Our most frequently asked questions

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

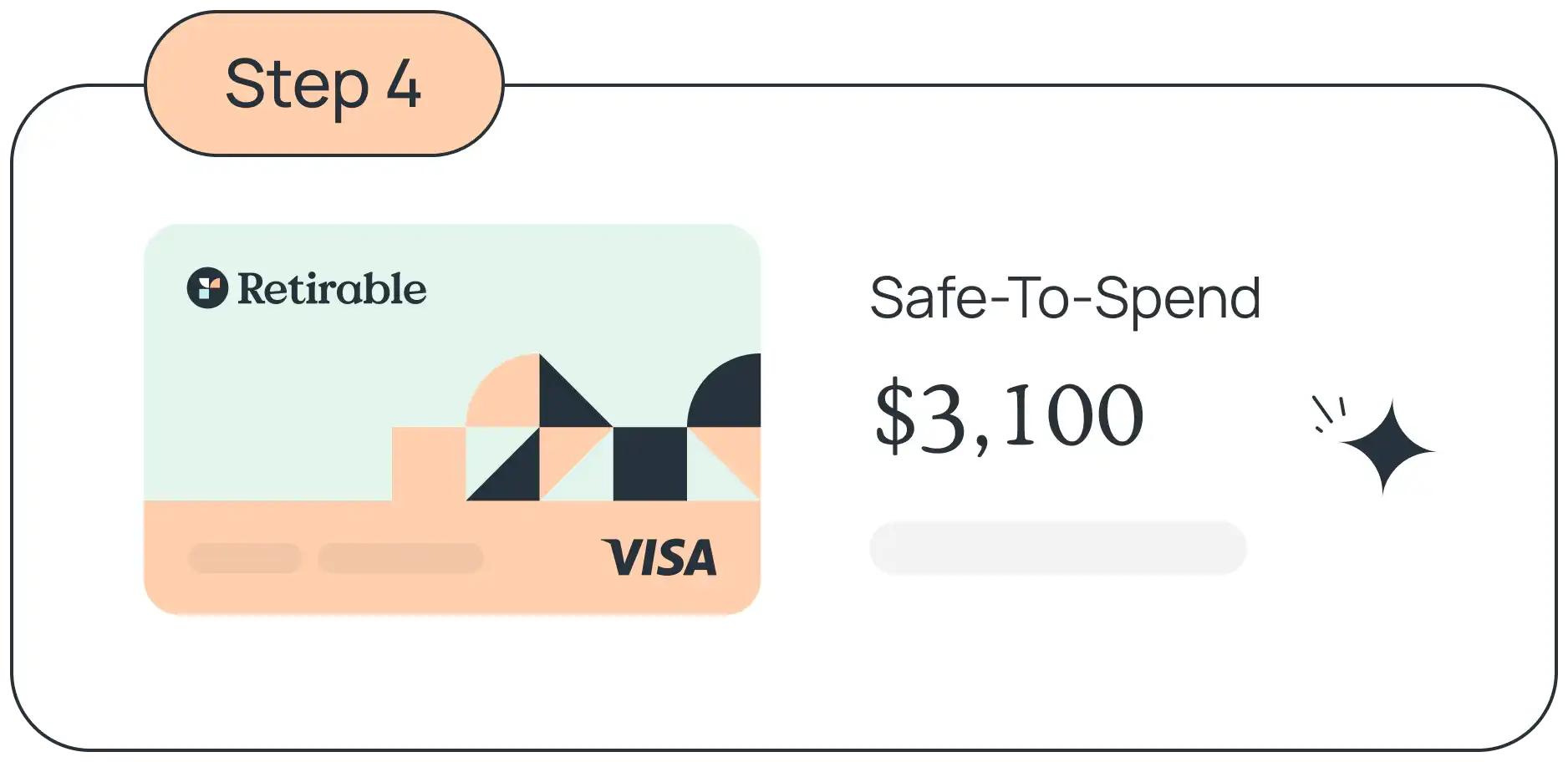

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.

Our most frequently asked questions

We’re here to help

How does Retirable make money?

Do you have a mobile app?

Is Retirable another robo-advisor?

What are your hours?

Is Retirable licensed?

Who’s behind Retirable?

What’s retirement decumulation, exactly?

What’s Retirable’s mission?

Who is Retirable for?

Where can I find your SEC registration?

Where is Retirable located?

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.

We've helped more than 50,000 people just like you.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.