How would a recession impact your retirement?

We surveyed the retirement landscape in 2023 to help you understand clearly how market and economic factors might affect your retirement now and in the future.

How would a recession impact your retirement?

We surveyed the retirement landscape in 2023 to help you understand clearly how market and economic factors might affect your retirement now and in the future.

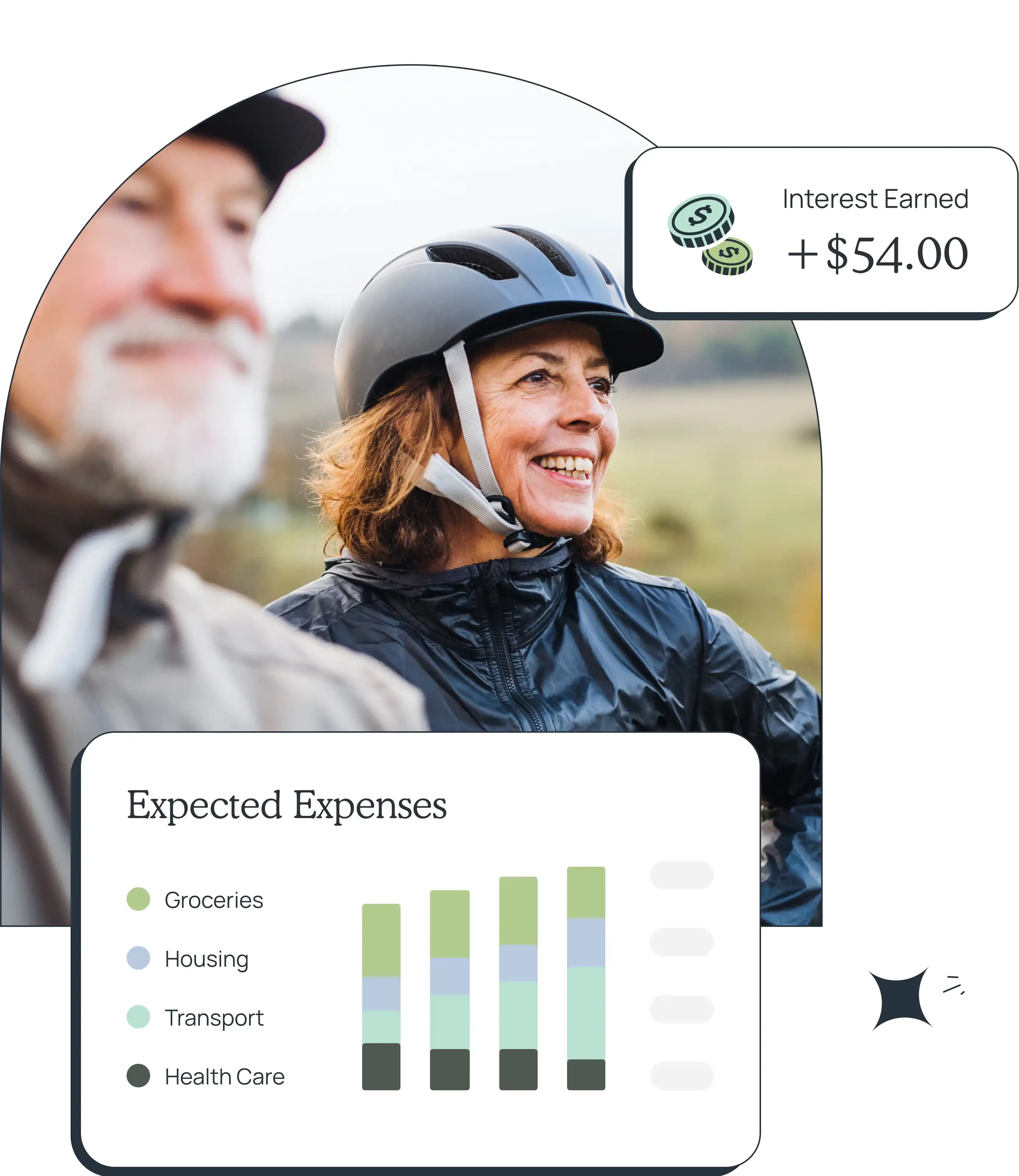

Plan ahead for any scenario

Discover methods to boost your savings and consolidate your debt while utilizing your biggest assets to help prepare for any potential economic changes.

Plan ahead for any scenario

Discover methods to boost your savings and consolidate your debt while utilizing your biggest assets to help prepare for any potential economic changes.

Invest in your ideal future

Learn how to balance your portfolio, minimize investment fees and lower your tax burden to make positive long-term impacts.

Invest in your ideal future

Learn how to balance your portfolio, minimize investment fees and lower your tax burden to make positive long-term impacts.

Spend retirement with more

Build strong retirement income strategies alongside a resilient spending plan to embrace the unknown.

Spend retirement with more

Build strong retirement income strategies alongside a resilient spending plan to embrace the unknown.

The tools you need to live your best retirement life.

Download our free guide to safeguard your retirement from whatever the economy might throw your way.

The tools you need to live your best retirement life.

Download our free guide to safeguard your retirement from whatever the economy might throw your way.