Lifestyle

Retirement communities, targeted at those 55 and older, attract seniors with the promise of state-of-the-art gyms, golf courses, dining options, and more—but not all of these developments are created equal. We’ve rounded up the top retirement communities by region so you can start to research the amenities worth paying for, and options located in or around the places you’d feel glad to call home during retirement.

C.E Larusso

•

Published June 14th, 2023

•

Updated January 22nd, 2024

Table of Contents

Key Takeaways

Retirement communities are for independent people age 55+, and offer special services and amenities for monthly fees

Some communities, often Continuing Care Retirement Communities, also offer increasing levels of healthcare to accommodate your needs as you get older

It’s important to weigh the cost of living in a retirement community, with HOA dues and other fees, against those entailed by other living arrangements, which could be less expensive

Retirement communities, targeted at those 55 and older, attract seniors with the promise of state-of-the-art gyms, golf courses, dining options, and more—but not all of these developments are created equal. We’ve rounded up the top retirement communities by region so you can start to research the amenities worth paying for, and options located in or around the places you’d feel glad to call home during retirement.

What Is a Retirement Community?

A retirement community is a group of homes—single-family houses, condominiums, townhouses, or a mix, depending on the community—typically available to those 55 and older, and owned and operated by a management service. Sometimes called “senior living communities” or “independent living communities,” these communities are intended for seniors who are able to live independently and don’t need specialized healthcare or assistance, though a few of them do offer some of these services.

Retirement communities typically have a wide offering of special amenities aimed at senior citizens. You’ll likely find several swimming pools, a golf course, various clubs, entertainment, and outdoor recreation opportunities within a well-appointed retirement community.

Types of Retirement Communities

Under the umbrella term of “retirement community” exist all sorts of details that dictate whether or not the community is for fully independent living, if it caters to a particular identity, range of healthcare services offered, and more.

Assisted living retirement communities

Assisted living facilities or nursing homes are for seniors who need assistance tackling the chores and activities of everyday life. This could be anything from laundry to 24/7 medical care.

Independent living retirement communities

Independent living retirement communities offer activities for socializing and enrichment, as well as support for home and community maintenance. These communities are intended for seniors who are active, healthy, and mostly able to live on their own without extra support—typically, they do not help retirees with bathing or daily medical care.

Age-restricted retirement communities

Nearly all retirement communities are age-restricted. This rule, which typically requires residents to be 55 years or older, ensures that the activities and amenities encourage seniors to interact with other seniors—this is meant to be a draw for potential residents.

Lifestyle retirement communities

If you have a particular identity or are dedicated to a hobby, there might be a retirement community that goes anova and beyond to cater to you. Some, for instance, offer services for those who own and ride horses, and others advertise themselves as LGBTQ+ communities.

Continuing Care Retirement Communities

CCRCs (Continuing Care Retirement Communities) are meant to blend independent living communities with assisted living ones. Essentially, you are usually offered the same level of amenities you might get at an independent living facility, with several specialized healthcare options available. As you grow older and your medical needs progress, CCRCs have the structure to meet your needs and care for you in a more involved way.

Typically, these facilities ask for a sizable entry fee in addition to monthly HOA dues in order to cover the cost of the healthcare—with CCRCs, the idea is that that larger entrance fee will cover the cost of your health needs down the road, so you don’t have to pay larger and larger monthly fees as you get older. However, this may be offset by staying in the same community as your healthcare needs increase over time.

Top Retirement Communities in the USA

If you’re ready to consider moving to a retirement community, start with this list of the top retirement communities in the US; the ones listed here have a bounty of amenities, and most are located near a major city for extra convenience.

