Retirement Accounts

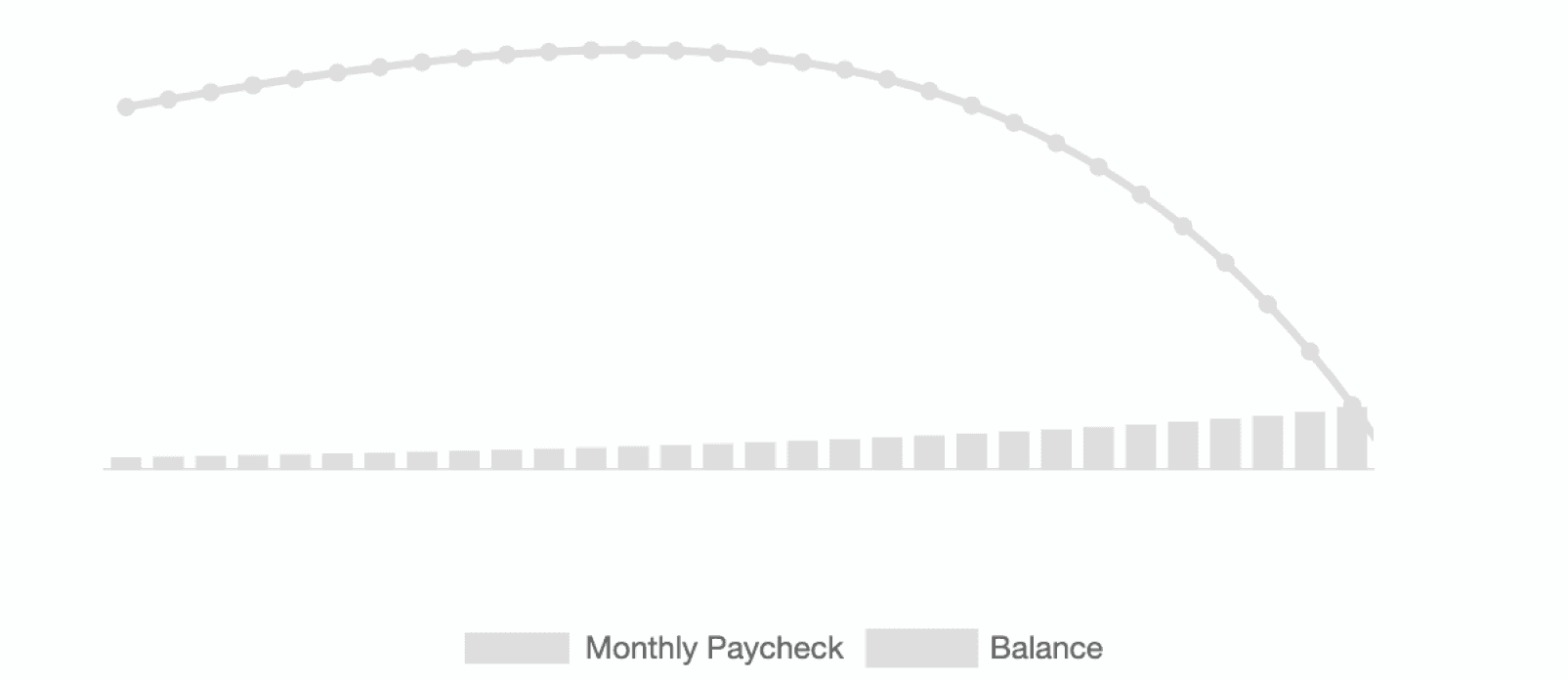

Retirable’s retirement calculator helps to project how much monthly retirement income your retirement nest egg can produce while ensuring your savings last as long as you need.

Birthday

Retirement savings

Retirement age

How much income can you expect each month in retirement? Our retirement income calculator is designed to give you a snapshot of what your existing savings can generate for you while making sure your savings last for at least 30 years.

Retirable

•

Published April 27th, 2021

Calculate Your Retirement Income

How much income can you expect each month in retirement? Our retirement income calculator is designed to give you a snapshot of what your existing savings can generate for you while making sure your savings last for at least 30 years.*

We’ve also made it easy to align your retirement income projections alongside future Social Security, Pension, and other retirement income sources from our free Retirable dashboard. Get started below:

How Our Retirement Income Calculator Works

Behind the scenes, the retirement income calculator assumes:

- A conservative 2% inflation rate

- Retirement accounts grow at an average annual return rate of 5.5% in pre-retirement. This rate reflects a 6% average return minus 0.5% in financial advisor fees in helping build and manage your retirement portfolio to match your particular investment profile.

How much money do you need to retire?

Commonly, people ask “how much do I need to save to retire”? The standard rule of thumb is to look to replace approximately 80% of your pre-retirement income with retirement savings, any pension income, and Social Security income for your retirement expenses. However, that retirement budget can vary widely depending on what your goals and vision are for your retirement years along with how long your retirement lasts. This retirement calculator allows you to personalize your retirement paycheck to your specific situation versus utilizing generalized rules of thumb related to retirement.

What Adjustments Can I Make to Improve my Future Retirement?

- Increase retirement savings contributions. Capture the power of compounding growth and adjust your budget to increase your retirement savings amounts. Your future retired self will thank you.

- Push back your retirement date. Delaying your retirement allows you to save more for that retirement and also lessens the number of years that you need to fund retirement expenses.

- Elect to receive your Social Security Benefits later. Delaying your benefits allows your lifetime benefits to grow when you do claim them.

- Lower retirement expenses in retirement Take advantage of senior citizen discounts, consider downsizing on your housing, and monitor your discretionary spending that can be put to better use.

- Diversify your retirement accounts Not only in what you invest in but also the accounts you utilize. Diversification in asset classes, account tax properties, and for different timeframes in your retirement can help safeguard against uncertainties.

- Avoid making large lump sum withdrawals from retirement accounts Making large withdrawals can result in additional taxes on those funds as well as lead to a smaller overall retirement nest egg to generate your future retirement income.

- Disclosure:

This calculator is for educational use only, illustrating how different user situations and decisions affect a hypothetical retirement income plan, and should not be the basis for any investment or securities product purchase decisions.

Estimated retirement paycheck amounts are simulations based on historical asset class returns and are not recommendations. Keep in mind that investing involves risk. The value of your investments will fluctuate over time, and you may gain or lose money.

IMPORTANT: The projections or other information generated by the Retirable Retirement Income Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

Share this advice

Retirable, the first-of-its-kind holistic retirement solution with the ongoing care of an advisor, offers products and services across the retirement investing, planning and spending spectrum. Retirable was founded by industry veterans to empower a worry-free retirement for everyone.

Decumulation

Paycheck

Lifestyle Planning

Income Sources

Strategies

Taxes

Risks

Share this advice

Retirable, the first-of-its-kind holistic retirement solution with the ongoing care of an advisor, offers products and services across the retirement investing, planning and spending spectrum. Retirable was founded by industry veterans to empower a worry-free retirement for everyone.

Free Retirement Consultation

Still have questions about how to properly plan for retirement? Speak with a licensed fiduciary for free.