Welcome, Good Morning America Viewers!

You've seen us on GMA—now take the next step toward a confident retirement.

Welcome, Good Morning America Viewers!

You've seen us on GMA—now take the next step toward a confident retirement.

Featured In

Featured In

Know you've come to the right place.

A dedicated fiduciary advisor to help you make key decisions

A dynamic financial plan to make your money last

Reliable retirement income to cover your daily expenses

$1M in identity theft insurance to protect your future

Know you've come to the right place.

A dedicated fiduciary advisor to help you make key decisions

A dynamic financial plan to make your money last

Reliable retirement income to cover your daily expenses

$1M in identity theft insurance to protect your future

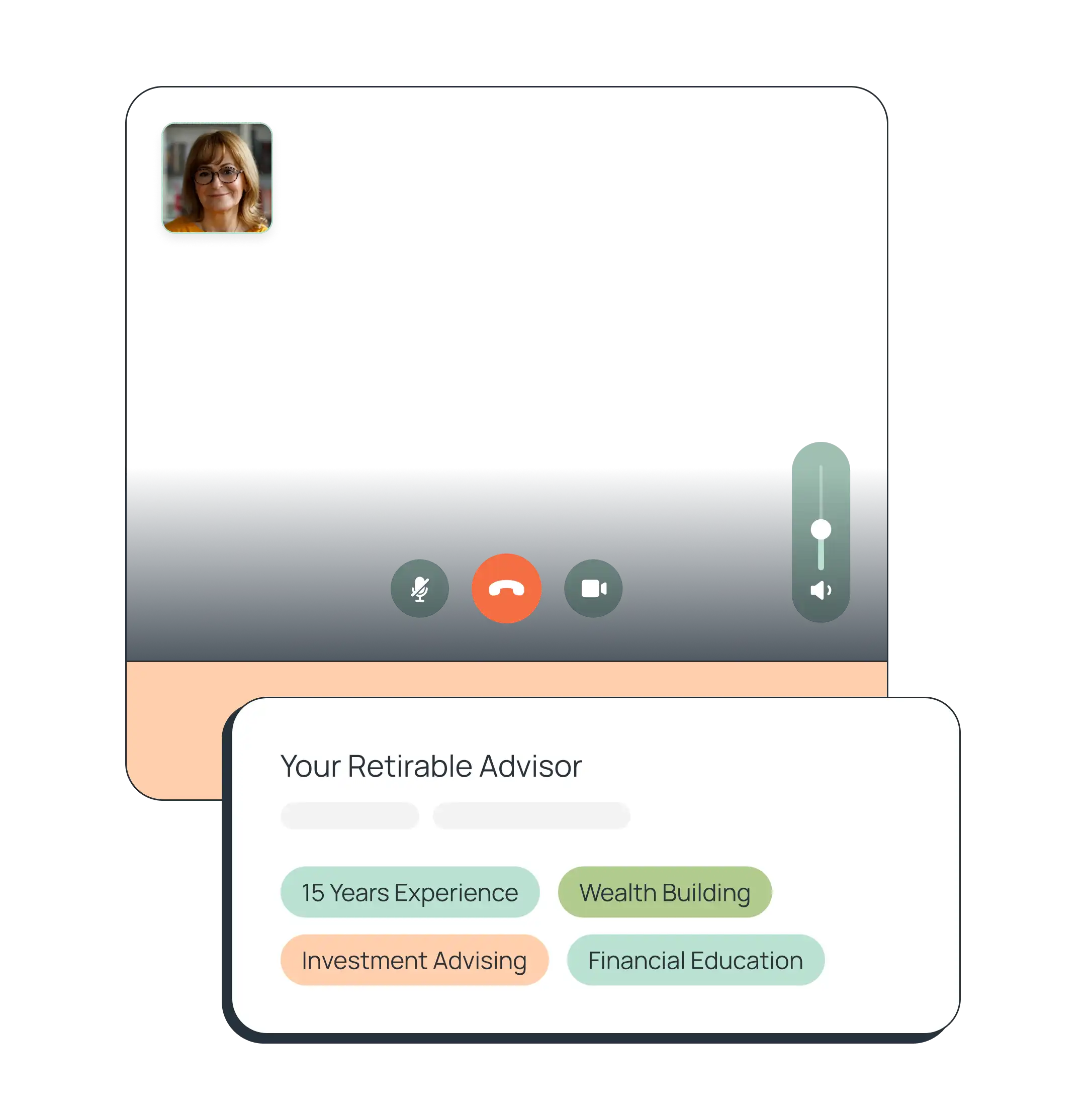

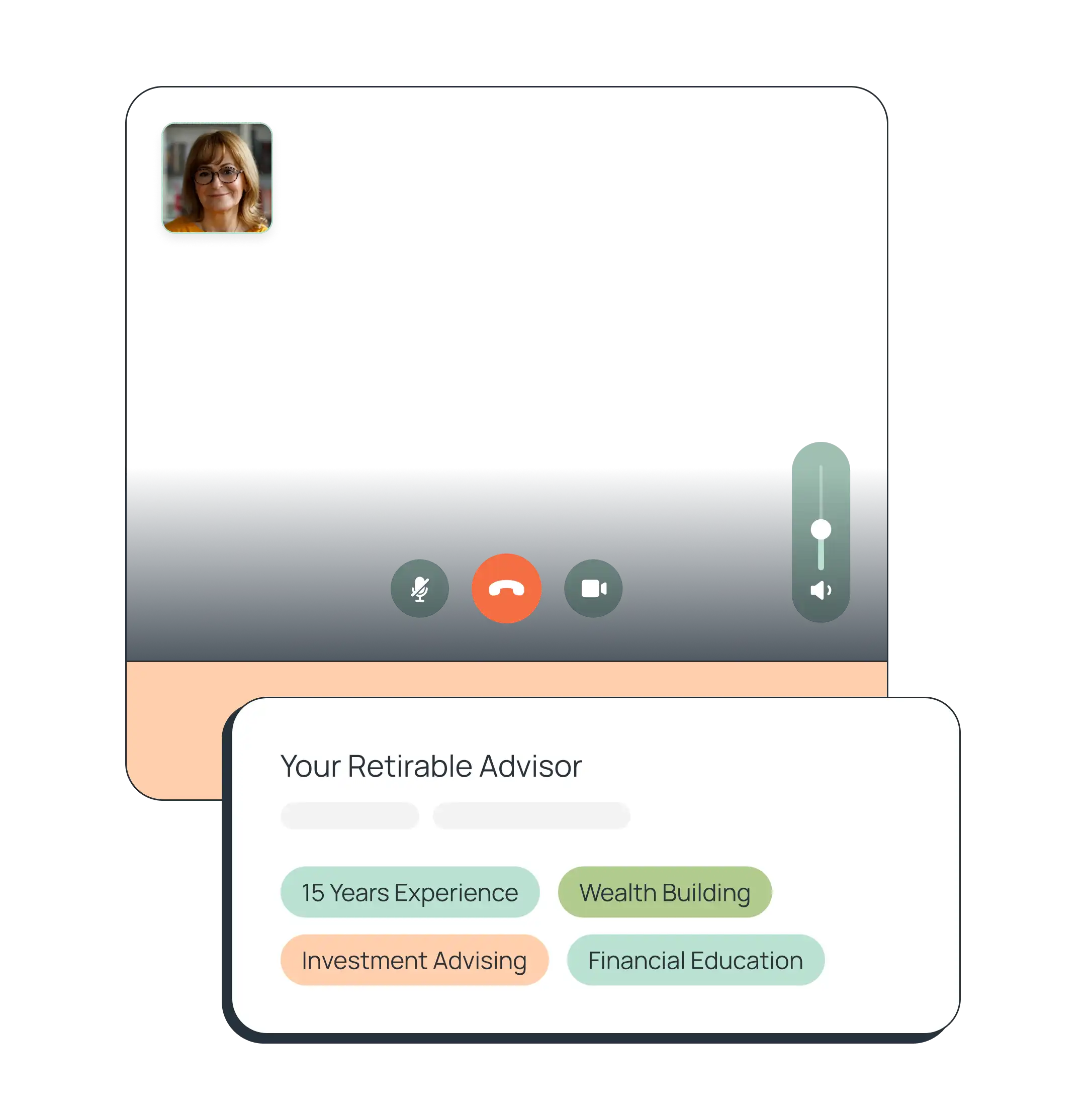

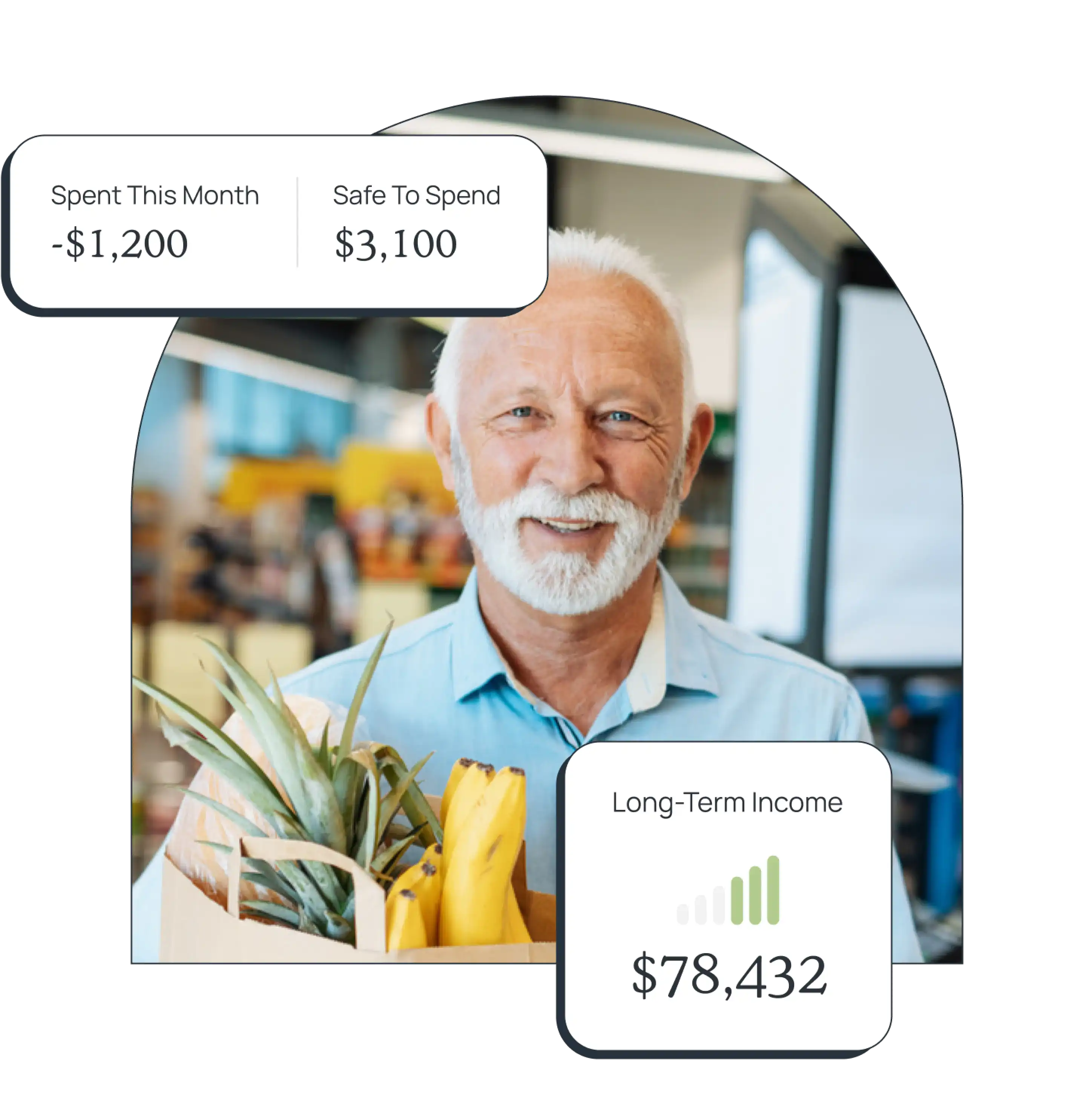

Enjoy ongoing expert care.

Our licensed financial advisors specialize in holistic retirement planning. You'll receive continuous guidance across all of retirement's big decisions: from income to healthcare to lifestyle needs.

Learn More

Enjoy ongoing expert care.

Our licensed financial advisors specialize in holistic retirement planning. You'll receive continuous guidance across all of retirement's big decisions: from income to healthcare to lifestyle needs.

Learn More

Follow a proactive plan.

Your advisor will establish a financial plan and investment strategy that:

Expertly balances risk and growth

Focuses on alignment with your goals and needs

Provides flexibility for the unexpected

Learn More

Follow a proactive plan.

