Protect your retirement income.

SPEND CONFIDENTLY. SAVE MONTHLY. 24/7 PROTECTION.

Retirable Income Protect+ helps you:

Protect your retirement income against inflation

Protect your retirement income for a rainy day

Protect your retirement income from fraud and money mistakes

Protect your retirement income.

SPEND CONFIDENTLY. SAVE MONTHLY. 24/7 PROTECTION.

Retirable Income Protect+ helps you:

Protect your retirement income against inflation

Protect your retirement income for a rainy day

Protect your retirement income from fraud and money mistakes

Featured In

Featured In

A confident, worry-free retirement.

Getting started is easy! We'll be there to provide the guidance you need, every step of the way.

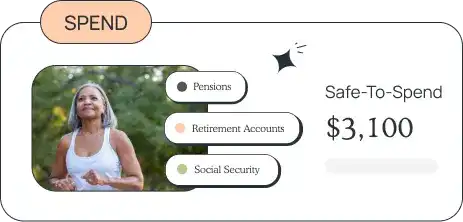

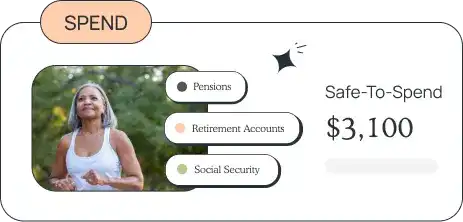

Safe-to-spend tools keep your lifestyle and plan aligned while budgeting and spending check-ins ensure your retirement stability.

Monthly cash sweeps help you build savings faster while our high-yield FDIC-insured account grows your wealth in retirement.

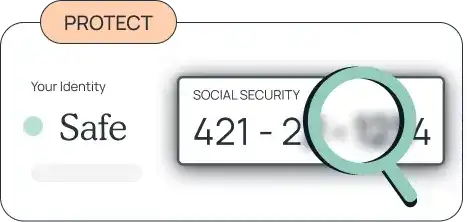

$1 million in identity theft insurance with a suite of identity and credit monitoring tools, lost wallet assistance, and the ability to block spam calls.

Get a personalized retirement spending and budgetary consultation with frequent check-ups to ensure your retirement stability.

Safe-to-spend tools keep your lifestyle and plan aligned while budgeting and spending check-ins ensure your retirement stability.

Monthly cash sweeps help you build savings faster while our high-yield FDIC-insured account grows your wealth in retirement.

$1 million in identity theft insurance with a suite of identity and credit monitoring tools, lost wallet assistance, and the ability to block spam calls.

Get a personalized retirement spending and budgetary consultation with frequent check-ups to ensure your retirement stability.

Know you've come to the right place.

Know what's safe-to-spend today to safeguard your tomorrow

Hedge against inflation by earning 5.12% APY* on your cash savings

Protect you and your family from fraud and online scams

Spending plan check-ups ensure your retirement stability