Northeast

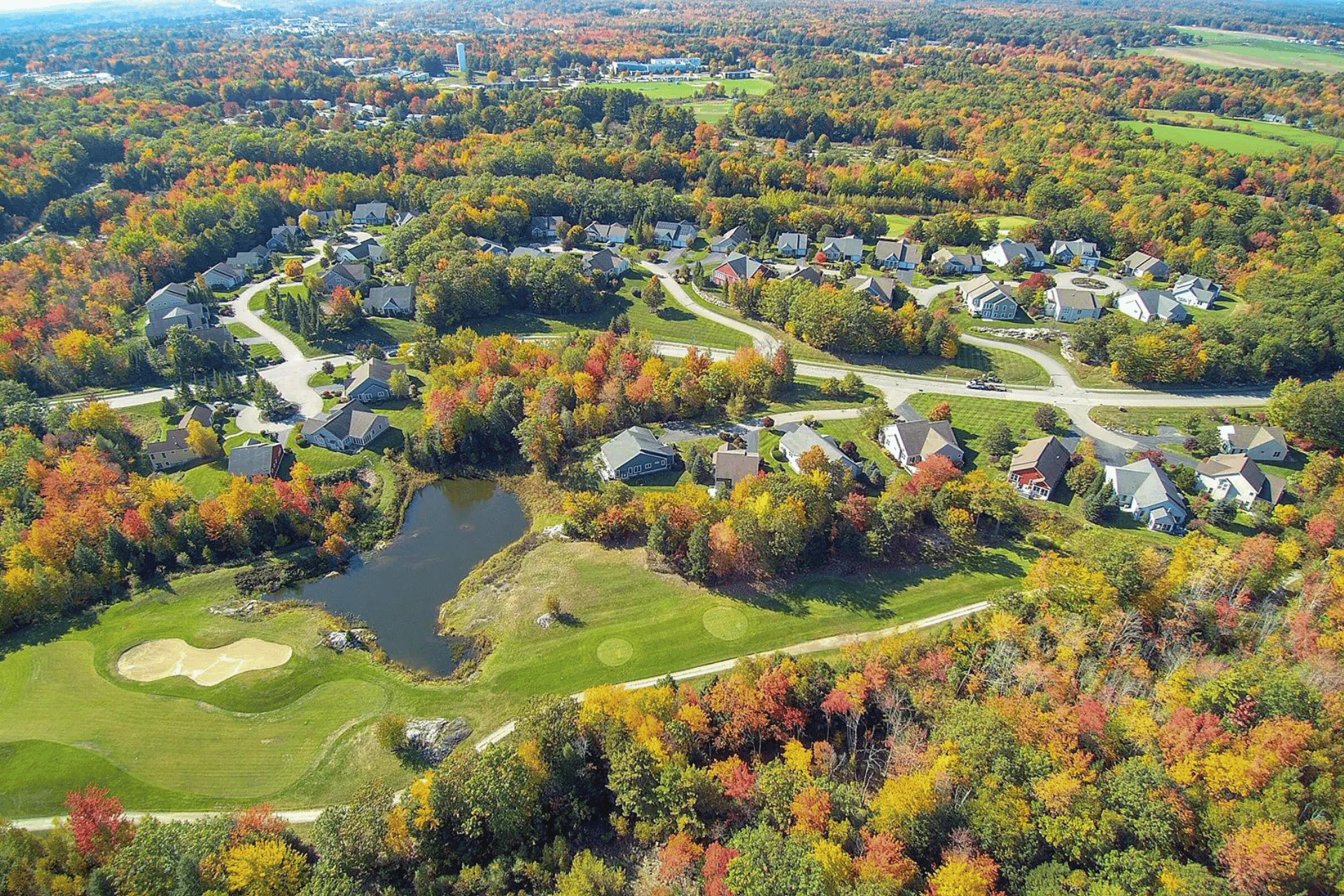

Highland Green

Based in Topsham, Maine, Highland Green is a community for those 55 and older; residents come from all over the country. An excellent place for those who want to live close to nature, the community sits adjacent to a 230-acre nature preserve, and most of the residents identify as active, with many volunteering at local arts and culture institutions. Amenities include a community center, tennis courts, a fitness area, an outdoor heated lap pool, and more.