Your advisor will establish a financial plan and investment strategy that:

Expertly balances risk and growth

Focuses on alignment with your goals and needs

Provides flexibility for the unexpected

Learn More

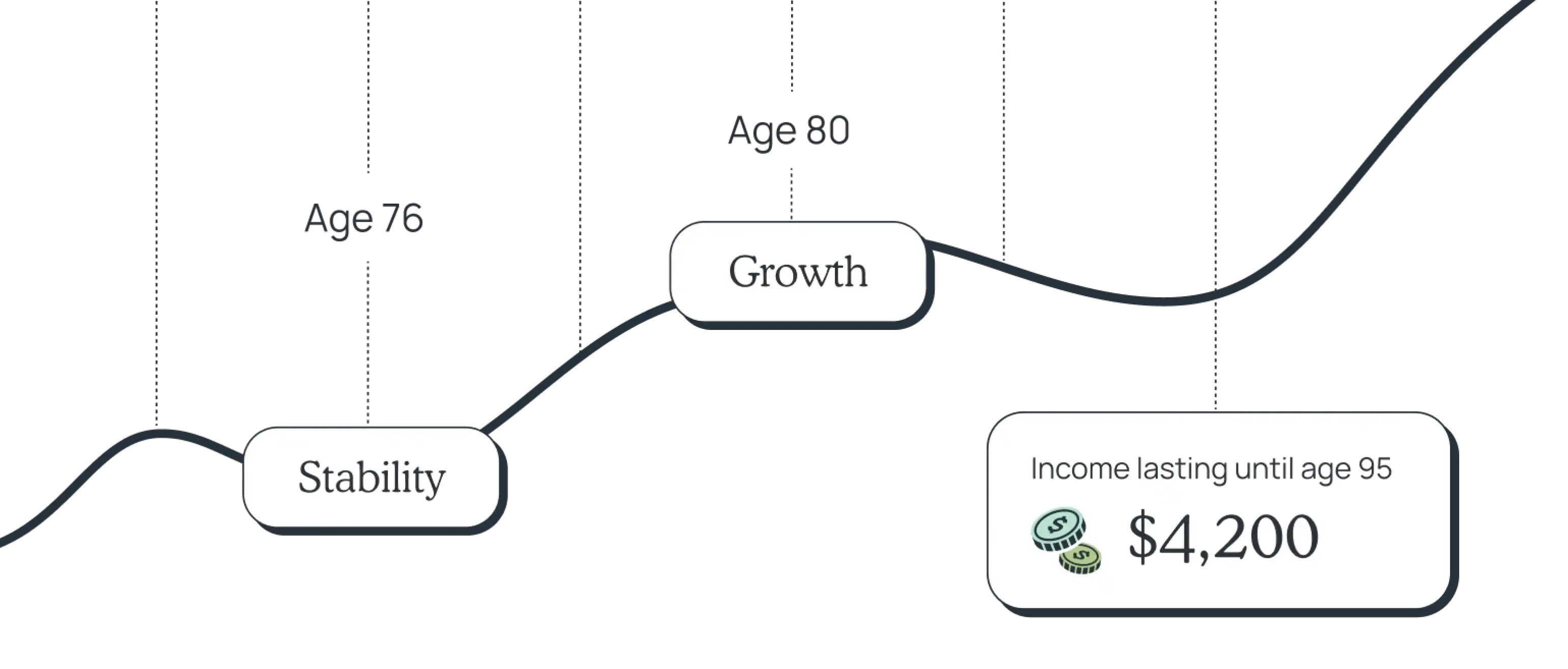

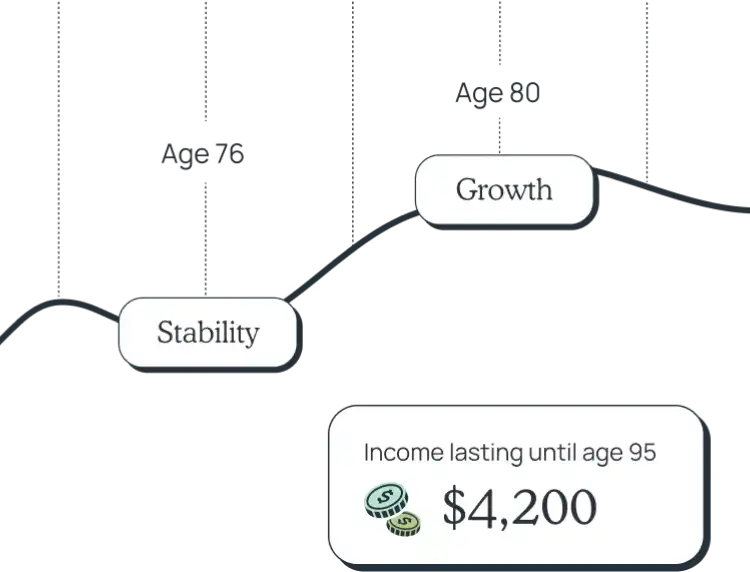

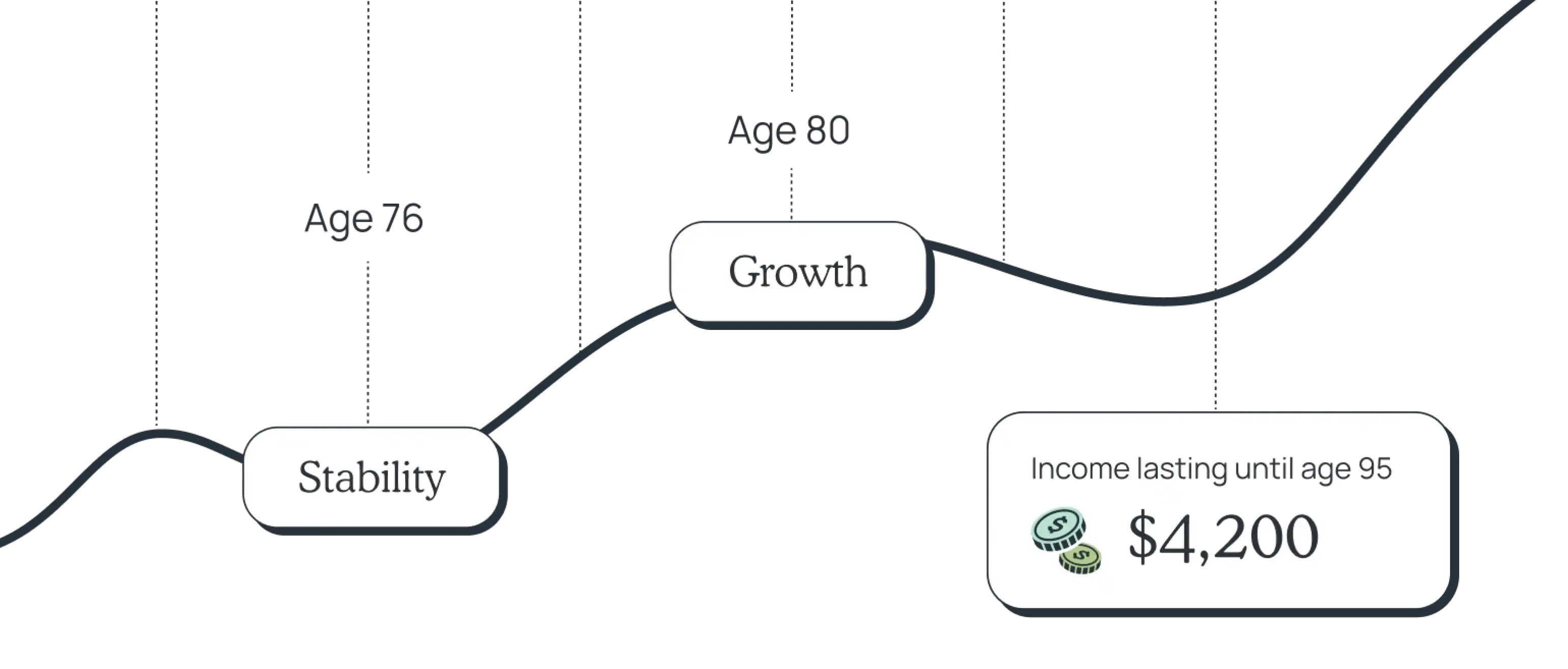

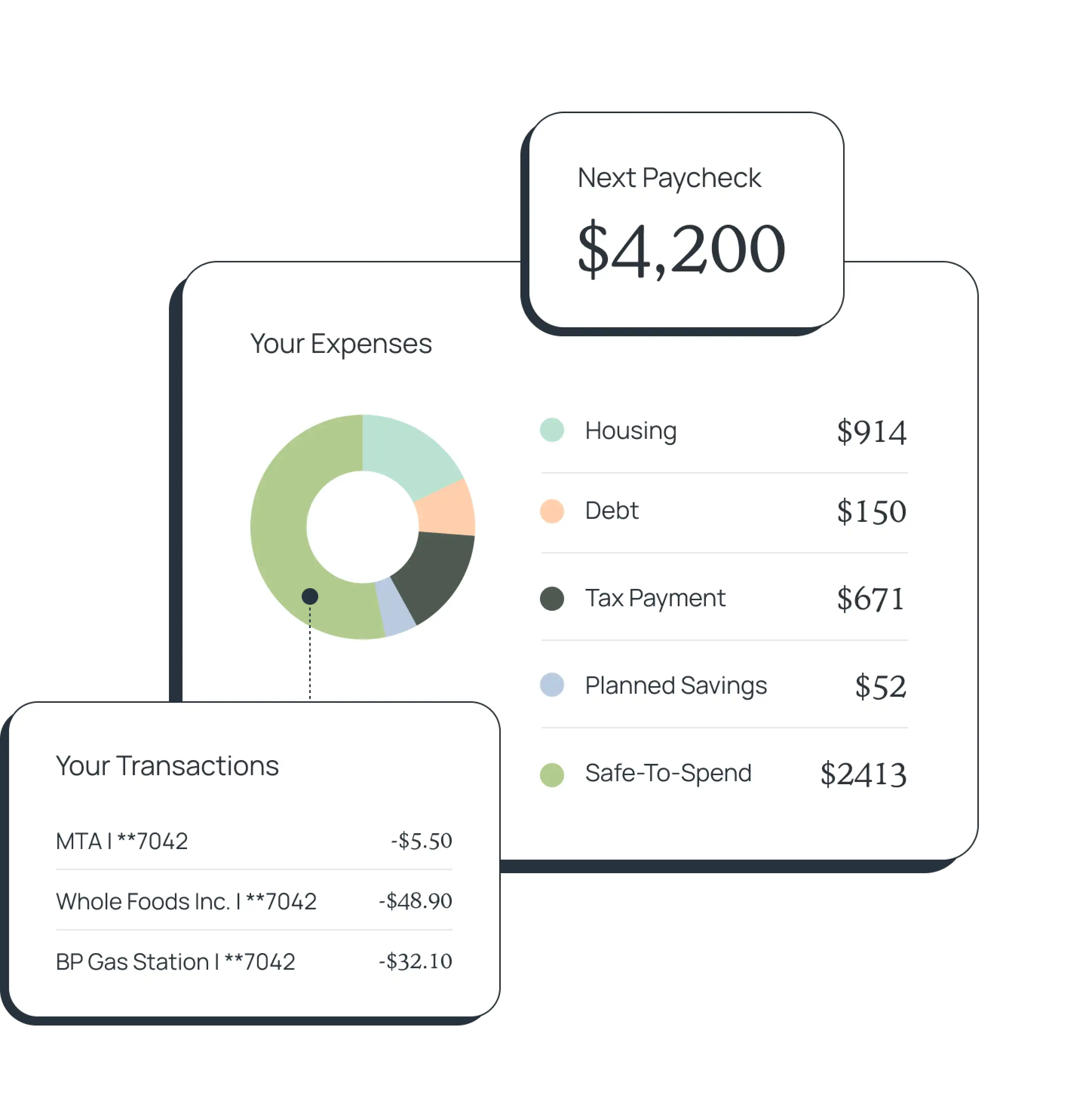

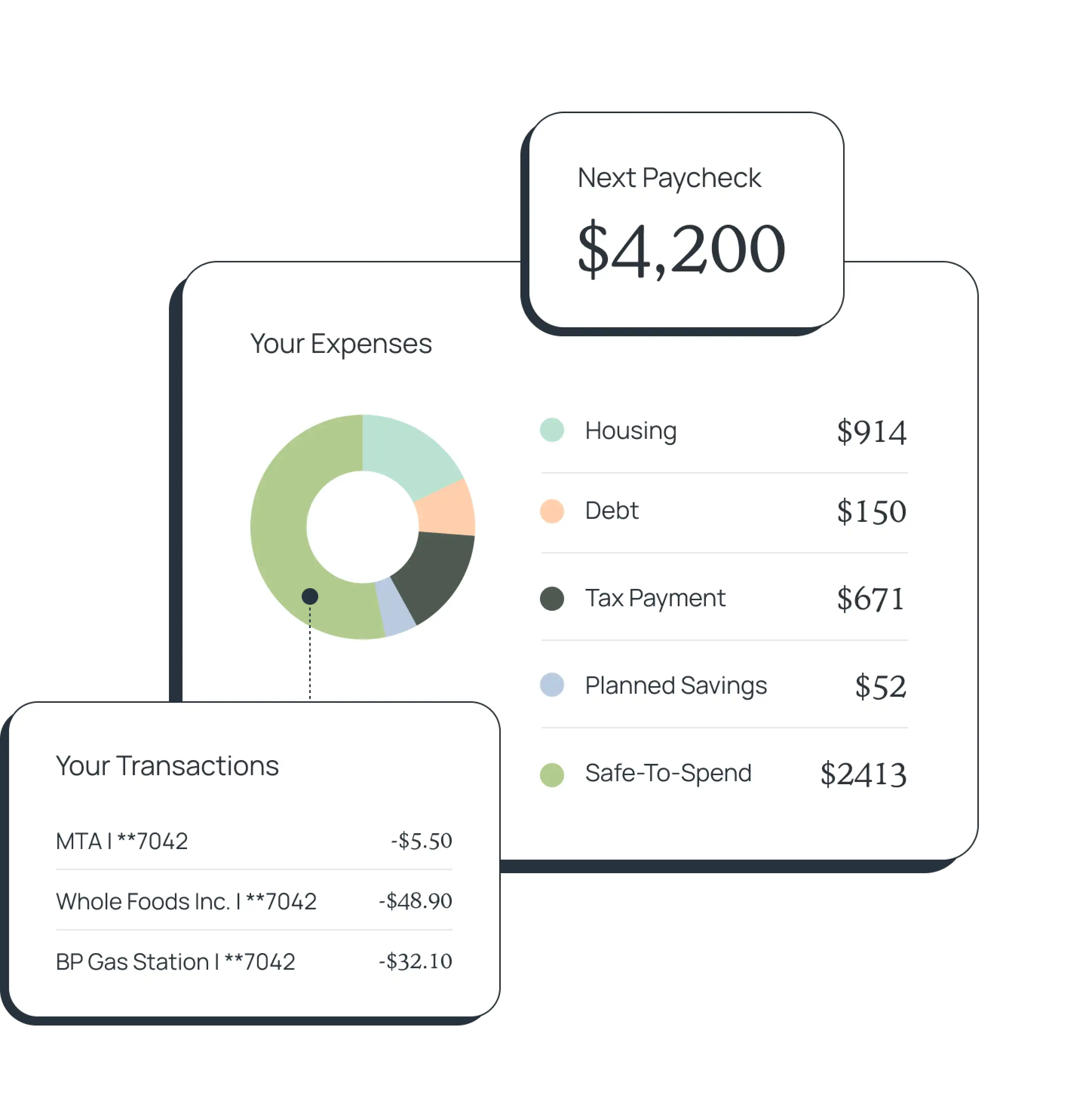

Receive a reliable income.

With monthly paychecks determined by a dynamic, customized plan, you'll always know where you stand and what you can comfortably spend next.

Learn More

Receive a reliable income.

With monthly paychecks determined by a dynamic, customized plan, you'll always know where you stand and what you can comfortably spend next.

Learn More

Plan

Dynamic retirement investment and income plan designed to maintain your lifestyle

Invest

Expert investment management built for cash flow, stability and growth

Spend

Reliable retirement income with one easy, safe-to-spend paycheck

Advice

Your dedicated fiduciary advisor provides guidance to help grow your savings and spend smarter

Save

Earn interest on your cash savings and emergency fund with our high-yield cash account

Protect

$1M in identity theft insurance with a suite of identity and credit monitoring tools

Plan

Personalized retirement investment and income plan designed to maintain lifestyle

Invest

Expert investment management built for cash flow, stability and growth

Advice

Fiduciary advisors provide guidance to help grow savings and spend smarter

Spend

Reliable retirement income with one easy, safe-to-spend paycheck

Save

Earn interest on cash savings and emergency fund with our high-yield cash account

Protect

$1M in identity theft insurance with a suite of identity and credit monitoring tools

We've helped more than 50,000 people just like you.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.