Welcome, MedicareQuick Clients!

MedicareQuick has partnered with Retirable to offer its clients a free financial consultation with a licensed fiduciary specializing for those in or near retirement.

Your agent will receive compensation for making the introduction and if you enter into a paying relationship with Retirable. You will not be charged any fee or incur any additional costs based on this referral. Retirable and your agent are not under common ownership or are otherwise related entities.

Welcome, MedicareQuick Clients!

MedicareQuick has partnered with Retirable to offer its clients a free financial consultation with a licensed fiduciary specializing for those in or near retirement.

Your agent will receive compensation for making the introduction and if you enter into a paying relationship with Retirable. You will not be charged any fee or incur any additional costs based on this referral. Retirable and your agent are not under common ownership or are otherwise related entities.

Let's build your best retirement.

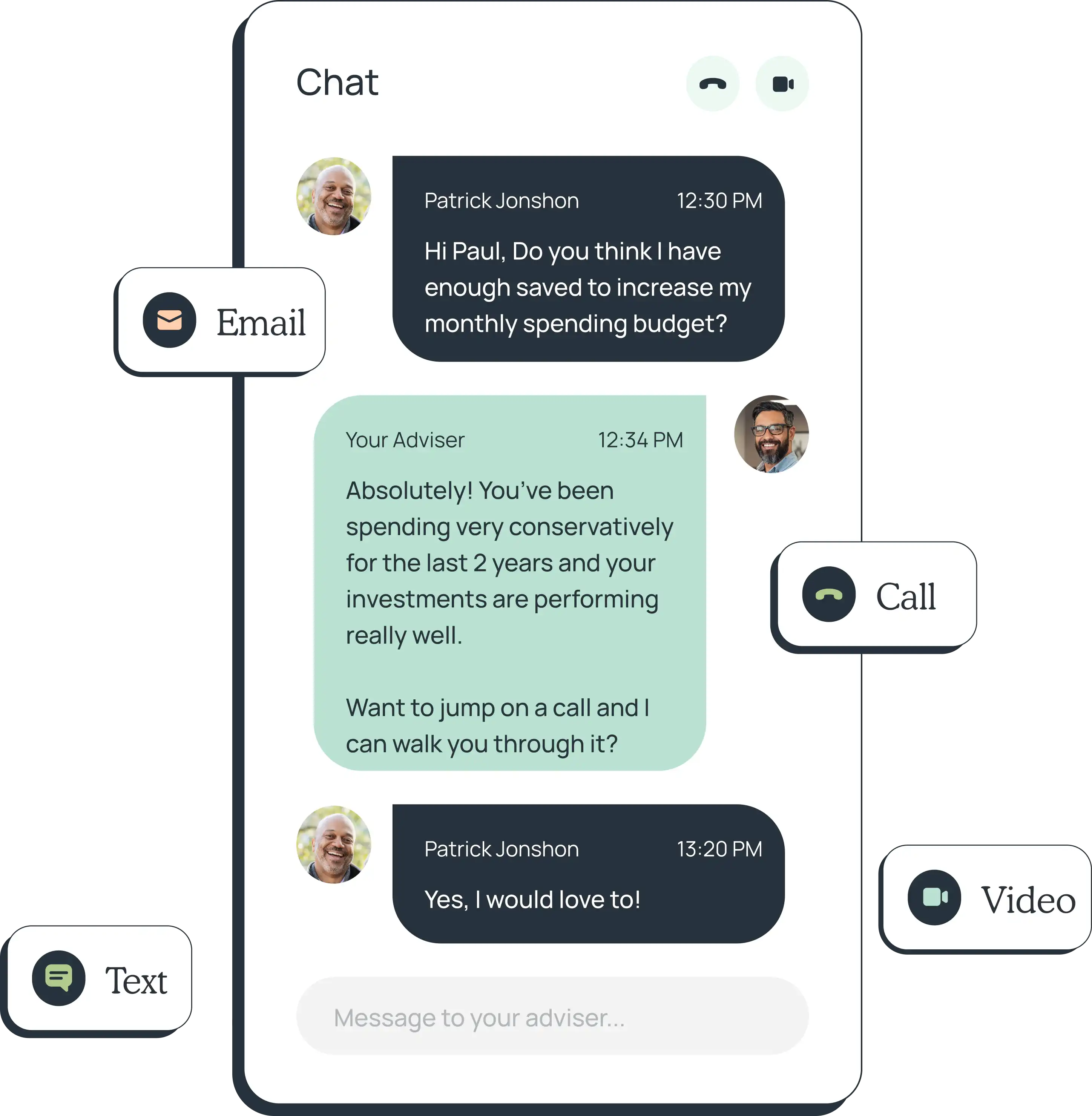

Your dedicated Retirable advisor is a U.S-based licensed fiduciary, specializing in holistic retirement planning. They're committed to always presenting your best solutions across retirement planning, enrollments, and other big decisions.

Let's build your best retirement.

Your dedicated Retirable advisor is a U.S-based licensed fiduciary, specializing in holistic retirement planning. They're committed to always presenting your best solutions across retirement planning, enrollments, and other big decisions.

Cover all your bases.

We specialize across all areas of retirement — including income, healthcare, housing, and quality of life. This enables us to better manage a holistic plan to serve your unique needs.

Cover all your bases.

We specialize across all areas of retirement — including income, healthcare, housing, and quality of life. This enables us to better manage a holistic plan to serve your unique needs.

See a better path forward.

There's a big difference between retiring and retiring comfortably. As you need to make key decisions, your advisor will help you understand what options are best for you and what it means for your income, investments, and lifestyle.

