

Share this advice

Stephanie Faris has written about finance for entrepreneurs and marketing firms since 2013. She spent nearly a year as a writer for a credit card processing service and has written about finance for numerous marketing firms and entrepreneurs. Her work has appeared on Money Under 30, The Motley Fool, MoneyGeek, E-commerce Insiders, and GoBankingRates.