Live your best retirement.

71 Ace Group has partnered with Retirable to support your retirement— regardless of your income level.

Retirable helps you:

Make key financial decisions with the ongoing guidance of an advisor

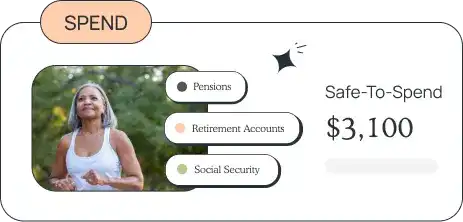

Know what's safe to spend each month

Earn monthly interest without limiting your spending

Protect yourself from fraud and online scams

As a special offer, you can get a retirement consultation with a financial advisor from Retirable — for FREE!

Talk to a licensed Retirable Advisor today!

Live your best retirement.

71 Ace Group has partnered with Retirable to support your retirement— regardless of your income level.

Retirable helps you:

Make key financial decisions with the ongoing guidance of an advisor

Know what's safe to spend each month

Earn monthly interest without limiting your spending

Protect yourself from fraud and online scams

As a special offer, you can get a retirement consultation with a financial advisor from Retirable — for FREE!

Talk to a licensed Retirable Advisor today!

Featured In

Featured In

A confident, worry-free retirement.

Getting started is easy! We'll be there to provide the guidance you need, every step of the way.

Get a personalized retirement plan with the ongoing guidance and monitoring of a dedicated fiduciary advisor.

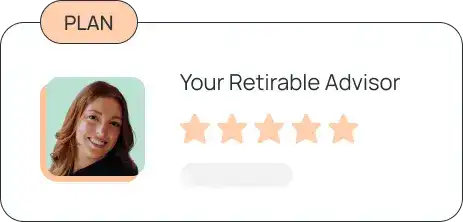

We'll review your savings, Social Security and other income sources, to help your personalized Safe-to-spend number each month.

Savings and budgetary insights maximize your cash flows while monthly cash sweeps help you have more cash to spend in retirement.

$1 million in identity theft insurance — along with real human assistance, white-glove credit freezing, lost wallet assistance, and the ability to block spam calls.

Get a personalized retirement plan with the ongoing guidance and monitoring of a dedicated fiduciary advisor.

We'll review your savings, Social Security and other income sources, to help your personalized Safe-to-spend number each month.

Savings and budgetary insights maximize your cash flows while monthly cash sweeps help you have more cash to spend in retirement.

$1 million in identity theft insurance — along with real human assistance, white-glove credit freezing, lost wallet assistance, and the ability to block spam calls.

We've helped more than 50,000 people just like you.

These testimonials are provided by current or former clients of Retirable. Clients do not receive any compensation for sharing their opinions and experience with our firm. Comments and opinions expressed in these testimonials may not be representative of any other person's experience with our firm.