See a better path forward.

There's a big difference between retiring and retiring comfortably. As you need to make key decisions, your advisor will help you understand what options are best for you and what it means for your income, investments, and lifestyle.

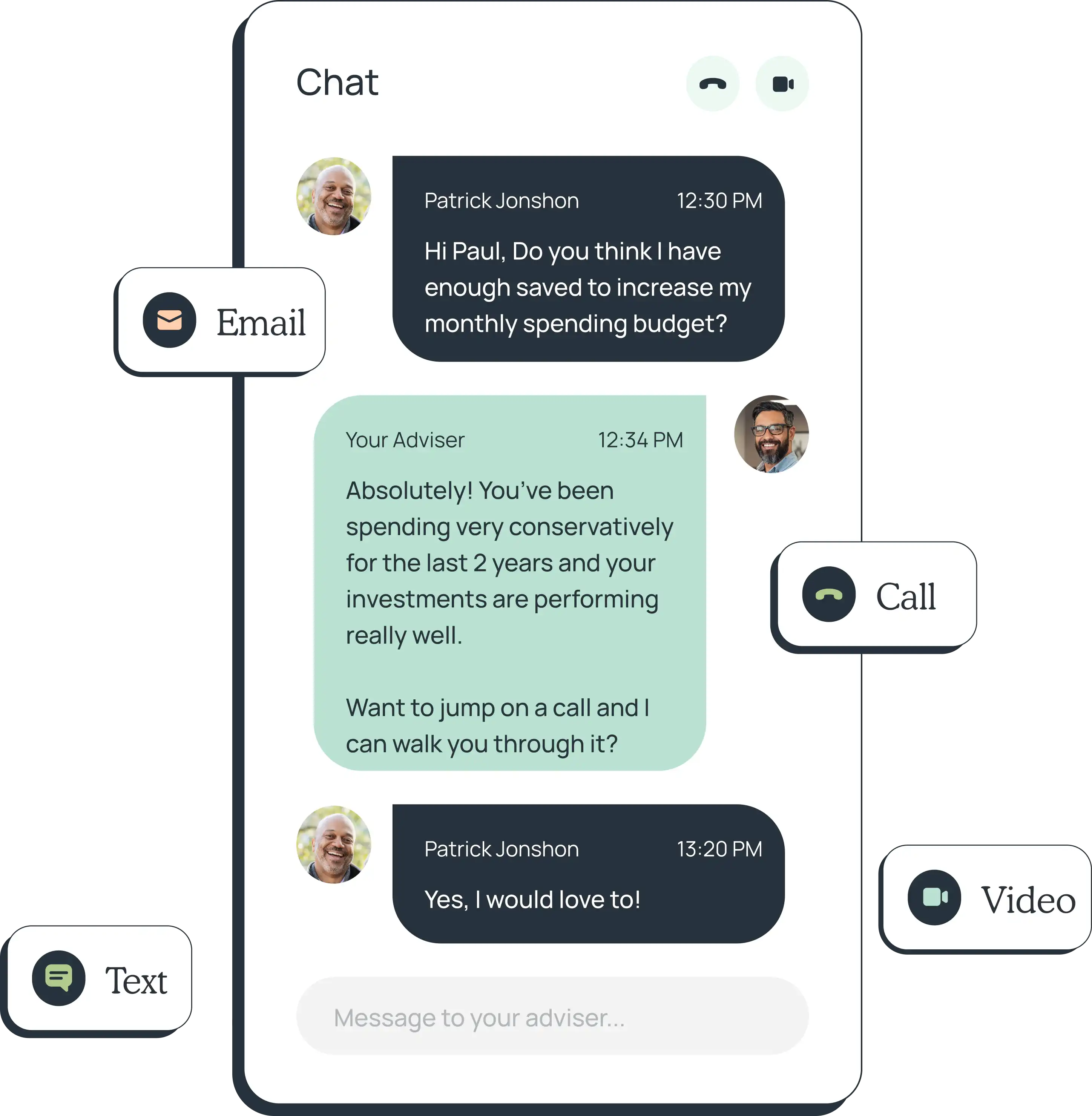

Navigate the unexpected.

Changes like market volatility, inflation and personal circumstances are inevitable. As these arise, your advisor is available to help you confidently adjust. If you have big life changes, we’ll let your MedicareQuick agent know so they can revisit your healthcare options.

Navigate the unexpected.

Changes like market volatility, inflation and personal circumstances are inevitable. As these arise, your advisor is available to help you confidently adjust. If you have big life changes, we’ll let your MedicareQuick agent know so they can revisit your healthcare options.

We know more than just investments.

Health Care, housing, Social Security, and beyond — we can provide help with everything impacting your retirement.

See when to elect and how much to expect.

Anticipate your changing needs and costs.

Use our expert strategies to help avoid unexpected bills.

Create a plan around your decision to move or stay.

Set financial goals to gift to your loved ones.

Incorporate plans for travel, projects, and more.

We know more than just investments.

Health Care, housing, Social Security, and beyond — we can provide help with everything impacting your retirement.

See when to elect and how much to expect.

Anticipate your changing needs and costs.

Use our expert strategies to help avoid unexpected bills.

Create a plan around your decision to move or stay.

Set financial goals to gift to your loved ones.

Incorporate plans for travel, projects, and more.

Health and wealth are key to a comfortable retirement.

From greater peace of mind to ongoing care, we're ready to lend a hand to MedicareQuick clients!

Health and wealth are key to a comfortable retirement.

From greater peace of mind to ongoing care, we're ready to lend a hand to MedicareQuick clients!