Gain the ultimate peace of mind in retirement.

Live a more confident retirement with a custom financial plan and reliable income. Claim your FREE retirement consultation with a dedicated retirement expert today!

Gain the ultimate peace of mind in retirement.

Live a more confident retirement with a custom financial plan and reliable income. Claim your FREE retirement consultation with a dedicated retirement expert today!

Know you've come to the right place.

Ongoing care of a fiduciary advisor

Financial planning and investment strategies that fit your lifestyle

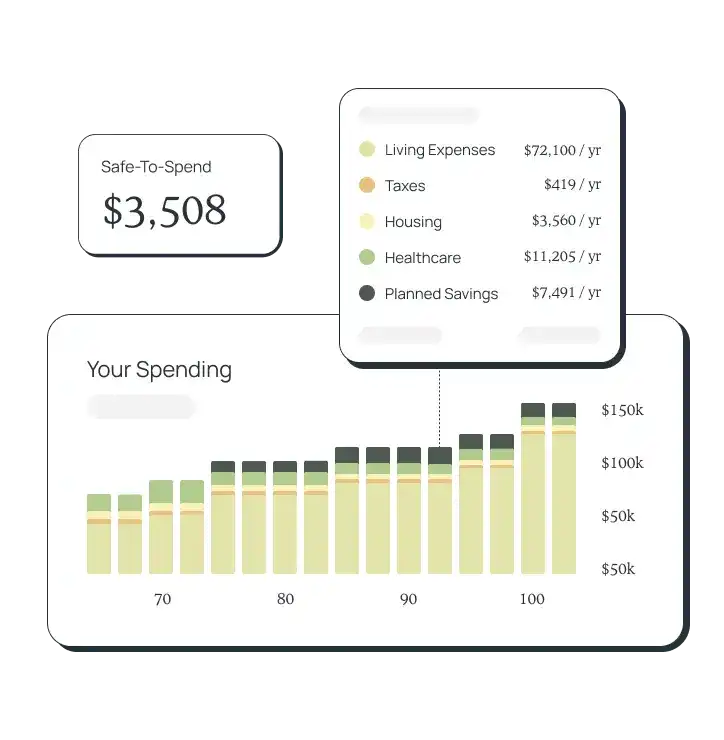

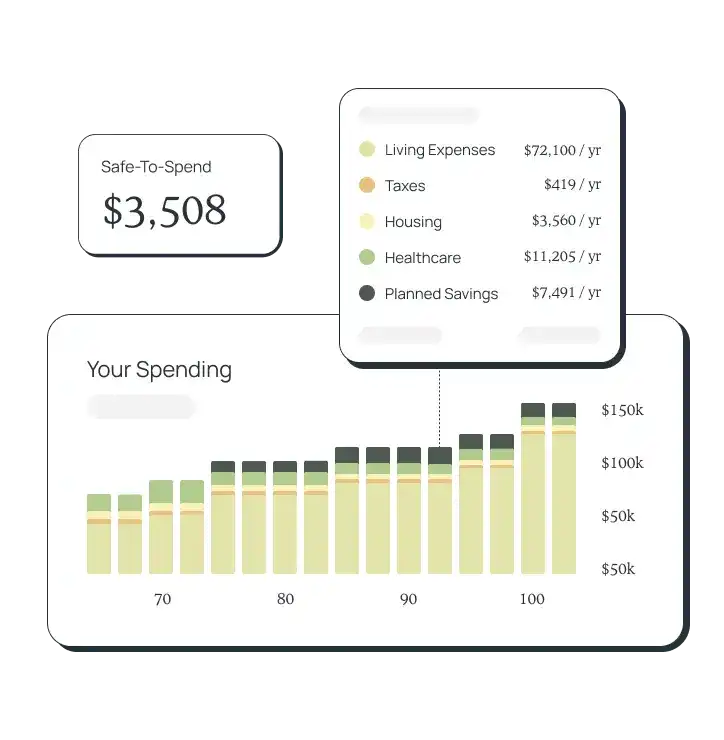

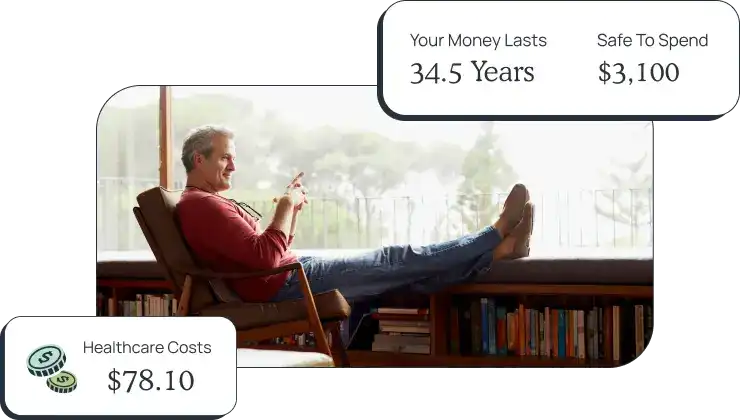

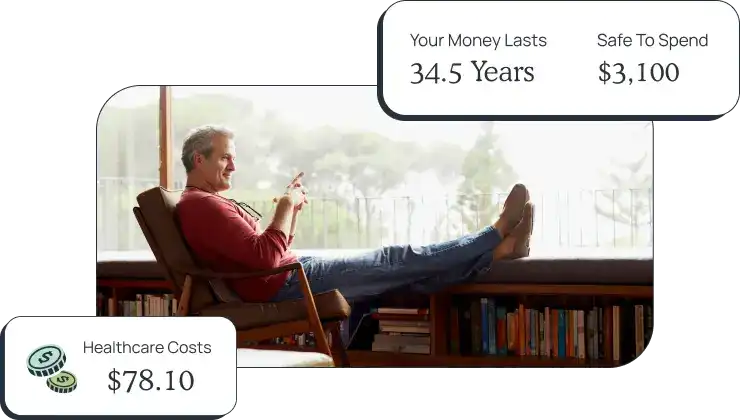

Monthly retirement income so you know what's safe to spend

3.09% APY to grow your cash savings and hedge against inflation*

Fraud protection with $1M in identity theft protection

Know you've come to the right place.

Ongoing care of a fiduciary advisor

Financial planning and investment strategies that fit your lifestyle

Monthly retirement income so you know what's safe to spend

3.09% APY to grow your cash savings and hedge against inflation*

Fraud protection with $1M in identity theft protection

Love it — or it's FREE!

Sign up to become a Retirable customer and if you're not satisfied with your Retirable investment account, you can activate the satisfaction guarantee within 60 days of your portfolio being invested. We'll refund all advisory fees paid during this period. †

Love it — or it's FREE!

Sign up to become a Retirable customer and if you're not satisfied with your Retirable investment account, you can activate the satisfaction guarantee within 60 days of your portfolio being invested. We'll refund all advisory fees paid during this period. †

