The card made for retirement spending

Spend tax-efficiently and directly from your savings while earning more on your cash with our high-interest account.

The spending companion to your retirement plan.

Your advisor will only put what's safe to spend in your account each month so you can spend confidently.

Monitor your savings in a high-yield account with one of the best APYs in the market.

Unite your income streams into one account for an easier retirement or build an emergency fund before retiring.

The spending companion to your retirement plan.

Your advisor will only put what's safe to spend in your account each month so you can spend confidently.

Monitor your savings in a high-yield account with one of the best APYs in the market.

Unite your income streams into one account for an easier retirement or build an emergency fund before retiring.

See what sets it apart

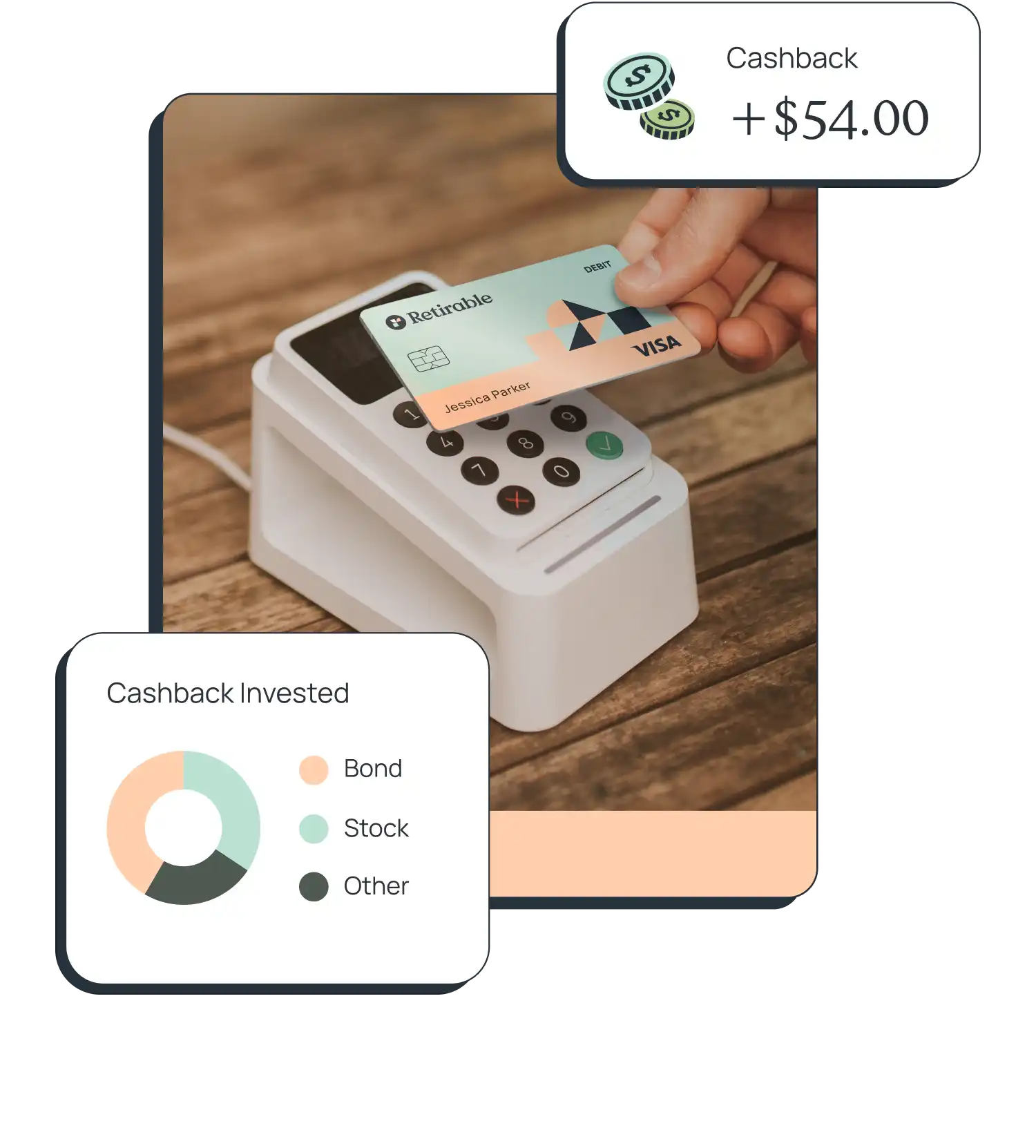

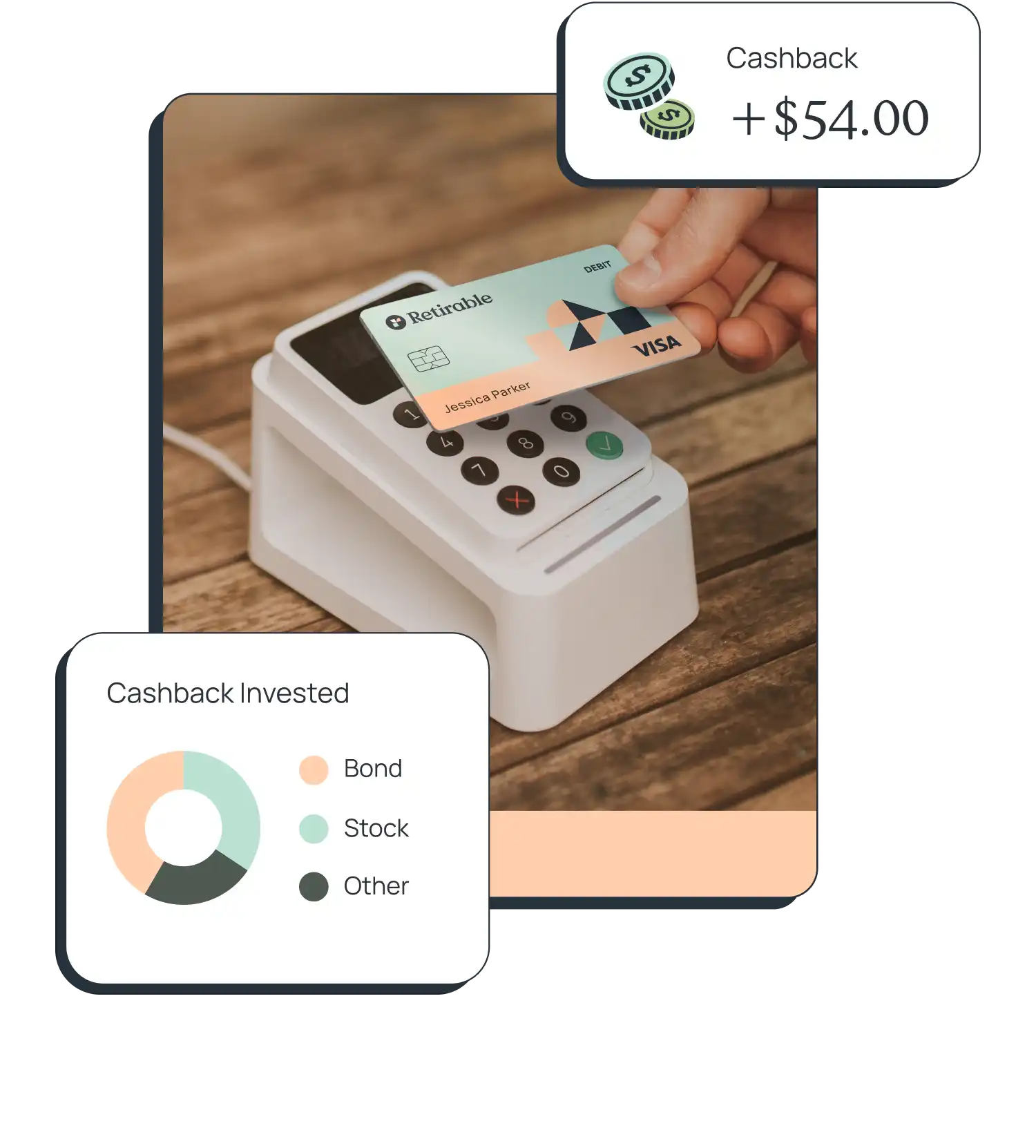

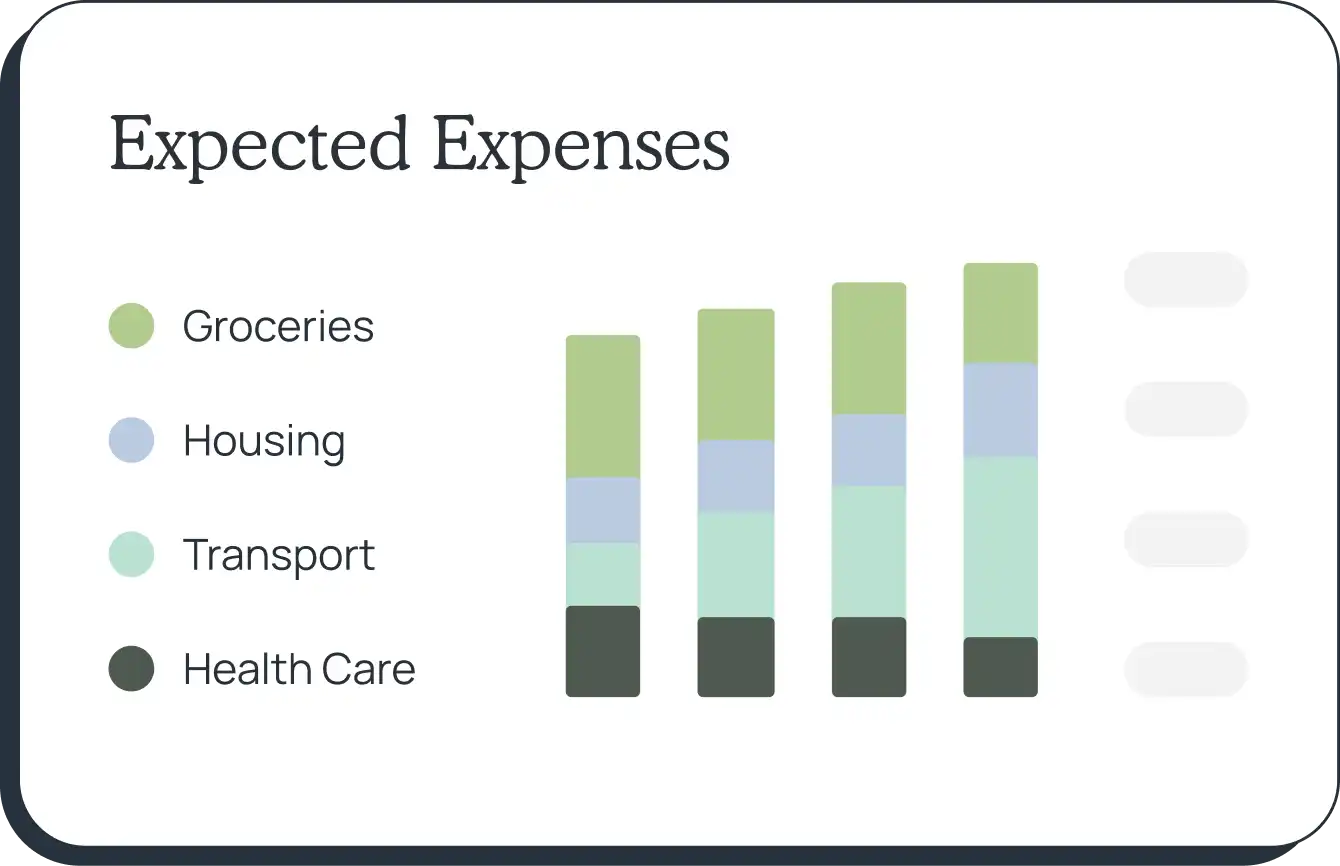

Take control of your spending.

No more waiting for fund transfers. Simply use your card to spend what you need from your retirement savings each month, using your spending plan as your guide.

Simplify your income streams.

Tax efficiently spend Social Security, pensions, and other income streams, all through your debit card.

