Life insurance is just a part of a broader retirement plan

Financial needs and goals are always changing. SelectQuote has partnered with Retirable to offer FREE retirement consultations for your next phase of life.

Life insurance is just a part of a broader retirement plan

Financial needs and goals are always changing. SelectQuote has partnered with Retirable to offer FREE retirement consultations for your next phase of life.

The peace of mind you deserve in retirement

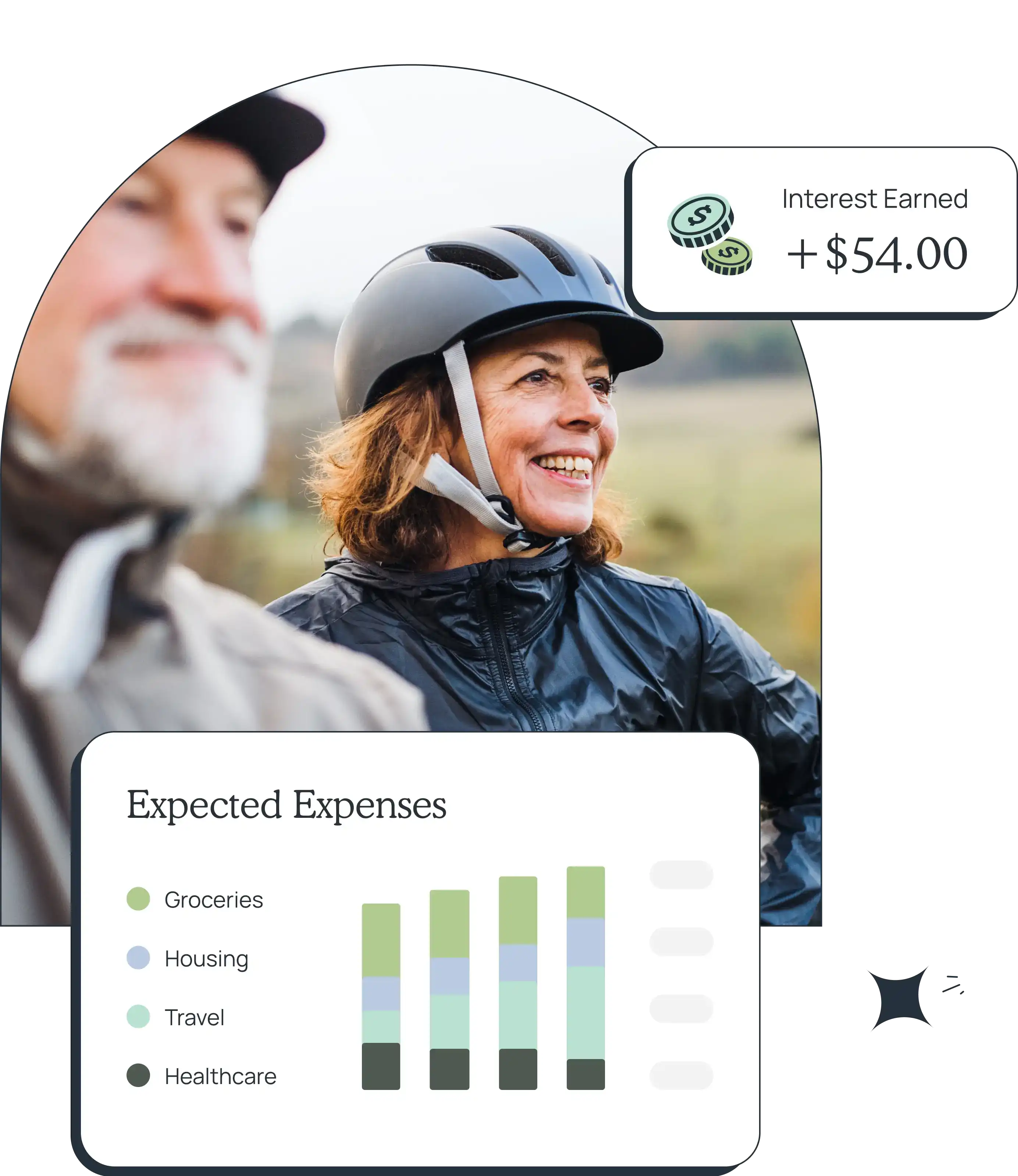

See what you can comfortably spend each month

Anticipate your changing healthcare needs and costs

Get an investment strategy designed to maintain your lifestyle

Plan to navigate inflation, taxes, and unexpected events

The peace of mind you deserve in retirement

See what you can comfortably spend each month

Anticipate your changing healthcare needs and costs

Get an investment strategy designed to maintain your lifestyle

Plan to navigate inflation, taxes, and unexpected events

You’re one step closer to total retirement wellness

SelectQuote and Retirable are here to help you gain peace of mind when it comes to your health and finances. Retirable provides a complete financial picture, giving you a more comfortable retirement.