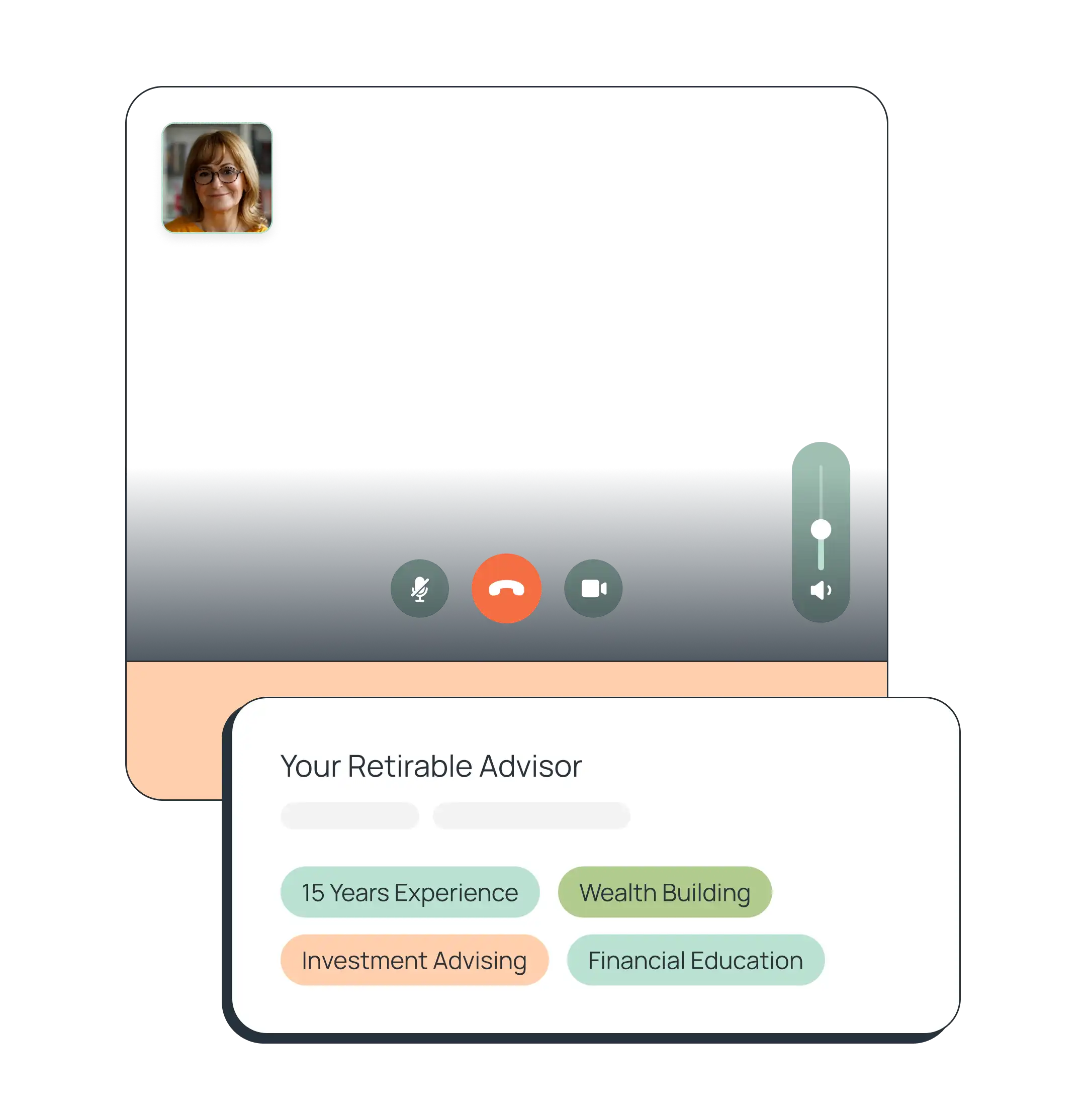

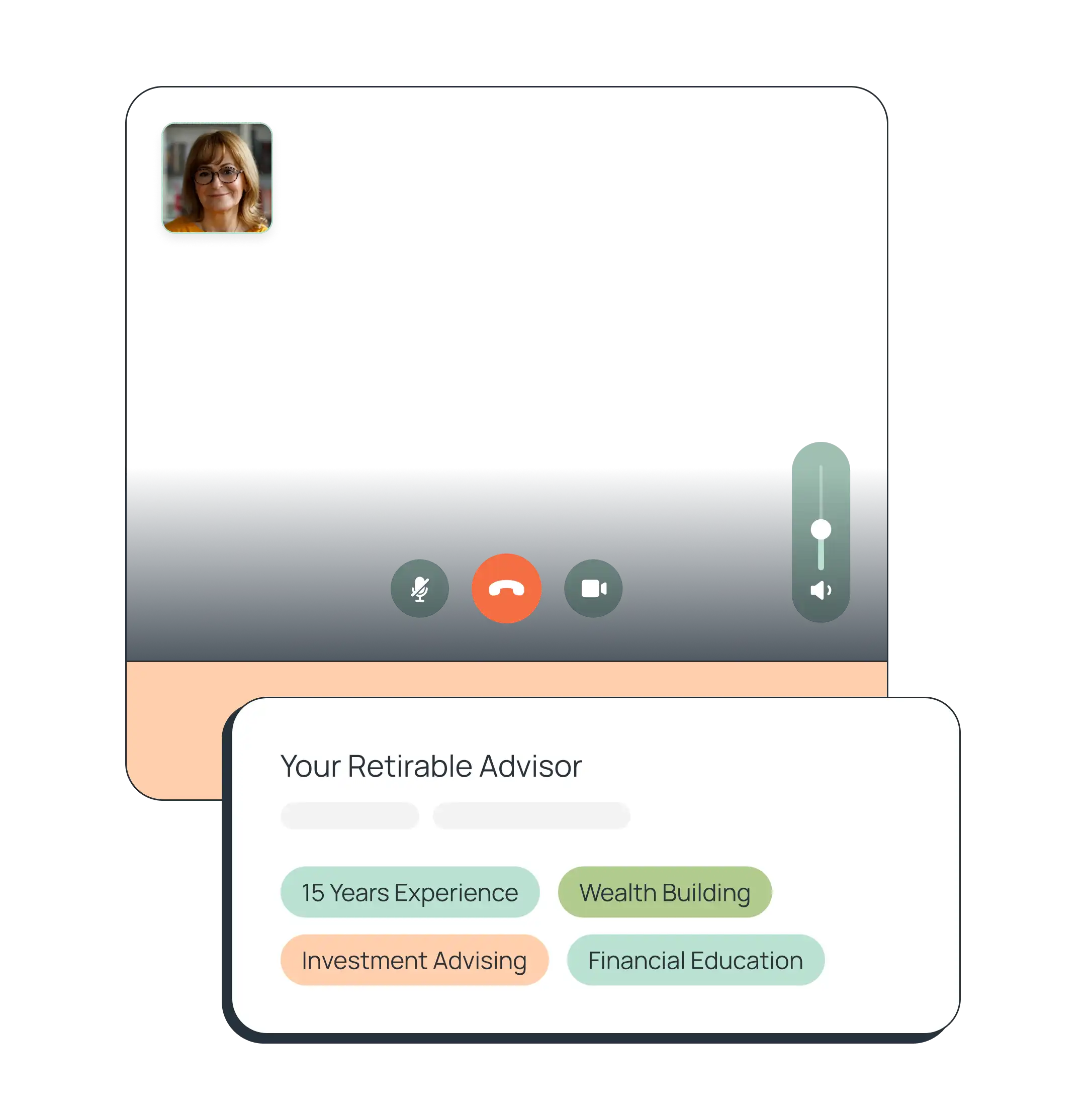

Enjoy ongoing expert care.

Our licensed financial advisors specialize in holistic retirement planning. You'll receive continuous guidance across all of retirement's big decisions: from income to healthcare to lifestyle needs.

Enjoy ongoing expert care.

Our licensed financial advisors specialize in holistic retirement planning. You'll receive continuous guidance across all of retirement's big decisions: from income to healthcare to lifestyle needs.

You’re one step closer to total retirement wellness

Retirable makes retirement planning, investing and spending simple. We work alongside you to provide a complete financial picture - giving you a more comfortable retirement.

You’re one step closer to total retirement wellness

Retirable makes retirement planning, investing and spending simple. We work alongside you to provide a complete financial picture - giving you a more comfortable retirement.

It all starts with a plan

With Retirable’s FREE consultation, we’ll review your savings, healthcare costs, Social Security and other income sources to put together a retirement investment and spending plan to align with your lifestyle goals.

It all starts with a plan

With Retirable’s FREE consultation, we’ll review your savings, healthcare costs, Social Security and other income sources to put together a retirement investment and spending plan to align with your lifestyle goals.

More than just financial advice

Retirable will deliver a detailed retirement plan, including:

Timing advice for Social Security, pensions and retirement accounts

Where to tax-efficiently place funds while working and in retirement

Current and expected healthcare costs throughout retirement

What is safe to spend each month in retirement, including distributions needed to replace income and cash flows through retirement

More than just financial advice

Retirable will deliver a detailed retirement plan, including:

Timing advice for Social Security, pensions and retirement accounts

Where to tax-efficiently place funds while working and in retirement

Current and expected healthcare costs throughout retirement

What is safe to spend each month in retirement, including distributions needed to replace income and cash flows through retirement