Evergreen Woods

In Branford, Connecticut, Evergreen Woods sits on 88 acres and is not far from the city of New Haven, where one can find several museums and cultural activities. Retirees can choose from one, two-, or three-bedroom apartments, and enjoy on-site spas, indoor heated pools, and a full-service dining program.

RiverWoods

RiverWoods, based in Exeter, New Hampshire, offers both independent living and assisted living, depending on your needs. The community boasts three distinct neighborhoods from residents to choose from, each with their own vibe. The Boulders, their newest campus, strives to minimize environmental-impact, and offers therapy goats (that’s not a typo) and art studios.

Southwest

Del Webb Sweetgrass

Located in Richmond, Texas, Del Webb Sweetgrass is close to Houston for those who need access to a larger city but want the quiet of a private community. The retirement community has several miles of walking trails, and special activities for residents such as cooking and dance lessons.

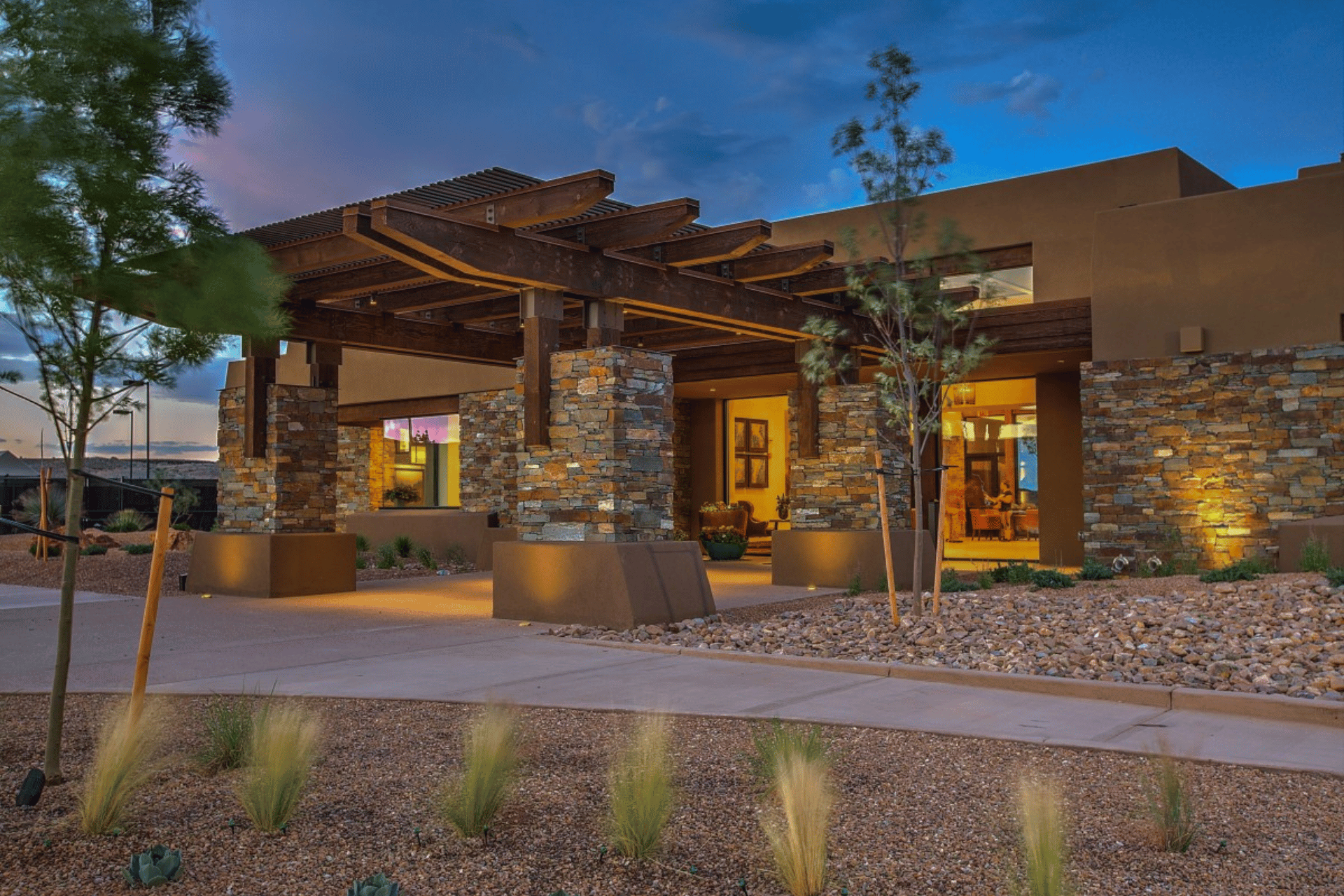

Del Webb Mirehaven

Another Del Webb property, this one is a short drive from Albuquerque and only one hour from the artsy Santa Fe, which boasts the Georgia O’Keefe museum, among other cultural sites. Homes at Del Webb Mirehaven mimic the low southwestern landscape, and the community has an enormous recreation center with billiards, a fitness room, and more, and is adjacent to Petroglyph National Monument.

Palmas Del Sol

Palmas Del Sol is located in Mesa, which is a short drive from Phoenix; residents can take advantage of the free shuttle to get to the city and enjoy its cultural offerings. The homes come in a range of sizes and prices, and you can enjoy many amenities, such as a ballroom, card room, a tennis court, and a pet park for those with furry friends.

West

Laguna Woods Village

If life at the beach is your goal, look no further than Laguna Woods Village. Only 10 miles from the coastline, the community boasts an equestrian center and many social clubs, based around hobbies such as archery, astronomy, and ceramics. There are three different micro-neighborhoods to choose from, so you can select the environment that feels best to you.

Sun City Summerlin

Right inside the bustling city of Las Vegas, Sun City Summerlin has views of the Vegas strips, the Nevada mountain range, and Red Rock Canyon. Along with a ballroom and movie theater, Sun City residents can enjoy outdoor activities like bocce and tennis, not to mention the nighttime fun available in Las Vegas proper.