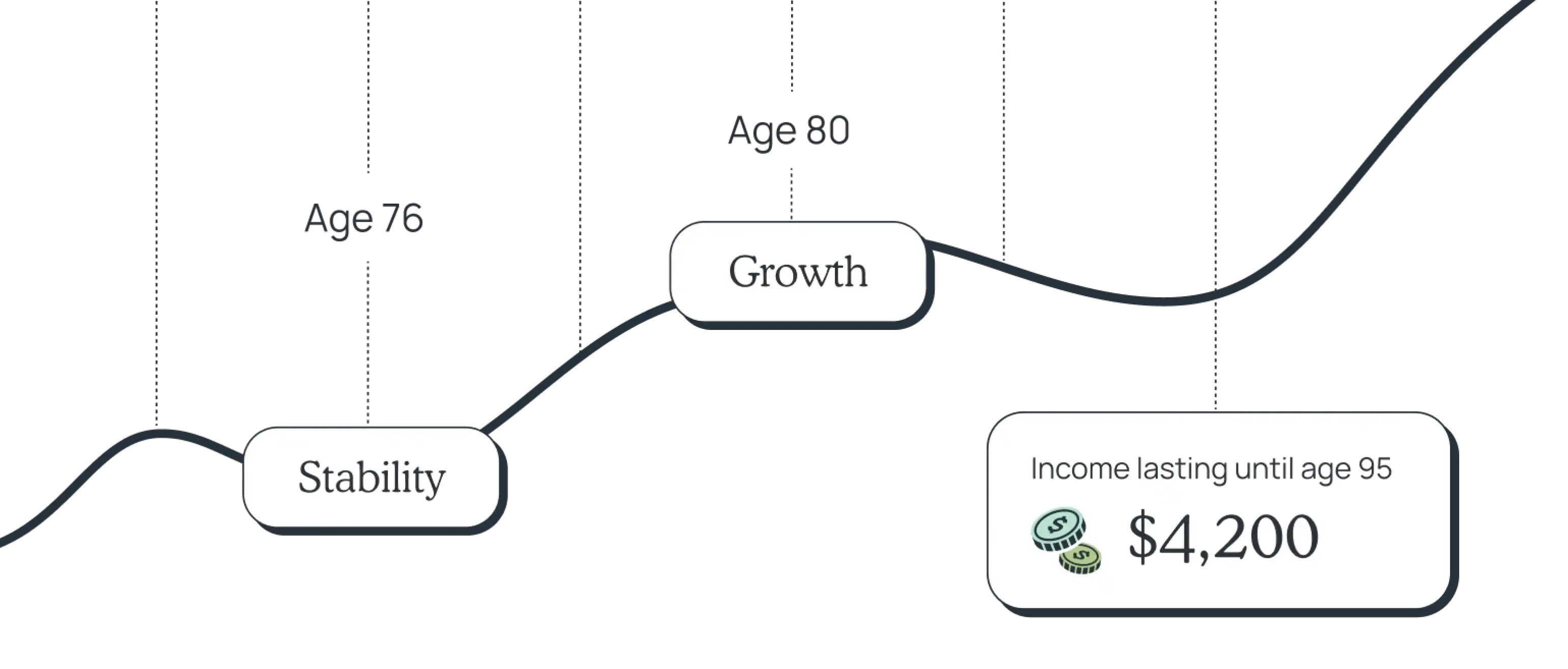

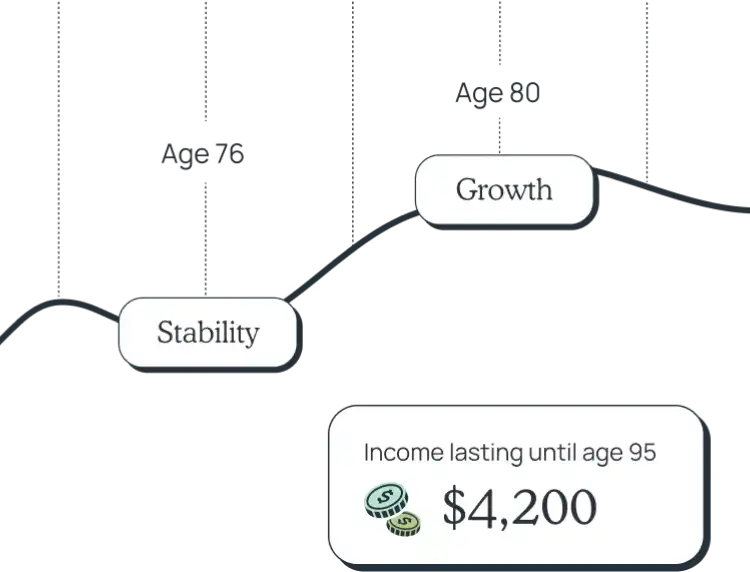

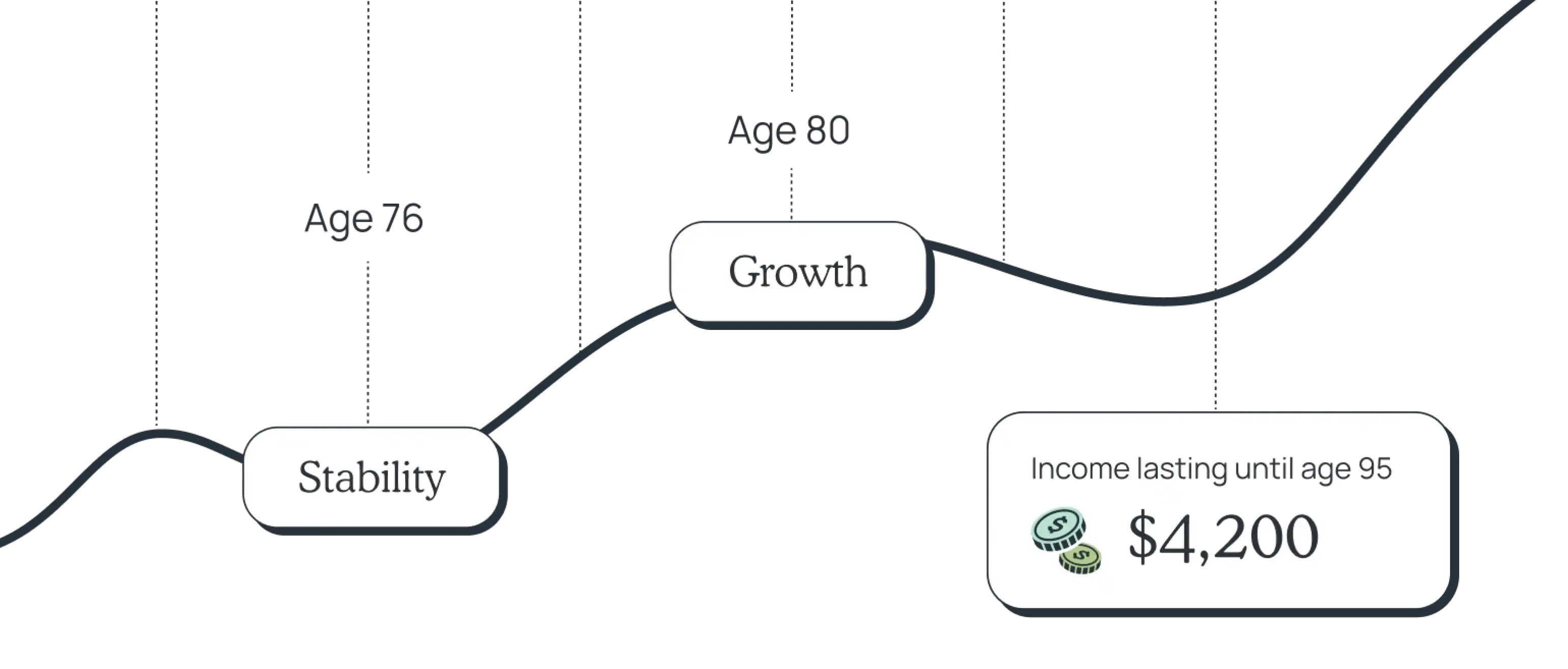

An investment strategy built for a sustainable retirement.

Our investment management strategy is designed with the complexities of retirement in mind. It's working behind the scenes so you can confidently spend your savings through retirement.

Current APY

2.74%

Build savings without limiting your spending.

Our cash management account sweeps your unused monthly retirement income into a high-yield savings account earning 2.74%.*

Our investment management strategy is designed with the complexities of retirement in mind. It's working behind the scenes so you can confidently spend your savings through retirement.

Our cash management account sweeps your unused monthly retirement income into a high-yield savings account earning 2.74%.*

Know you've come to the right place.

Ongoing care of a fiduciary advisor

Financial planning and investment strategies that fit your lifestyle

Monthly retirement income so you know what's safe to spend

2.74% APY to grow your cash savings and hedge against inflation

Fraud protection with $1M in identity theft protection

Know you've come to the right place.

Ongoing care of a fiduciary advisor

Financial planning and investment strategies that fit your lifestyle

Monthly retirement income so you know what's safe to spend

2.74%* APY to grow your cash savings and hedge against inflation

Fraud protection with $1M in identity theft protection

Get your questions answered by the experts.

Talk to a licensed Retirable Advisor today!