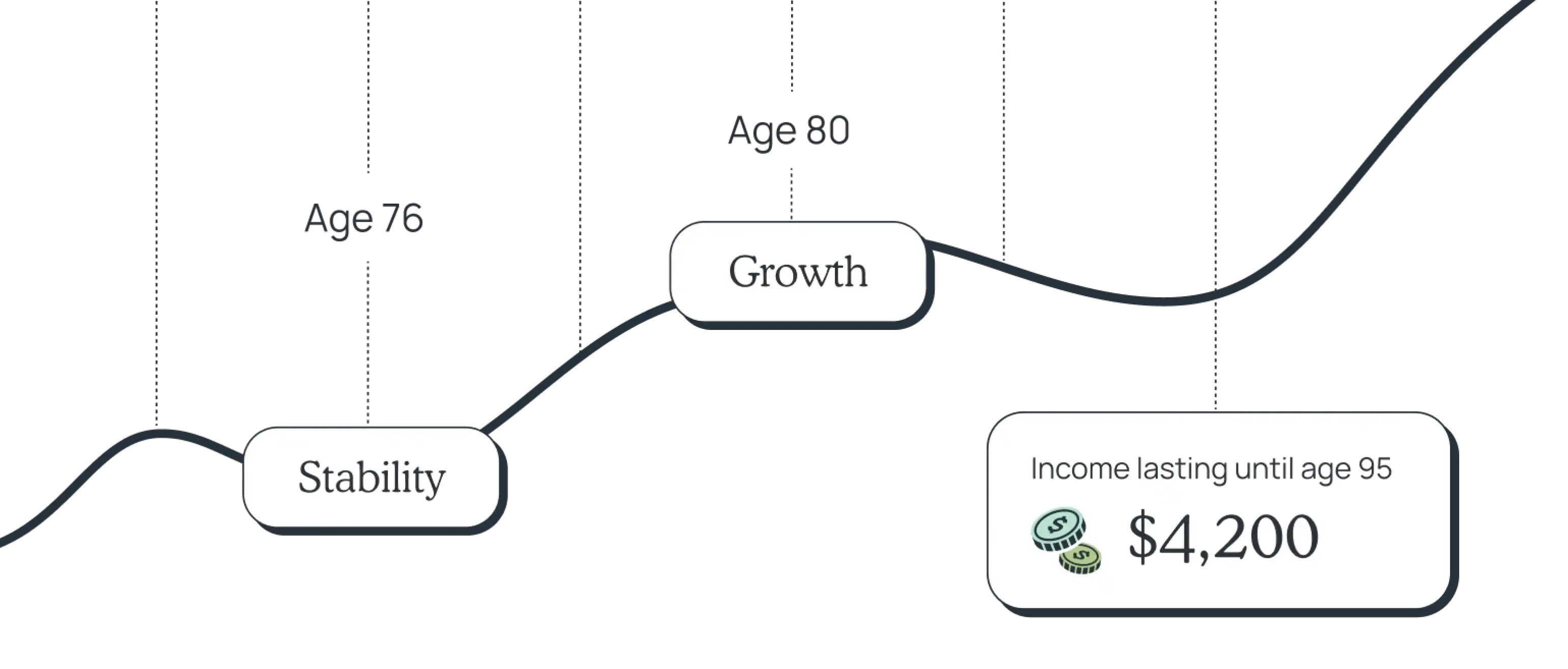

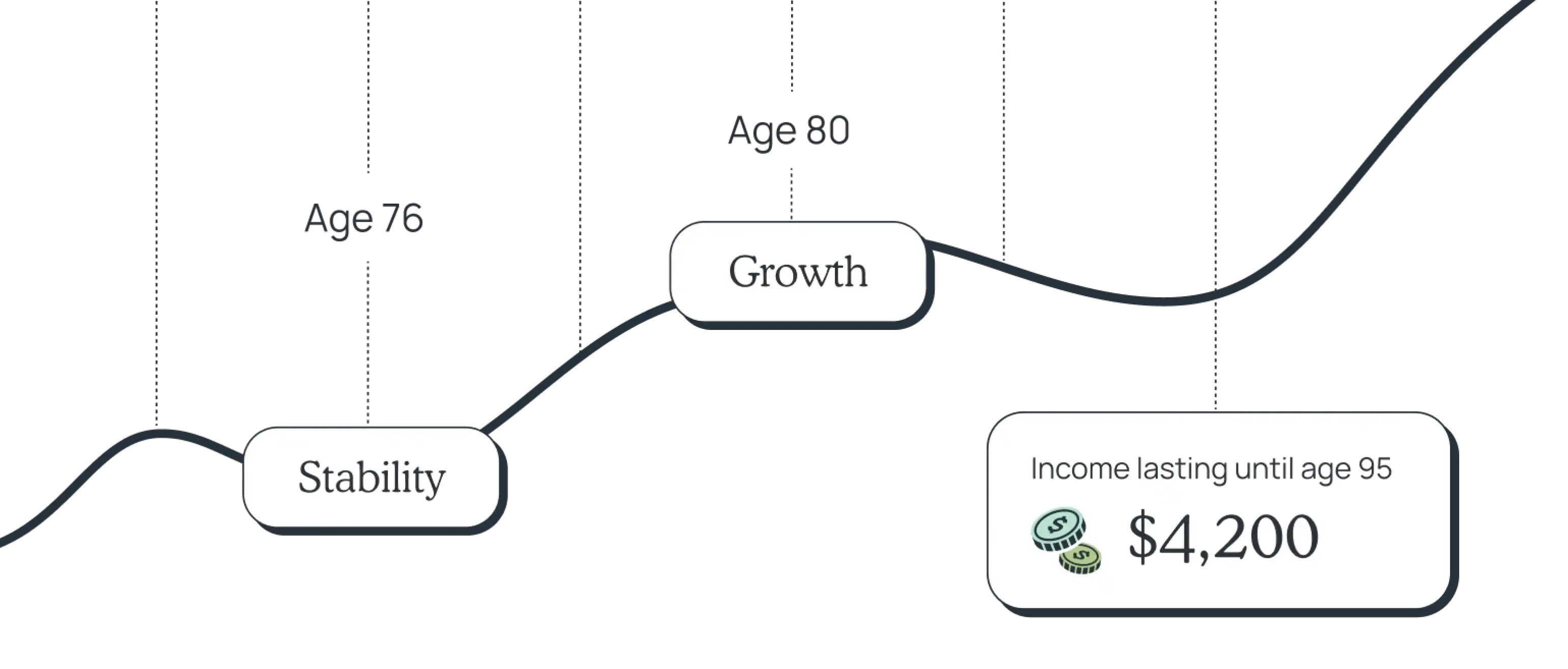

Spend retirement with more freedom

Reliable retirement income helps you spend confidently throughout retirement. Your funds stay in your name, the ability to make changes stays in your hands.

Spend retirement with more freedom

Reliable retirement income helps you spend confidently throughout retirement. Your funds stay in your name, the ability to make changes stays in your hands.

A trusted partner through retirement.

Retirable is your retirement planning, investing and spending platform with the ongoing care of a fiduciary advisor. As your health and wealth changes, you’ll have the experts on your team to make the right adjustments along the way.

A trusted partner through retirement.

Retirable is your retirement planning, investing and spending platform with the ongoing care of a fiduciary advisor. As your health and wealth changes, you’ll have the experts on your team to make the right adjustments along the way.