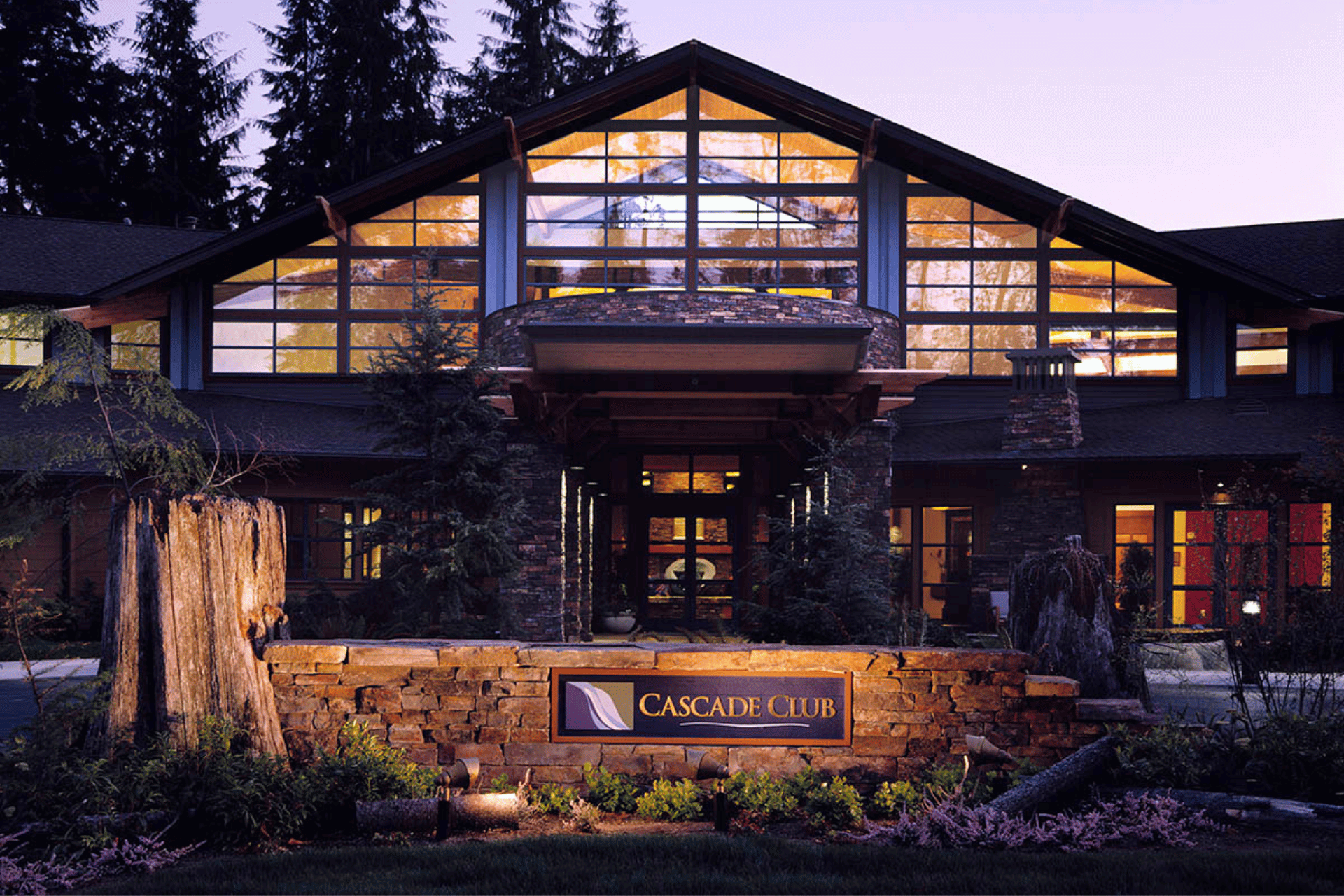

Trilogy at Redmond Ridge

Trilogy at Redmond Ridge is in the state of Washington, where you’ll get to enjoy the retirement community’s amenities as well as the added bonus of zero income tax. Trilogy focuses on healthy living, with a Center for Well Being focused on exercise classes, a running track, and pools available for you and your family. In addition, the community sits at the base of miles of hiking and walking trails.

Southeast

The Villages

The Villages is one of the most well-known retirement communities in the country, due to the fact that it is sprawling and is home to a huge population: it’s 57-square miles, with nearly 80,000 residents. One draw, of course, is the bustling community, but the fact that Florida has no income tax certainly doesn’t hurt, either. Residents at The Villages enjoy a variety of community events and activities; the community has its own performing arts spaces, churches, movie theaters, and more.

Sun City Hilton Head

The largest retirement community in South Carolina’s Lowcountry, Sun City Hilton Head is home to over 16,000 residents. Another Del Webb-designed property, Sun City has six swimming pools—two indoor and four outdoor—as well as three fitness centers. It maintains a robust calendar of events, featuring live music and other performances.

Lake Providence

Located in Mount Juliet, Tennessee, Lake Providence has homes for sale or for rent, the largest of which have three bedrooms and three bathrooms, as well as a two-car garage. Mt. Juliet is only about 17 miles from the great music city of Nashville, where one can also find excellent restaurants and comprehensive shopping centers. At Lake Providence, residents can enjoy a clubhouse, fishing spots, and a playground for visits with grandchildren.