You’re one step closer to total retirement wellness

SelectQuote and Retirable are here to help you gain peace of mind when it comes to your health and finances. Retirable provides a complete financial picture, giving you a more comfortable retirement.

It all starts with a plan

With Retirable’s FREE consultation, we’ll review your savings, healthcare costs, Social Security and other income sources to put together a retirement investment and spending plan to align with your lifestyle goals.

It all starts with a plan

With Retirable’s FREE consultation, we’ll review your savings, healthcare costs, Social Security and other income sources to put together a retirement investment and spending plan to align with your lifestyle goals.

More than just financial advice

Retirable will deliver a detailed retirement plan, including:

Timing advice for Social Security, pensions and retirement accounts

Where to tax-efficiently place funds while working and in retirement

Current and expected healthcare costs throughout retirement

What is safe to spend each month in retirement, including distributions needed to replace income and cash flows through retirement

More than just financial advice

Retirable will deliver a detailed retirement plan, including:

Timing advice for Social Security, pensions and retirement accounts

Where to tax-efficiently place funds while working and in retirement

Current and expected healthcare costs throughout retirement

What is safe to spend each month in retirement, including distributions needed to replace income and cash flows through retirement

Spend retirement with more freedom

Reliable retirement income helps you spend confidently throughout retirement. Your funds stay in your name, the ability to make changes stays in your hands.

Spend retirement with more freedom

Reliable retirement income helps you spend confidently throughout retirement. Your funds stay in your name, the ability to make changes stays in your hands.

A trusted partner through retirement.

Retirable is your retirement planning, investing and spending platform with the ongoing care of a fiduciary advisor. As your health and wealth changes, you’ll have the experts on your team to make the right adjustments along the way.

A trusted partner through retirement.

Retirable is your retirement planning, investing and spending platform with the ongoing care of a fiduciary advisor. As your health and wealth changes, you’ll have the experts on your team to make the right adjustments along the way.

We've helped more than 50,000 people just like you.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.

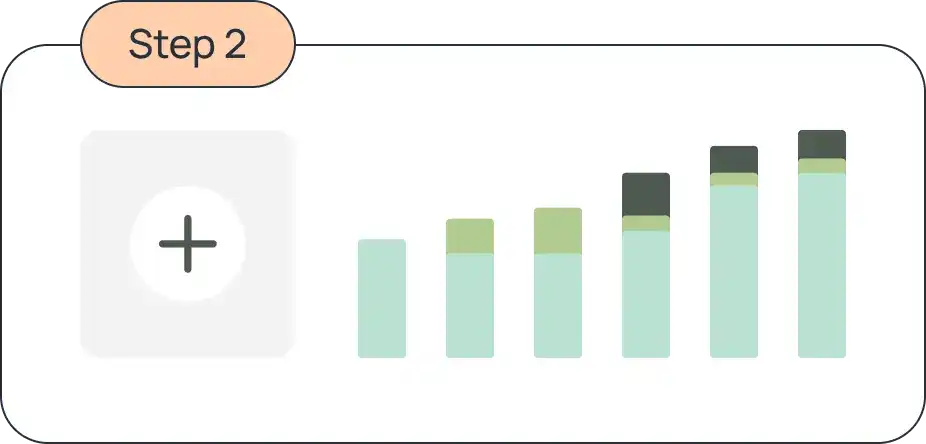

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.

Let's build the retirement you've earned.

Getting started is easy and we'll be there to provide the guidance you need, every step of the way.

We'll review your savings, Social Security and other income sources, while gaining a greater understanding of your goals and needs.

We'll work with you to create an investment strategy and spending plan that ensures your savings will last, while allowing you to spend with confidence.

Next, we'll simplify your savings into one or more Retirable IRAs where we can apply our retirement-specific tax strategies, investment allocations, and spending guidance.

Need to make a withdrawal? We'll show you what's safe to take out and adjust your plan in real-time based on what you choose. And while you're busy living life, we'll make sure all your investments stay on track.