An investment strategy built for a sustainable retirement.

Our investment management strategy is designed with the complexities of retirement in mind. It's working behind the scenes so you can confidently spend your savings through retirement.

Current APY

3.09%

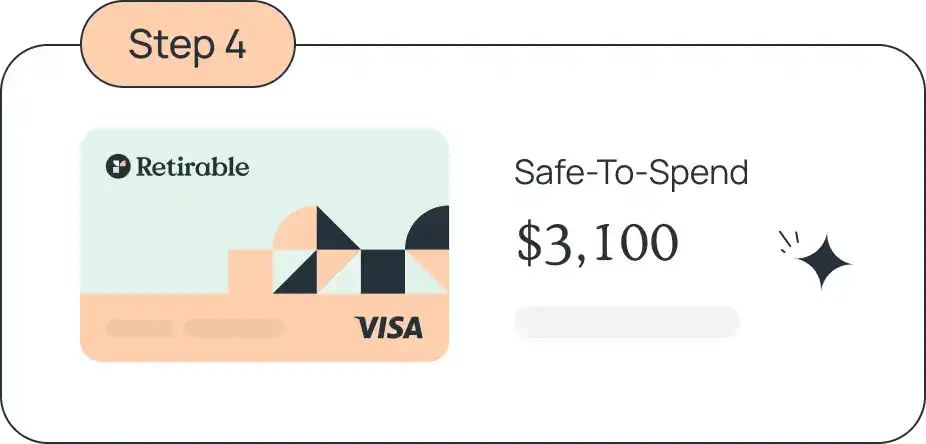

A debit card that empowers your lifestyle.

No more waiting on slow bank transfers to spend your savings. Our cash management account holds your monthly safe-to-spend balance while earning high interest to make your cash go further.

Our investment management strategy is designed with the complexities of retirement in mind. It's working behind the scenes so you can confidently spend your savings through retirement.

No more waiting on slow bank transfers to spend your savings. Our cash management account holds your monthly safe-to-spend balance while earning high interest to make your cash go further.

We've helped more than 50,000 people just like you.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.