Stone Creek

Ocala, Florida, is home to the Appleton Museum of Art as well as Silver Springs State Park. It’s also where you’ll find Stone Creek Retirement Community, which has an enormous golf course, sports courts, and a full calendar of events. There is also boat storage on-site, so residents can enjoy the waterways that surround the city.

Midwest

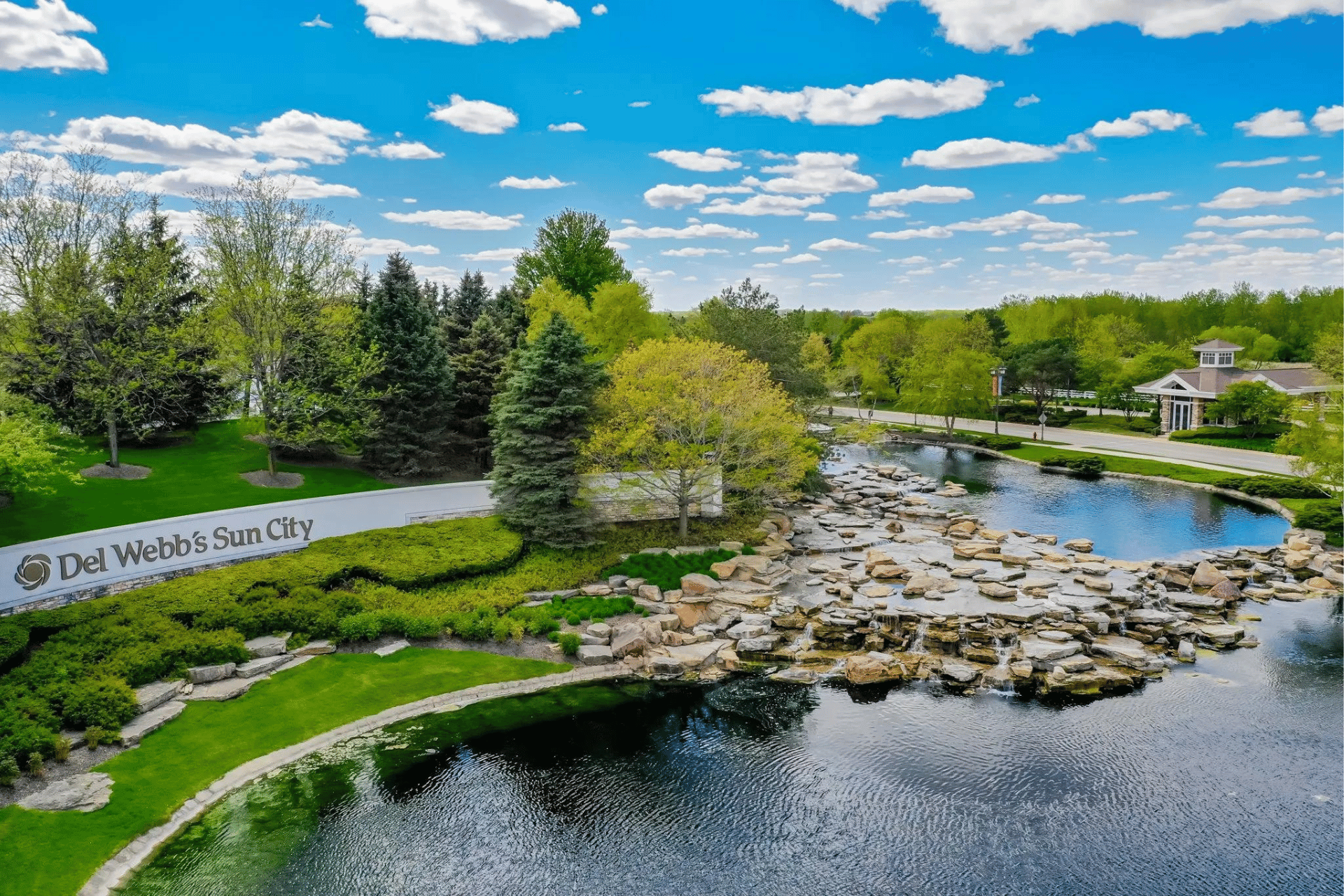

Sun City Huntley

Relatively close to Chicago in the village of Huntley, Illinois, this location of Sun City has condominiums, townhouses, and single-family homes—a range of options depending on your housing needs. The restaurant on-site, Jameson’s, has views of the 18-hole golf course, a sports bar, and patio seating. Clubs for residents focus on topics like canasta, model railroads, and Scrabble.