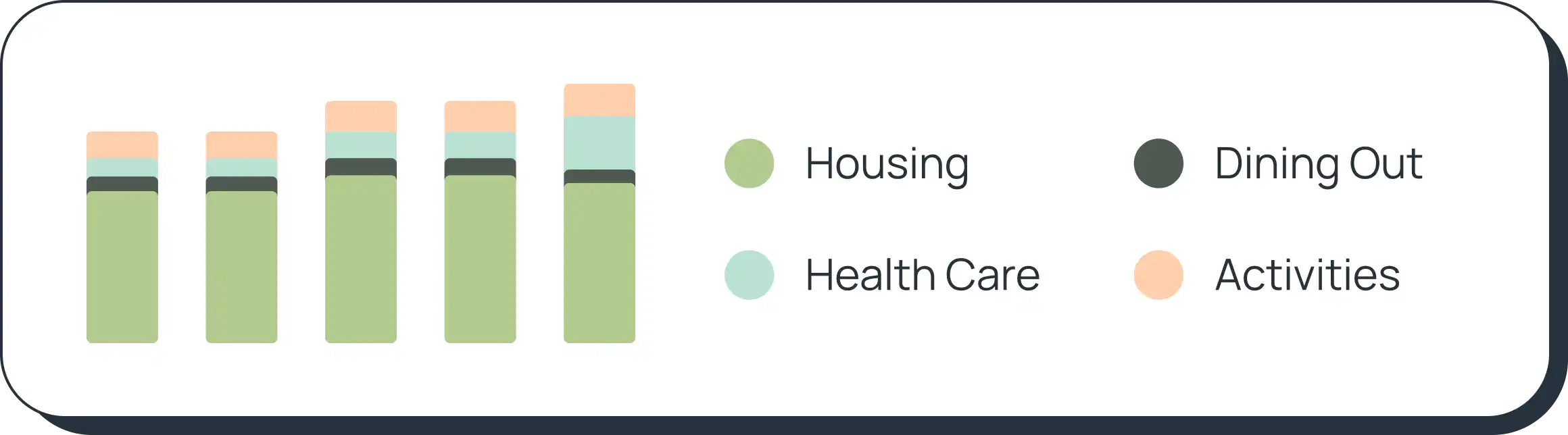

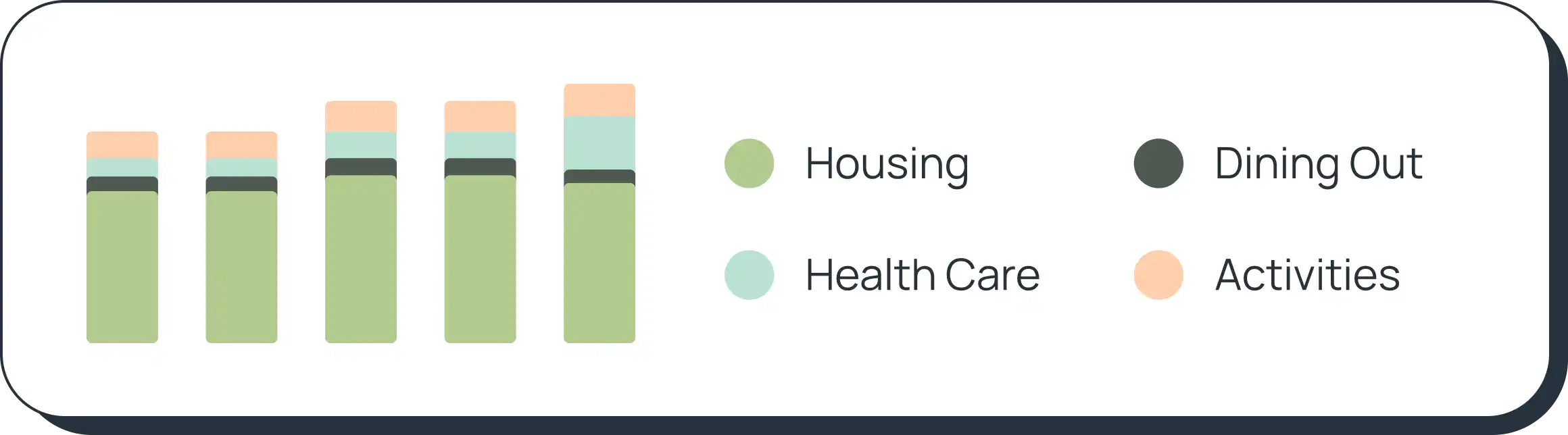

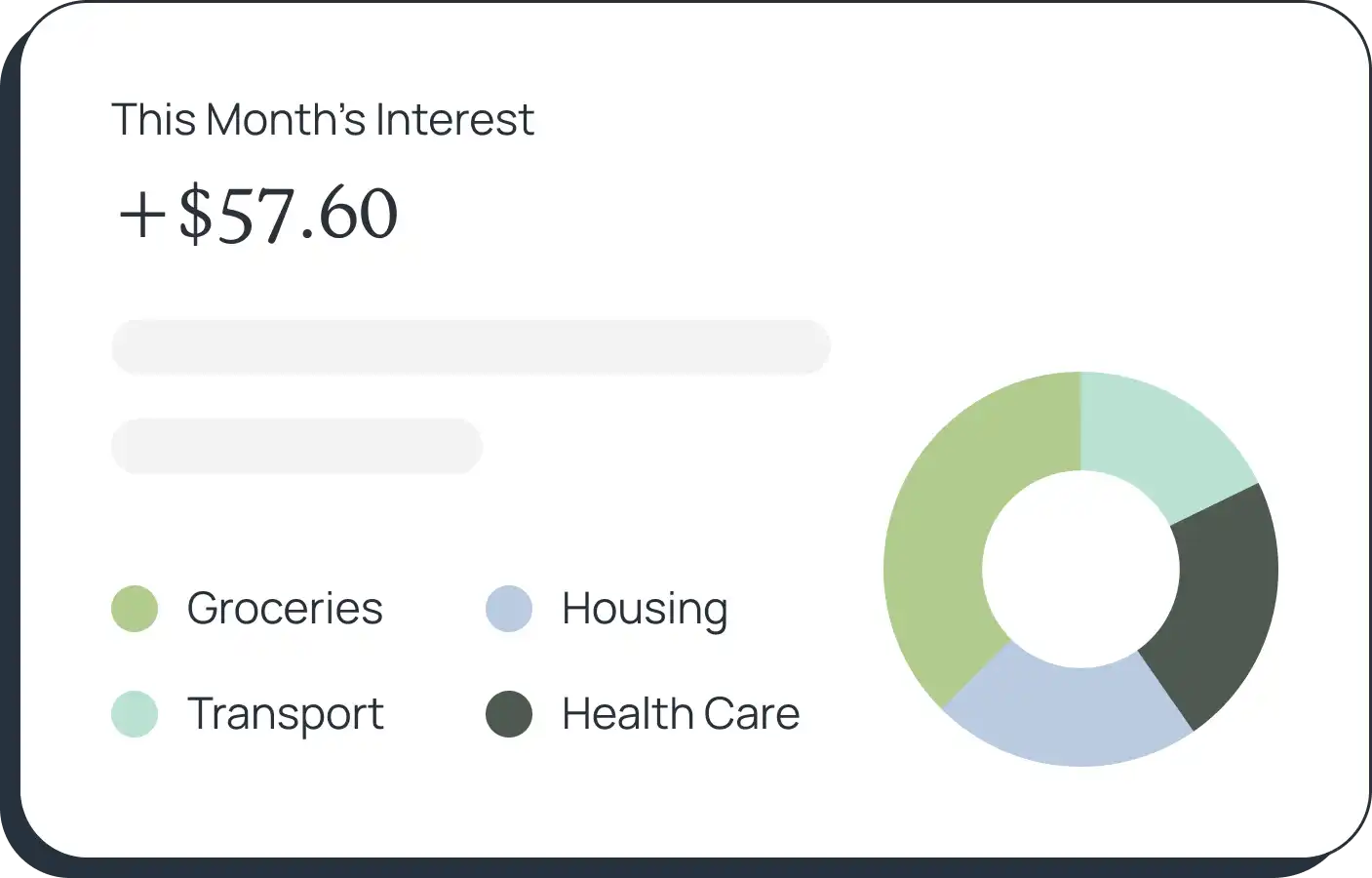

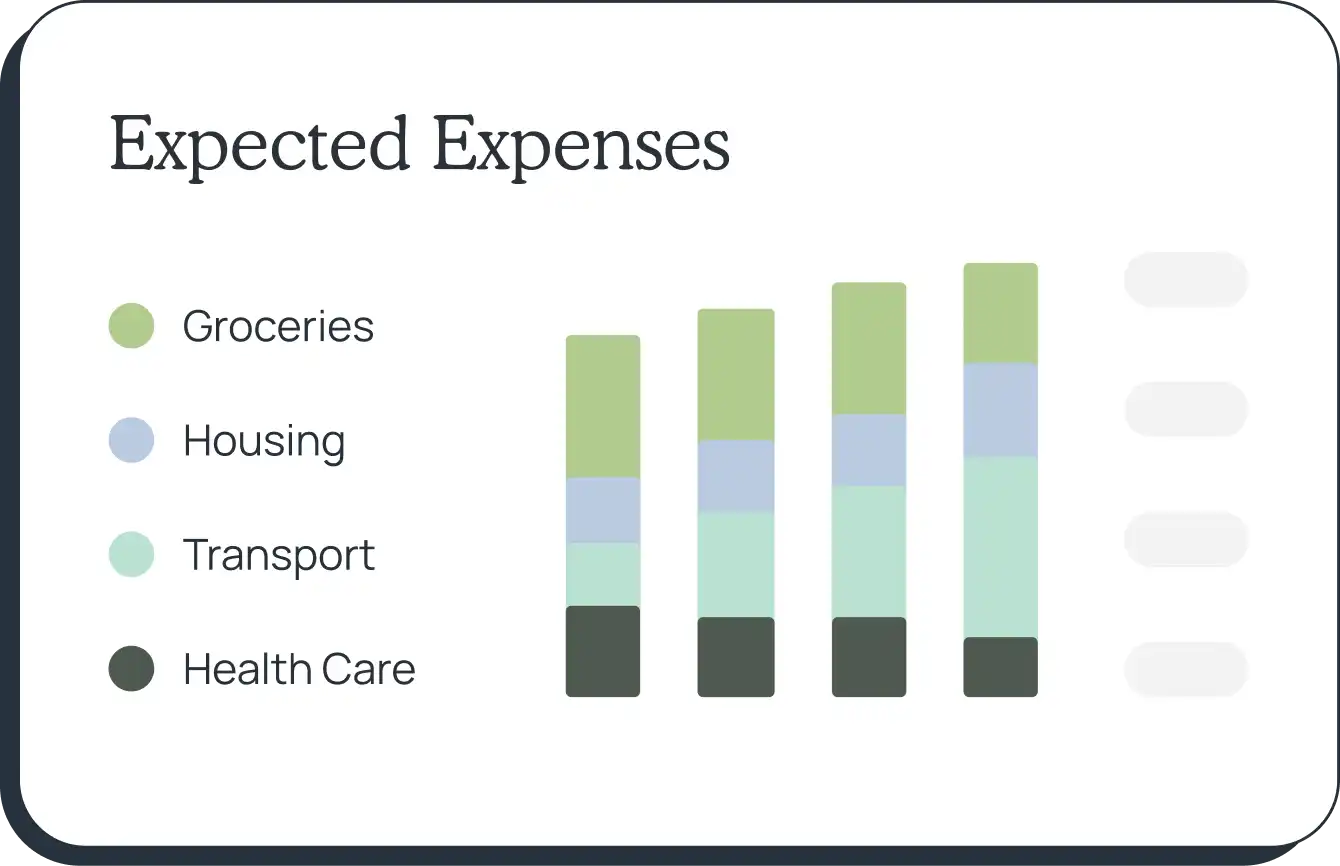

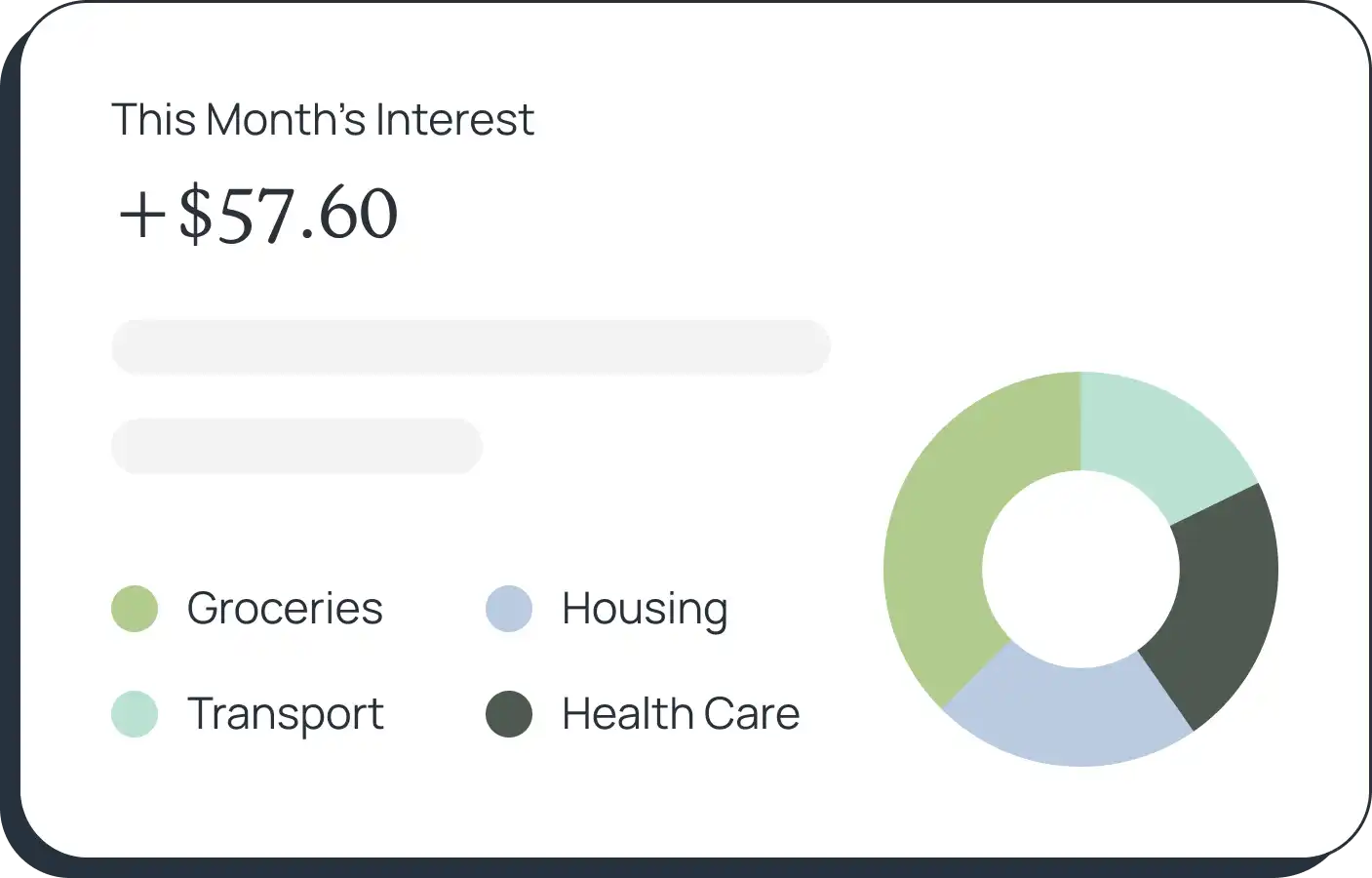

Monitor your spending.

Get a better understanding of your monthly cash flows to help your advisor personalize your plan.

Make your cash go further.

With inflation on everyone's mind, we're proud to offer our clients high interest rates on their cash balances. Retirees can earn some protection against inflation while pre-retirees can build emergency savings faster than before.

See what sets it apart

Take control of your spending.

No more waiting for fund transfers. Simply use your card to spend what you need from your retirement savings each month, using your spending plan as your guide.

Simplify your income streams.

Tax efficiently spend Social Security, pensions, and other income streams, all through your debit card.

Monitor your spending.

Get a better understanding of your monthly cash flows to help your advisor personalize your plan.

Make your cash go further.

With inflation on everyone's mind, we're proud to offer our clients high interest rates on their cash balances. Retirees can earn some protection against inflation while pre-retirees can build emergency savings faster than before.

How it works

Add your free card** anytime to work alongside your retirement plan and make spending easier to track.

Every month your advisor will automatically load your account with your safe to spend amount.

Easily generate lifestyle insights on your spending while earning 2.56% APY* on your cash balance.

How it works

Add your free card** anytime to work alongside your retirement plan and make spending easier to track.

Every month your advisor will automatically load your account with your safe to spend amount.

Easily generate lifestyle insights on your spending while earning 2.56% APY* on your cash balance.