Saddlebrook Farms

Saddlebrook Farms is equidistant from Milwaukee and Chicago, giving you access to two extraordinary cities. The village in which the community is located, Grayslake, is home to several natural preserves for nature strolls and hiking. Saddlebrook itself has many social clubs, community gardens, and a bus that delivers you to local shopping and restaurants.

Carillon at Cambridge Lakes

Offering ranch homes with flexible layouts, the Carillon at Cambridge Lakes retirement community is located in Pingree Grove, Illinois. The community has lots of activities to keep retirees busy, from bocce to aerobics classes and yoga to poker nights.

Tips for choosing the right retirement community

The first thing to consider is location. Is the community in a state and city or metropolitan area where you can enjoy arts and cultural activities if you wish? Is the weather there appealing? In addition, consider the community’s proximity to health services you may need, as well as its distance from family and friends.

Speaking of healthcare, you should confirm that the facilities are fully accessful, equipped with wheelchair ramps, handrails, grab bars, and other features. Be sure to ask the staff about this—even if you don’t require this assistance now, there’s no guarantee you won't in the future.

You should also review all the housing options within the community and make sure there is something you want—if they only offer single-family homes and you are more interested in downsizing into a condo, then it might not be appropriate for you. Confirm there is storage for all of your things, and that you’ll enjoy waking up and drinking coffee in the kitchen every morning. And then, at night, of course, you’ll want to be safe. What kind of security does the community offer? Is there a check-in system for guests? Are there cameras to monitor activity?

Finally, ask the staff about the amenities and community activities. A great retirement community will have a little something for everyone, with nearby parks and trails for those who love the outdoors. In addition, some may have the added benefit of on-site events, such as concerts and plays, and a calendar that lists all of these activities—sometimes the community has the calendar available on its website for you to peruse, but if not, ask the staff.

Retirement factors when choosing a city to retire

Even if The Villages has all the amenities you could possibly dream of, will you be able to handle Florida’s humid summers? Before jumping into a new neighborhood or retirement community, consider these factors.

Cost of Living

While overall inflation will impact your budget in retirement, each state will have a higher or lower cost of living that should be considered. Alabama, for instance, has a very low cost of living, 14% lower than the national average, while California’s is 16% higher than the average, making it a much more expensive state to retire to. Each state and municipality will also have its own income tax, so look into that when calculating the overall taxes you will pay to live in any place.

Retirement Communities

Retirement communities are one way to ensure you are living in a place with lots of other people your age, and continue to socialize during retirement. As we noted in our round up, many of these communities have lots of activities and natural attractions to recommend them, and are nearby big metropolitan areas in case you need additional fun.

Weather

If you’re considering a location that has different weather from what you’re used to, it might be wise to spend six or eight months there to confirm you can handle the new climate. Texas summers, with their triple-digit temperatures, can be just as tough to bear as Minnesota’s long, snowy winters.

Active Living

If staying fit and healthy is important to you, you should research different places and the outdoor recreation available, as well as the number of gyms that support older members with classes focused on gentle movement and mobility. You might also consider the walkability of a particular city—walking is an excellent, low-impact form of exercise that can help keep you in shape as you get older.

Healthcare

Make sure that there are nearby specialists to assist with any medical conditions you need care for, and that a hospital is close by. Many university towns have their own medical systems, and can be welcoming places for retirees.

Costs associated with retirement communities

A retirement community has a lot of benefits: lots of socialization opportunities, support for active living, golf courses, pools, and easy access to larger metropolises. That said, it’s worth weighing whether or not living in a retirement community is the best choice, compared to staying in your home or looking into another living arrangement.

Housing costs

The ongoing cost of housing in a retirement community is usually lower than homes in the broader market, but the HOA fees can ultimately make them more expensive. That said, those fees could offset the usual amount you spend on dining and recreation, and give you the comfort of living in a place surrounded by people your age. Some communities allow residents to rent instead of own, which could be one way to test life in a retirement community before you make a bigger commitment. The cost of housing, ultimately, will depend on the community’s location and general real estate prices there.

HOA fees

Homeowner Association fees, or HOA fees, are those you pay to your housing board to cover the maintenance of your home and the grounds surrounding it. These fees cover things like lawn care, some exterior home repairs, pool upkeep, and more. Sometimes, they also cover your utilities such as your phone line and WiFi. HOA fees are often $800 a year or more, so it’s an important cost to factor into your overall budget when deciding whether a retirement community is the right choice for you.

Entrance fees

On top of your HOA fees, some retirement communities—usually Continuing Care Retirement Communities—also charge entrance fees for those moving in, intended to offset the costs of the services and amenities. Sometimes, these fees are refundable if you move out of the community. A one-time entrance fee usually ranges from $50,000 to $350,000 for a one-bedroom home, but the price can vary depending on location, demand, level of care and services, and more.

Community fees

Because retirement communities have so many amenities, they often also have community fees to support these activities and offerings. The fees might be optional, such as for the use of the golf course or country club, or required for basic amenities offerings, such as use of the fitness facilities.

How retirees pay for community living

Paying for your new life in a retirement community won’t be cheap, but might be cheaper in the long run than alternative living situations. That said, the ongoing HOA or entrance fees might require you to dig around for extra money to cover the new expenses.

Property sales & investments

Since buying a home in a retirement community is cheaper than buying one on the broader market, it’s possible that the sale of your current home will be more than enough to cover the move and fees, especially if you are moving from a higher cost-of-living location to a lower one. You might also have real estate investments, and be able to use the income from those to support your new housing fees.

Social security & retirement accounts

The benefits paid out from your social security, pension, or other retirement plan could cover some or all of your community living expenses.

Family & friends

In addition to the options above, you might seek financial help from your children, siblings, or friends.

Questions to ask a retirement community

When touring a retirement community, make sure to ask some difficult questions so you can fully understand the offerings, amenities, and culture. Remember that this will be your new home and new neighbors; you should feel welcome and happy. Here is a sample set of questions you might consider asking:

- How does your community welcome new residents?

- How do you keep residents safe?

- What does your meal plan look like?

- How many residents live here?

- What activities are available?

- What can a resident do if they have a complaint?

- What are your rules on family visitation?

- How do you foster a sense of community?

- Is transportation available?

- Can I customize my home?

- Are my pets welcome?

- Do you have additional storage?

- Do some homes come furnished?

Making the decision to live in a retirement community is just one of many that pre-retirees and retirees need to evaluate as they plan their retirement. This decision can have continuous effects on your overall financial picture, so make sure you take a look at your holistic retirement picture before you make the move. Consult a fiduciary financial advisor to better understand the entirety of your retirement picture and discover what housing options make most sense for your golden years.

Share this advice

A professional content writer, C.E. Larusso has written about all things home, finance, family, and wellness for a variety of publications, including Angi, HomeLight, Noodle, and Mimi. She is based in Los Angeles.

Share this advice

A professional content writer, C.E. Larusso has written about all things home, finance, family, and wellness for a variety of publications, including Angi, HomeLight, Noodle, and Mimi. She is based in Los Angeles.

Free Retirement Consultation

Still have questions about how to properly plan for retirement? Speak with a licensed fiduciary for free.